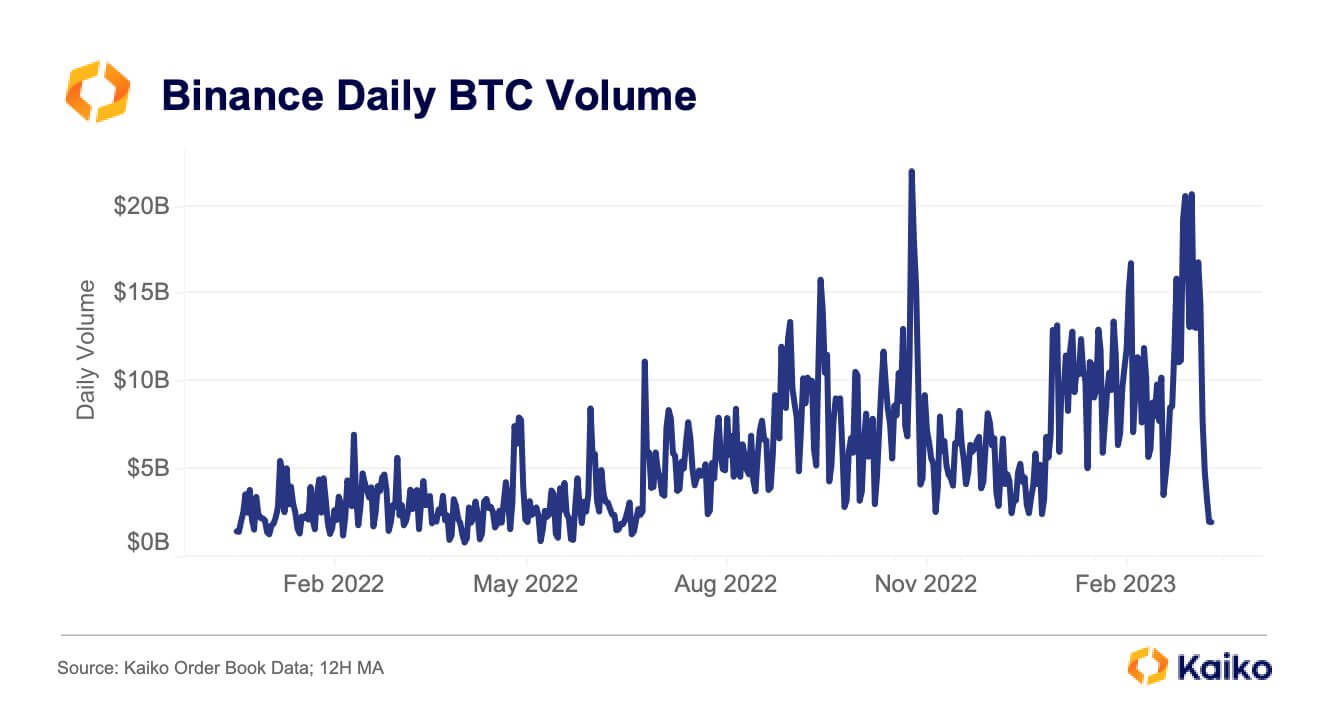

Binance’s Bitcoin (BTC) each day buying and selling quantity has fell to its lowest ranges since July 4, 2022, as the results of ending its zero-fee buying and selling for all buying and selling pairs besides TrueUSD (TUSD), in line with Kaiko information.

Kaiko researcher Riyad Carey identified that the final time Binance’s quantity went this low was two days earlier than it launched the zero-fee buying and selling choices. In response to him, the quantity decline coincided with the tip of free buying and selling.

Binance ended the free buying and selling choice for many of its BTC’s stablecoin pair on March 22 — citing the current regulatory points dealing with the area. The free buying and selling choice helped the trade improve its market share to 72% from 50.5% — it additionally accounted for roughly 61% of its whole quantity.

