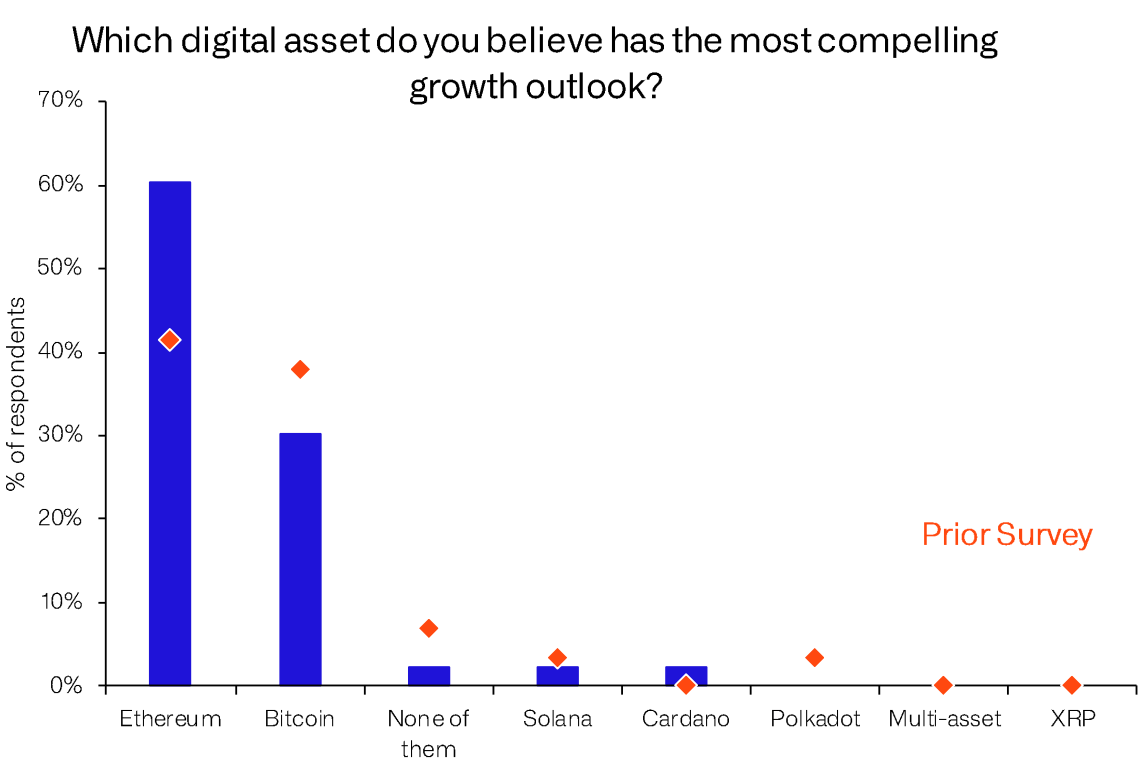

Round 60% of buyers consider that Ethereum (ETH) has a extra compelling development outlook, in line with a survey by CoinShares.

Versus the 60% siding with ETH, solely 30% of the respondents mentioned Bitcoin (BTC) had essentially the most compelling development outlook, in line with the CoinShares survey.

The survey included 43 buyers who managed a complete of $390 billion value of property. Among the many contributors, those that recognized as Wealth Managers (25%) and Household Workplace (25%) accounted for half of the group. One other 22% and 17% recognized as Hedge Fund and Institutional, respectively.

Yr-to-year adjustments

It may be seen {that a} bulk of buyers shifted to ETH from BTC when evaluating the most recent outcomes with outcomes from 2022.

The blue columns on the chart beneath symbolize the most recent outcomes, whereas the pink marks present the outcomes from final 12 months’s survey.

Solely 40% of the respondents mentioned ETH had extra compelling development potential, whereas solely rather less than 40% selected BTC within the 2022 survey. In a single 12 months, buyers who opted for ETH spiked to 60%, whereas those who voted for BTC fell to 30%.

Despite the fact that buyers distanced themselves from BTC, this 12 months’s outcomes present a rise within the variety of buyers who invested in it. 30% of the contributors personal BTC, which marks a rise from 24% in 2022, in line with CoinShares.

Digital property in portfolios

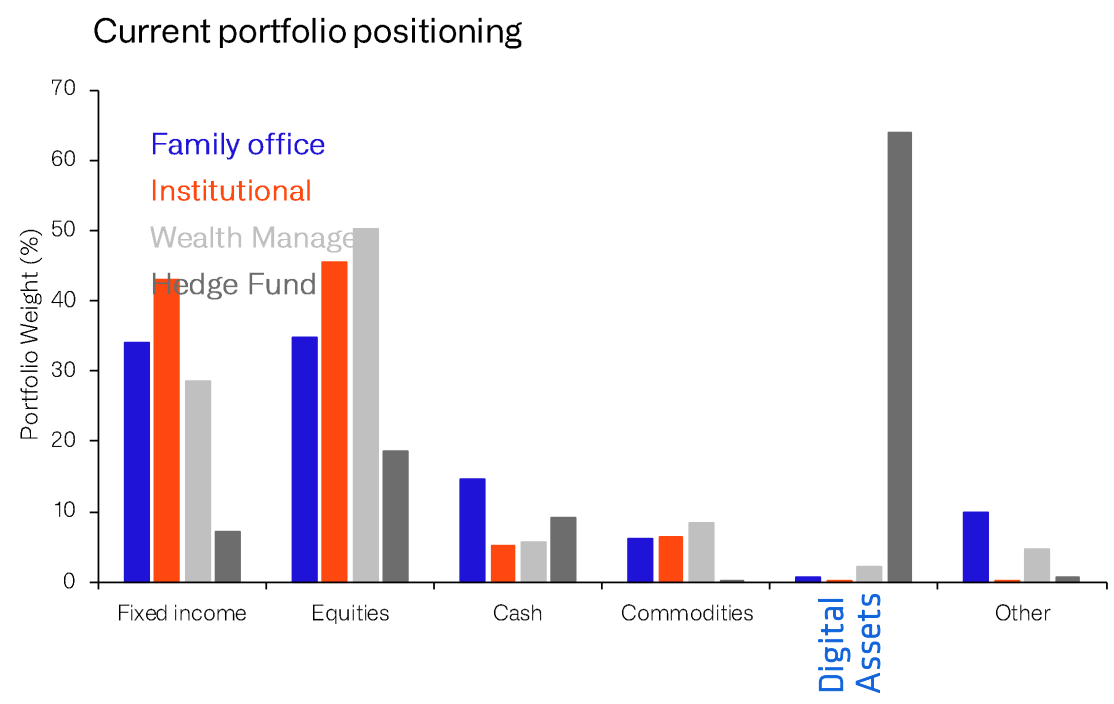

The newest numbers indicated that digital property accounted for 1.1% of portfolios, which marks a big improve from final 12 months’s 0.7%.

Hedge Funds particularly have significantly elevated their investments in digital property, CoinShares information revealed. Within the meantime, institutional buyers decreased their digital property to beneath 1%.