A survey of 835 institutional merchants from 60 completely different international places revealed that 72% haven’t any plans for crypto buying and selling in 2023, based on information launched by JPMorgan.

In line with the survey, most merchants had no real interest in crypto buying and selling due to market volatility. 46% of the merchants stated unstable markets’ could be their best every day buying and selling problem in 2023, whereas 22% stated liquidity availability could be essentially the most important subject. Others cited points like regulatory change, information availability, worth transparency, and many others.

The merchants’ selections might have been influenced by the crypto market’s document poor efficiency in 2022. Previously yr, Bitcoin (BTC) and different digital belongings traded at document lows, and the trade additionally noticed the capitulation of a number of crypto corporations.

The survey confirmed that 8% of the merchants at the moment commerce crypto, whereas 6% plan on buying and selling throughout the following yr. The remaining 14% revealed plans to start out buying and selling throughout the subsequent 5 years.

In the meantime, regardless of the merchants’ reluctance about crypto, they predicted that the asset class would see one of the vital important will increase in digital buying and selling volumes over the following yr.

The main monetary establishment requested these merchants about their buying and selling plans and components that would affect them in a survey carried out between Jan. 3 and Jan. 23.

Blockchain and AI is among the many prime 3 expertise to form the way forward for buying and selling

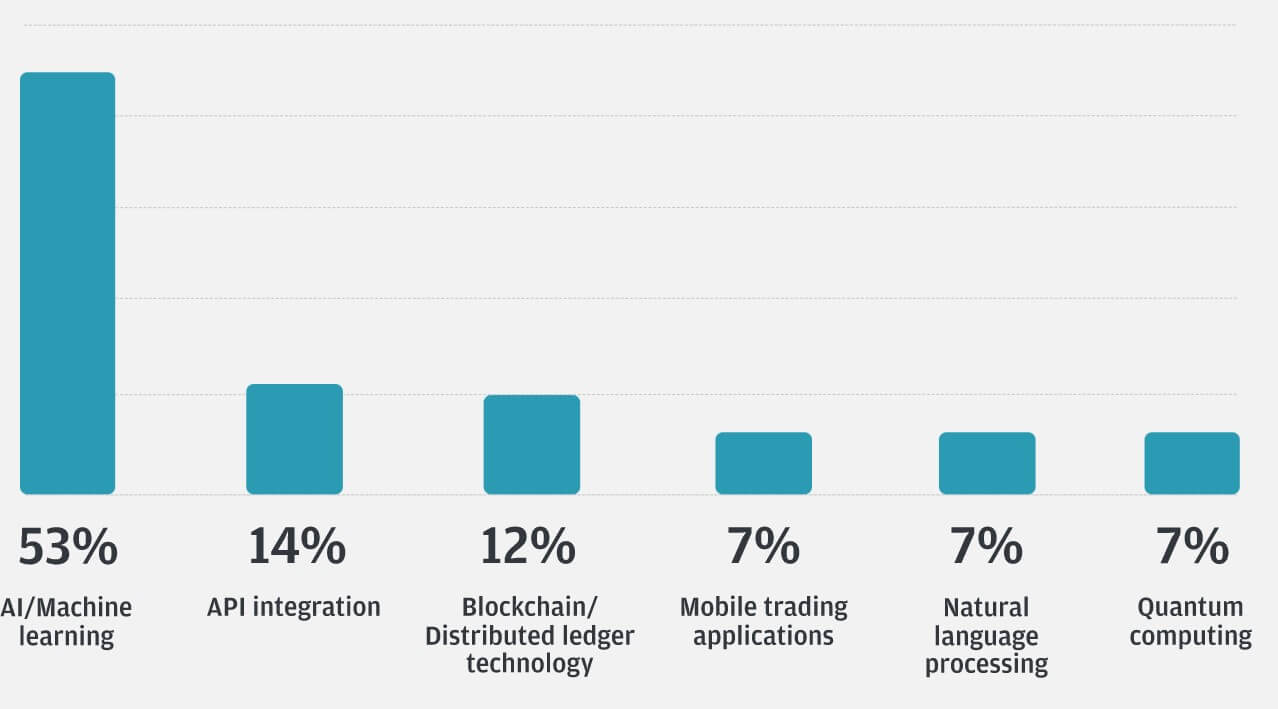

In line with the ballot, 53% suppose Synthetic Intelligence and Machine Studying would play essentially the most important function in shaping the way forward for buying and selling over the following three years. Alternatively, 12% suppose future buying and selling will probably be formed by blockchain expertise.

This starkly contrasts with the ballot leads to 2022, when blockchain expertise and AI acquired 25% of all votes, respectively.

Over the previous yr, curiosity in AI expertise has soared considerably with the developments in OpenAI’s ChatGPT.

Macroeconomic components

On macroeconomic components that would affect their trades, the merchants imagine a recession poses essentially the most important threat to the market in 2023, adopted carefully by fears of inflation and geopolitical conflicts. In 2022, the merchants’ largest fear was inflation.

In the meantime, round half of the merchants count on inflation ranges to lower, whereas 37% count on it to stage off. 19% of them suppose inflation will preserve rising.

Inflation ranges rose to a 40-year excessive in 2022, forcing monetary regulators worldwide to hike their rates of interest constantly.