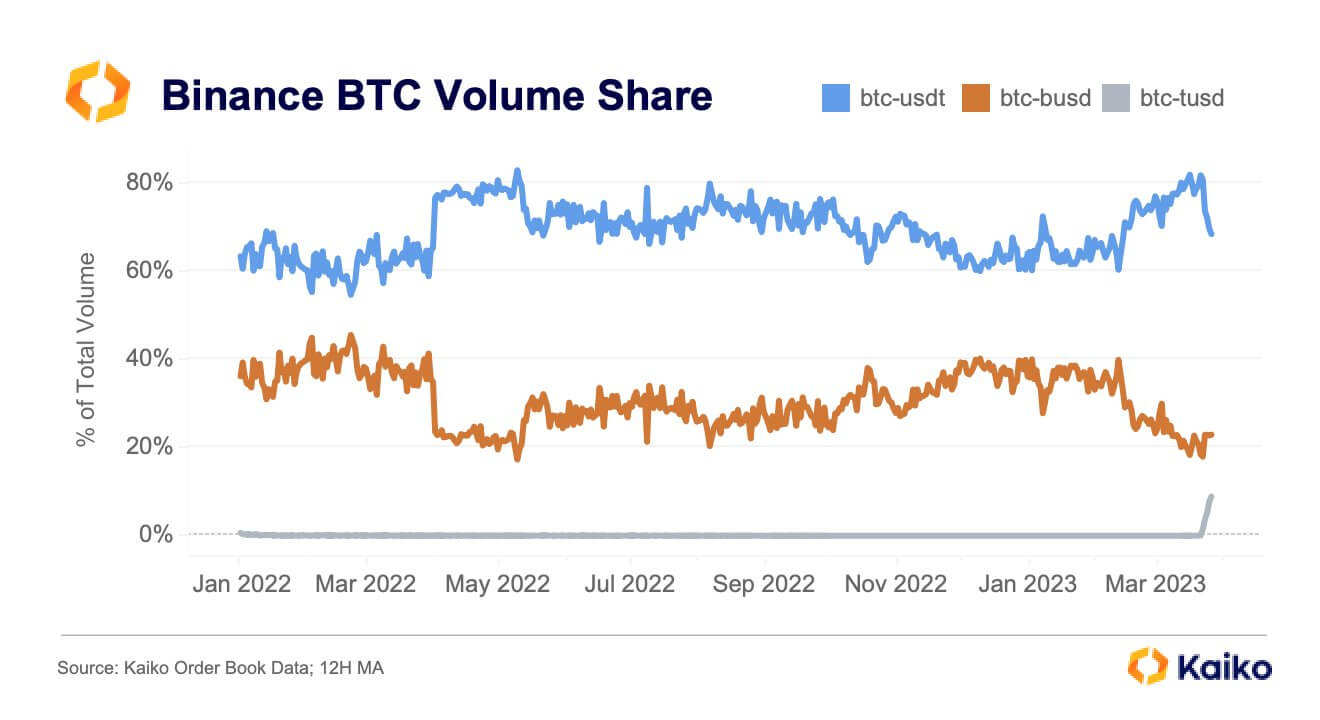

In the meantime, Binance’s BTC-TUSD market share elevated to roughly 10% whereas BTC-USDT quantity on the trade plunged to 68% from 81%.

Since Binance phased out the zero-fee buying and selling, TUSD’s liquidity has risen by greater than 250% — whereas liquidity for stablecoins like Tether’s USDT and Binance USD (BUSD) has declined greater than 60%, respectively.

