The most important information within the cryptoverse for Jan. 11 noticed Avalanche announce a partnership with AWS as Silvergate revealed that it obtained a $4.3 billion bailout from a San Francisco Financial institution. In the meantime, Robinhood is delisting and promoting its BSV, WazirX has printed its proof-of-reserves report, and FTX has recovered $5 billion. Plus, analysis on Bitcoin costs and their relation to the Client Value Index (CPI).

CryptoSlate Prime Tales

Avalanche features 20% in hours after Amazon partnership announcement

Avalanche (AVAX) grew by 20% in a couple of hours after Ava Labs’ partnership with Amazon Net Providers went stay.

The partnership will assist to scale blockchain adoption throughout enterprises, establishments, and governments, based on experiences. With Ava Labs becoming a member of the AWS Accomplice Community (APN), it will likely be capable of deploy merchandise on AWS with greater than 100,000 companions worldwide.

Silvergate obtained a $4.3B bailout after FTX collapse

Silvergate Financial institution obtained $4.3 billion from the San Francisco-based Federal Residence Mortgage Financial institution final yr, following the collapse of crypto change FTX, based on the agency’s This fall, 2022 flings.

Silvergate’s enterprise mannequin focuses on offering banking companies to crypto exchanges and buyers. Round 90% of the financial institution’s deposits come from crypto.

On the finish of the third quarter, Silvergate’s 10 greatest depositors, together with Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle, represented about half of the financial institution’s deposits. Because of the FTX collapse, Silvergate was in a crucial place, because it held deposits for each FTX and Alameda Analysis.

Robinhood to market promote BSV after delisting Craig Wright’s Bitcoin variation

Customers of the favored inventory and crypto buying and selling app Robinhood are reacting to the announcement that the platform will delist Craig Wright’s Bitcoin SV (BSV) on Jan. 25.

A Robinhood spokesperson additional instructed CryptoSlate that any BCV held on the platform by clients after the deadline will likely be “bought at market worth and credited to their Robinhood shopping for energy.”

The change comes as part of Robinhood’s routine evaluation of its crypto merchandise, which means BSV will proceed to be tradeable on the app till the deadline. Nevertheless, it additionally highlighted that buyers residing in Hawaii, Nevada, and New York have restricted capabilities to commerce BSV.

Bitcoin price $120M withdrawn from exchanges on Jan. 10

Round $120 million price of Bitcoin (BTC ) was withdrawn from crypto exchanges on Jan. 10, based on Glassnode’s knowledge.

Roughly $50 million of the withdrawals got here from Binance, whereas $30 million was pulled from Coinbase.

There have been extra BTC outflows than inflows on crypto exchanges because the starting of 2023. Essentially the most vital BTC influx was round $80 million, which occurred on Jan. 4 –nevertheless, exchanges noticed outflows price roughly $40 million on the identical day.

On different days, the companies have principally seen extra outflows than inflows.

WazirX publishes proof of reserves of property price $285M

Indian-based crypto change WazirX has printed its Proof-of-Reserves (PoR) report, which reveals it holds about $285 million price of crypto property.

WazirX famous that about 90% of customers’ property (price $259.15 million) are held in wallets at Binance, whereas the remaining 10% ($26.54 million)are saved in scorching and heat wallets.

WazirX famous that it has ample reserve funds to fulfill customers’ withdrawal calls for at any time, because it has greater than 1:1 reserve holdings of customers’ property.

FTX lawyer proclaims $5B in property recovered

FTX recovered over $5 billion comprised of money, funding securities and liquid cryptocurrencies, based on Reuters.

“We have now positioned over $5 billion of money, liquid cryptocurrency and liquid investments securities.”

Andy Dietderich — an FTX lawyer — offered the replace to the case on Jan. 11, informing a chapter decide in Delaware initially of the FTX Senate Banking listening to.

Dietderich additionally stated that FTX plans to promote non-strategic investments that had a e-book worth of $4.6 billion, though the corporate’s books have been described as unreliable.

Binance-Voyager deal will get preliminary courtroom approval regardless of SEC objections

The U.S. chapter courtroom for the Southern District of New York offered an preliminary greenlight for the Binance-Voyager deal on Jan. 10, Reuters reported.

Decide Michael Wiles authorized the disclosure statements that defined the varied facets of the deal.

Nevertheless, Decide Wiles requested the attorneys engaged on the deal to revise the proposed order earlier than he provides ultimate approval. The deal will likely be finalized at a future courtroom listening to. Till then, the decide requested Voyager to hunt the votes of all its collectors on the sale of its $1 billion property to Binance.

Analysis Spotlight

Analysis: Bitcoin stays underneath strain forward of CPI knowledge; Michael Burry makes stagflation name

Analysts forecast a year-over-year improve of 6.5% within the U.S. Client Value Index (CPI) for December 2022 — with the Bureau of Labor Statistics’ official knowledge releasing Jan. 12 — however 2023 might deliver some upside as investor Michael Burry expects CPI to maneuver decrease this yr however warned that any subsequent pivot on rates of interest to stimulate financial exercise would set off a second inflationary spike.

