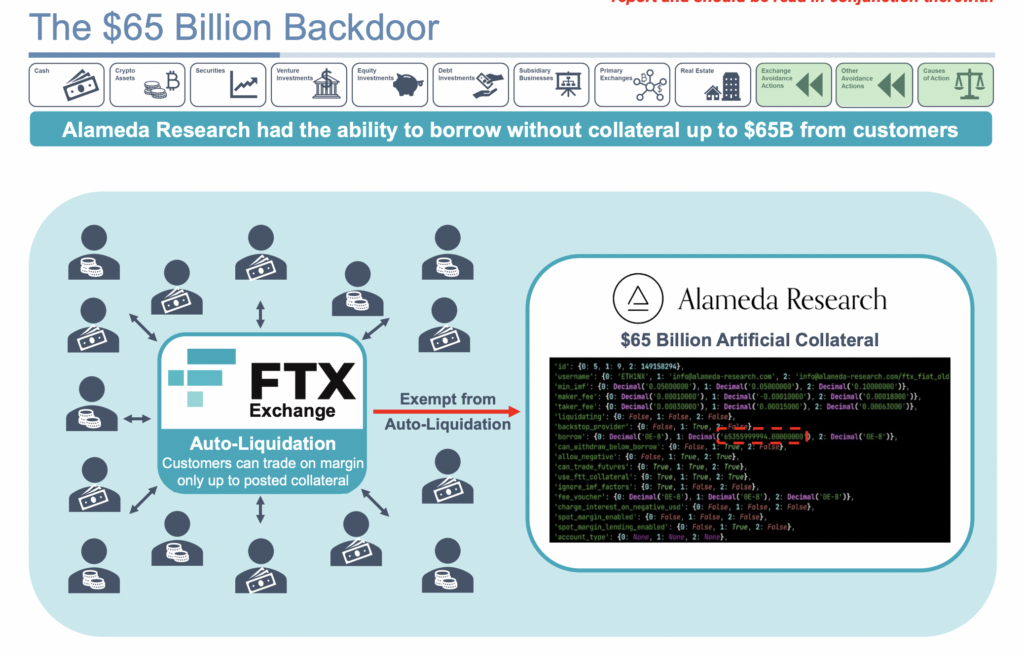

A latest courtroom submitting within the FTX chapter case has revealed a “$65 billion backdoor” between Alameda and FTX. The submitting features a deck detailing the present findings relative to FTX group funds.

The deck contains an illustration of the FTX liquidation course of alongside a code pattern that allegedly represents the Alameda backdoor.

Whereas clients have been auto-liquidated primarily based on the margin phrases supplied by FTX, Alameda was allegedly exempt from auto-liquidation. Additional, Alameda was not required to put up any actual collateral for trades. As an alternative, it was allowed to commerce with “synthetic capital.” If confirmed true in courtroom, this offense alone could be one in every of historical past’s most vital examples of fraud.