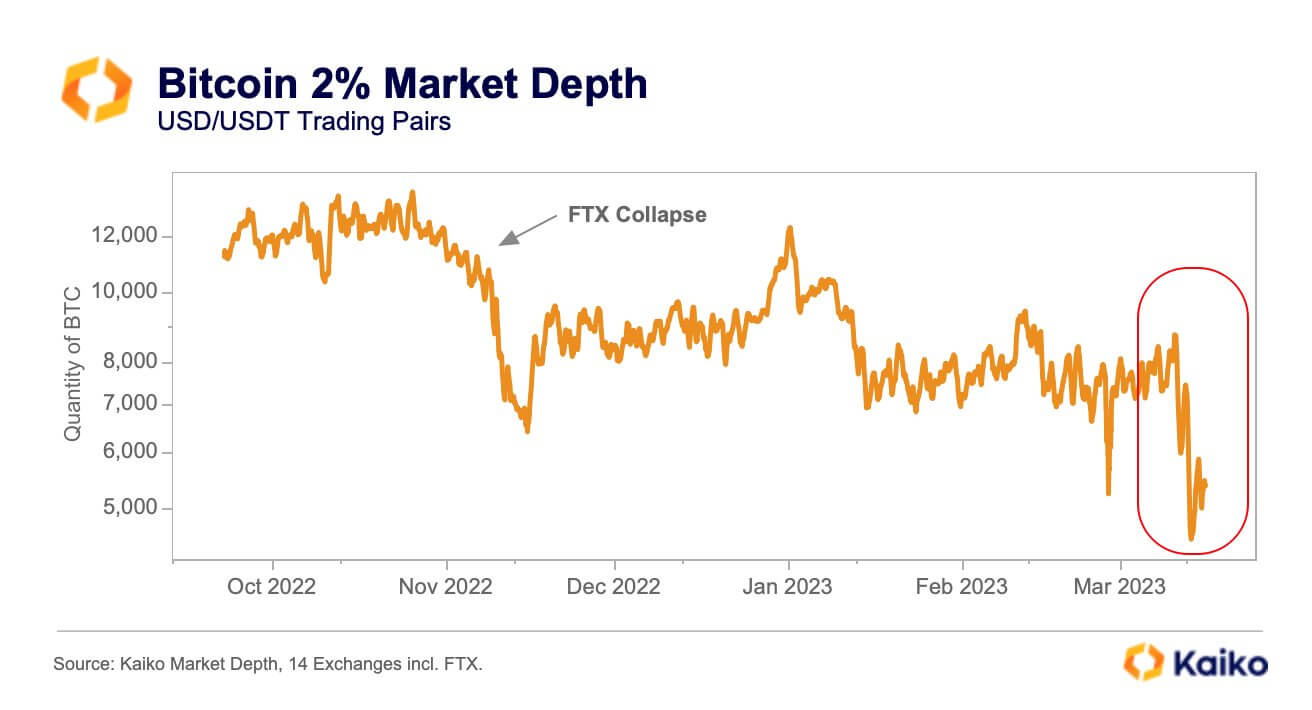

Bitcoin’s declining liquidity

Whereas Bitcoin has rallied by round 70% within the present yr, market liquidity surrounding the flagship digital asset has dropped to a 10-month low. Market liquidity is how straightforward it’s to transact an asset with out affecting value.

Kaiko’s Conor Ryder famous that the current collapse of crypto-friendly banks has deeply affected U.S.-based exchanges as a result of closure of US Greenback cost rails. He added that “market makers within the area [are] dealing with unprecedented challenges to their operations.”

In response to Ryder, USD pairs spreads have suffered extra volatility as a result of uncertainty surrounding the crypto trade in america. Apart from that, slippage on U.S-based exchanges has elevated resulting from these points.

For context, the slippage on a BTC-USD 100,000 promote order on Coinbase has elevated by 2.5x from what it was in early March whereas that of Binance has barely moved.

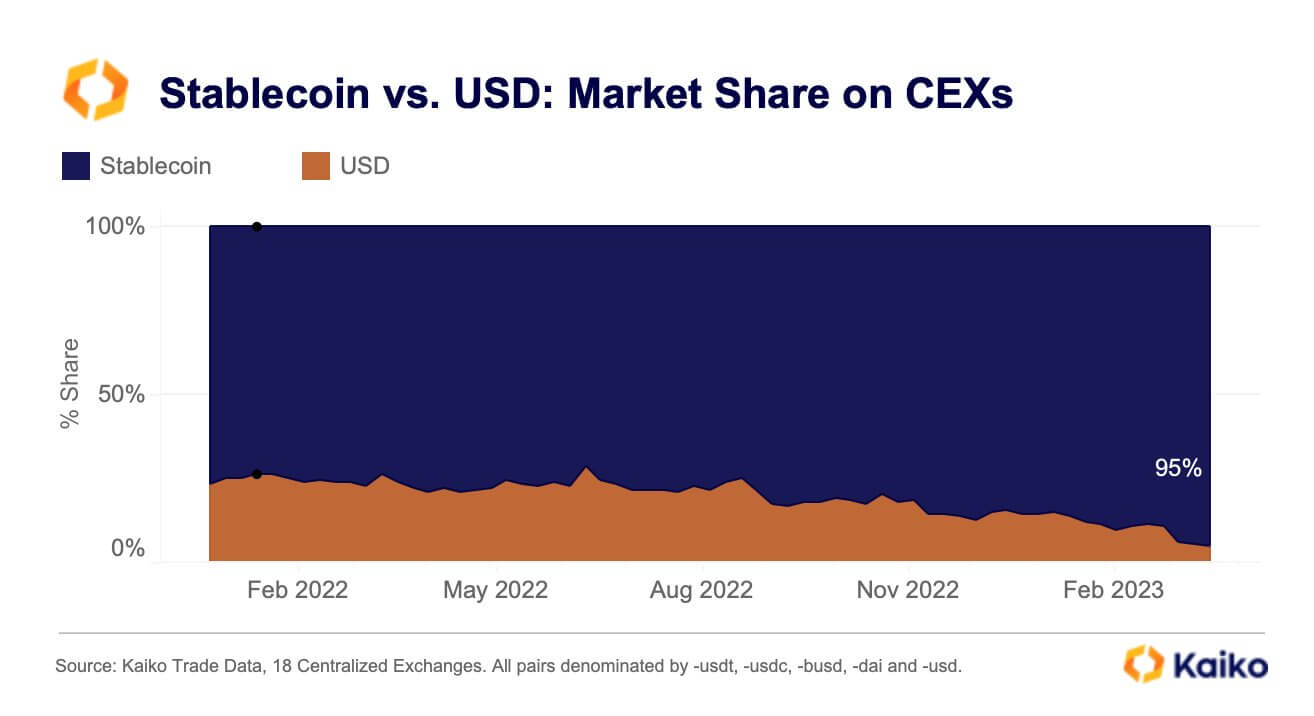

In the meantime, the elevated tightening of USD entry has seen exchanges pivot to stablecoins. In response to Kaiko information, stablecoins now account for 95% of buying and selling volumes on centralized exchanges.

Ryder famous that whereas the pivot to stablecoins dulls the impression of US banking points, it’s impacting liquidity within the nation and will not directly damage.