November 2022’s precise CPI got here in at 7.1%, lower than the forecasted 7.3% charge. The higher-than-expected consequence led to a soar in crypto costs through the announcement, with Bitcoin posting a right away spike to $18,000 on the time.

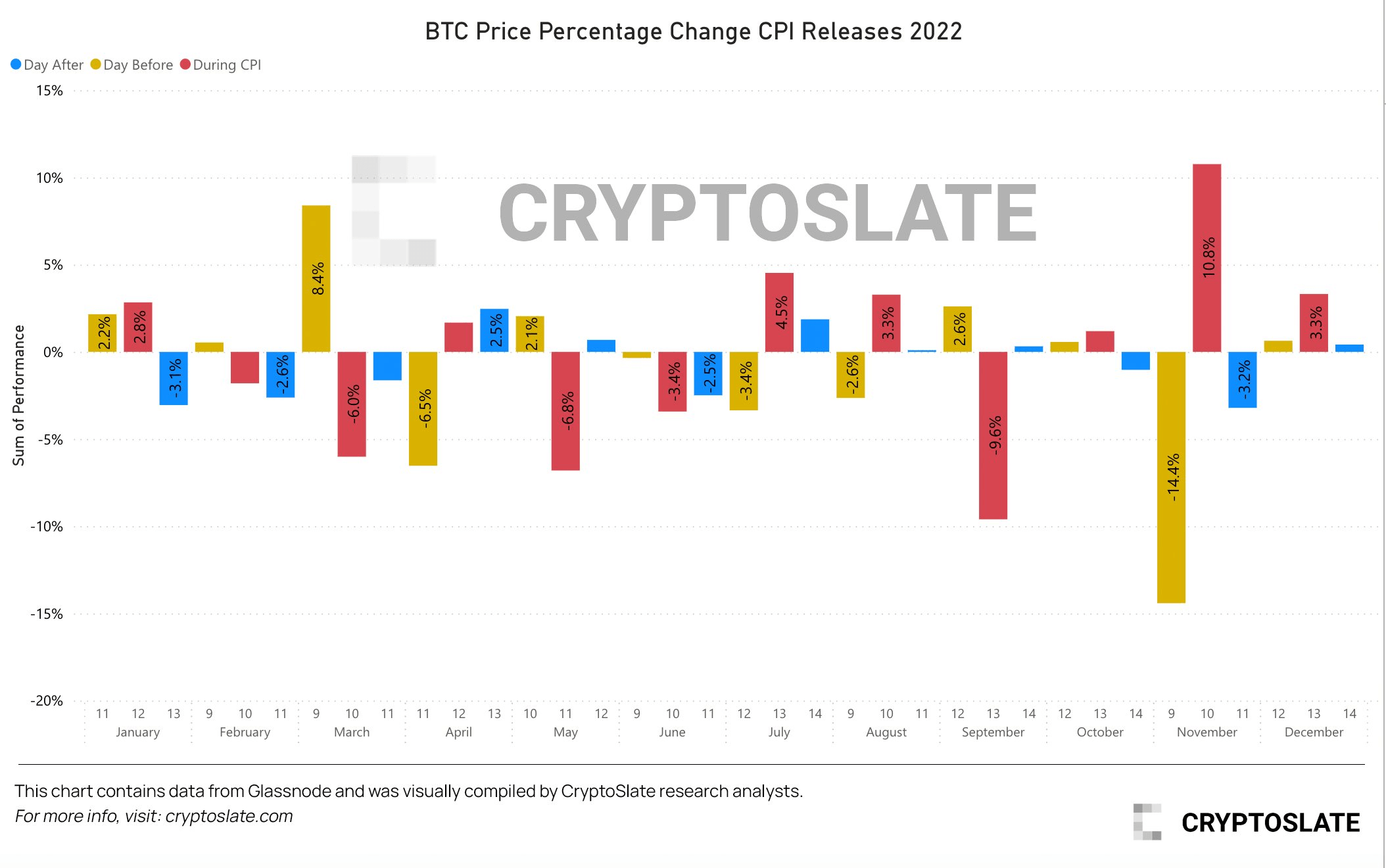

All through this bear market, CPI knowledge and rate of interest bulletins have been vital catalysts to crypto value volatility earlier than, after, and through bulletins. However to what extent?

The chart beneath reveals roughly half constructive and half adversarial results on the Bitcoin value earlier than the CPI announcement; this was additionally the case through the announcement.

In contrast, the day after the announcement tended to yield principally adversarial value results, presumably as buyers have had time to soak up the truth of elevated client costs and the following continuation of rate of interest hikes.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) rose 0.49% to commerce at $17,545.89, whereas Ethereum (ETH) was up 0.1% at $1,342.12.

Greatest Gainers (24h)

- SingularityNET (AGIX): 39.04%

- Ergo (ERO): 27.02%

- Voyager Token (VOY): 24.71%

Greatest Losers (24h)

- Gala (GALA): -11.82%

- Lido DAO Token: -10.23%

- Bitcoin SV (BSV): -9.8%