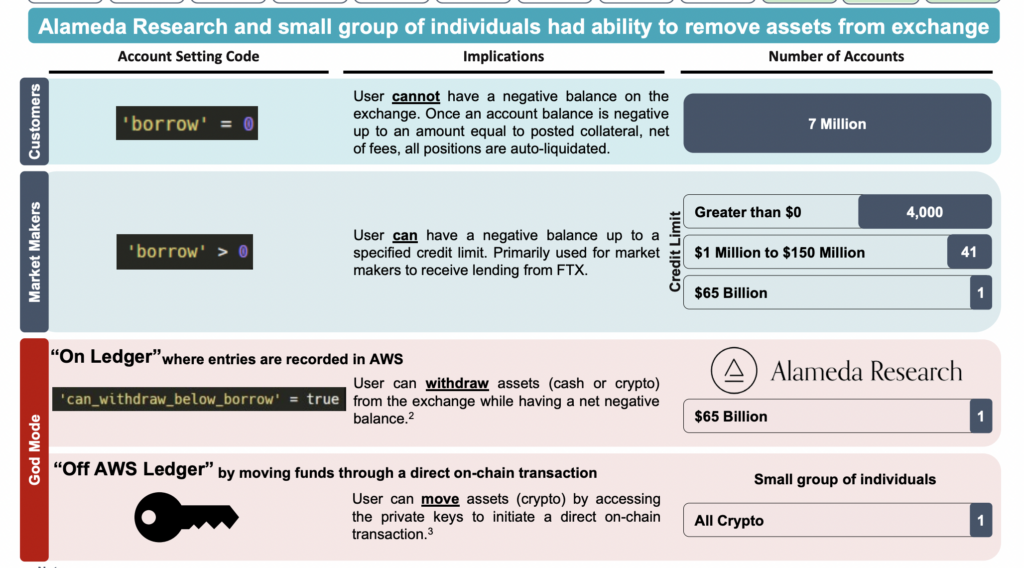

Much more damningly, the deck additionally confirms the existence of a ‘god mode’ by which a small group of people have been in a position to transfer funds off the trade. Examples of the code for every group have been illustrated through a selected “account setting code” within the trade’s codebase.

Seven million commonplace clients’ entry codes have been set so they may not borrow if their balances have been zero. Market makers for the corporate had credit score limits of as much as $150 million. Seemingly, 4,000 market markets had credit score limits as much as $1 million, with an additional 41 between $1 million and $150 million.

Nonetheless, Alameda had entry to $65 billion, some 43,000% greater than the most important credit score restrict given to different market makers. As well as, Alameda’s credit score line was categorized as part of the ‘god mode’ that allowed particular privileges. The power additionally allowed Alameda to withdraw money or crypto whereas having a detrimental steadiness. All of those transactions have been recorded on FTX’s Amazon AWS servers.

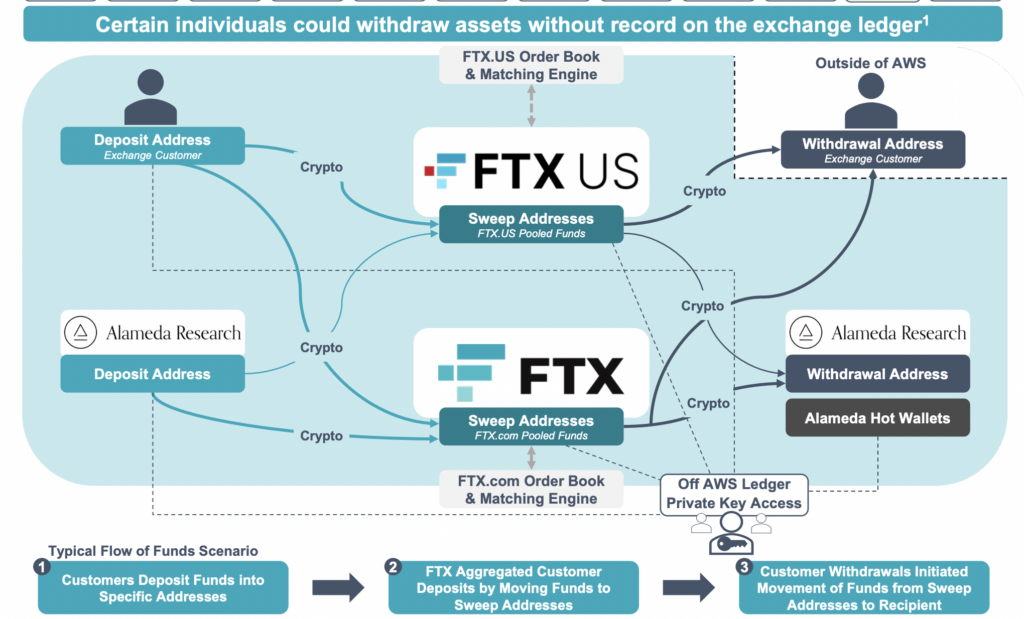

Moreover, a “small group of people” had an “off AWS Ledger” switch means permitting them to maneuver funds and not using a hint. These transfers have been obtainable throughout any crypto held by FTX however not money. Customers with this stage of clearance had entry to particular wallets’ personal keys, permitting them to provoke on-chain transactions instantly.

The flowchart of FTX’s AWS cash movement can also be illustrated throughout the deck. The chart under reveals how funds have been coming throughout a number of events between FTX and FTX.US.

Throughout his look earlier than the Home of Representatives in December, FTX CEO John Ray III described the monetary document holding at FTX as a few of the worst he’d seen in his profession and famous unacceptable administration practices, together with the commingling of property and lack of inner controls