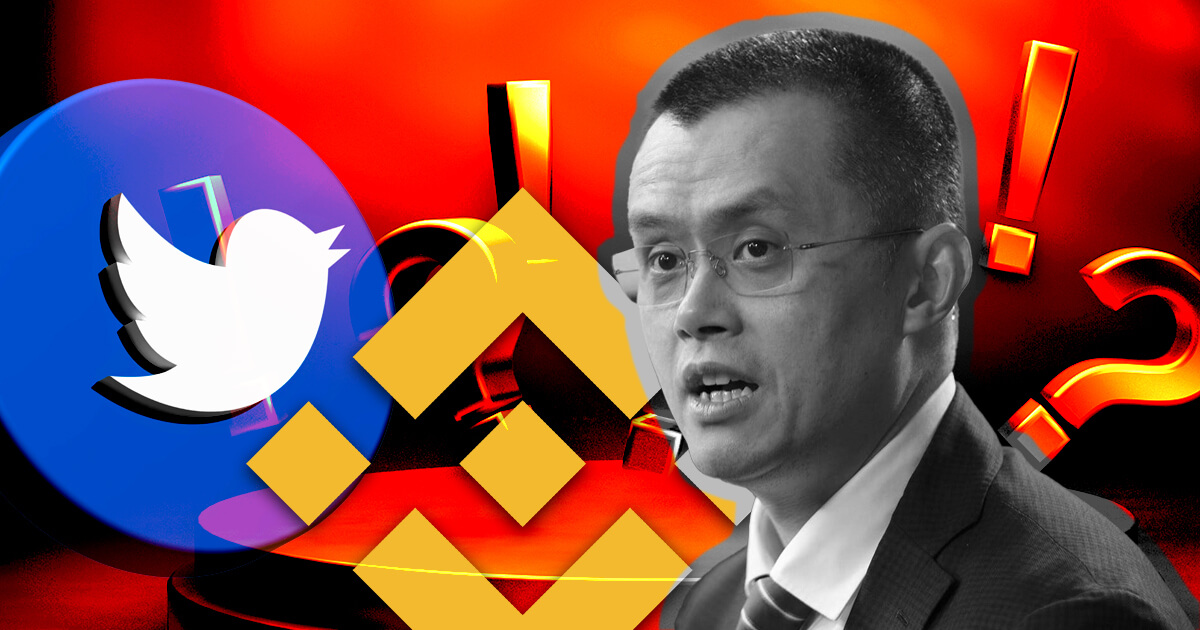

Binance CEO Changpeng Zhao (CZ) mentioned that stablecoin regulation might assist speed up its adoption, in accordance with a Feb. 1 Twitter thread.

CZ identified that stablecoins are underneath sturdy regulatory focus and their regulation would “deliver much-needed certainty to issuers, customers, and repair suppliers.”

Stablecoins have confronted elevated scrutiny over the previous yr following the collapse of Terra’s algorithmic stablecoin UST. Monetary regulators have highlighted the hazards the asset class poses to the broader monetary system and have elevated their regulatory efforts across the house.

CZ famous that we’re already seeing the advantages and use instances of stablecoins in “cross-border funds, hedging towards inflation, and even assist disbursement.”

CZ praises Hong Kong’s “determined method”

The Binance CEO praised the Hong Kong authorities’s “determined method to stablecoins.”

CZ highlighted that Hong Kong’s method will present “a extra outlined scope for regulated actions, particularly governance, issuance, stabilization preparations, and wallets – together with entry and holdings administration.” He added that:

“[The] Adoption of a risk-based method to determine which stablecoins are in scope, aiming to mitigate threat to financial & monetary programs – thus beginning with fiat-backed.”

CZ mentioned he “absolutely helps” the necessities for 1:1 backing and redemption at par whereas touting his trade’s stablecoin BinanceUSD (BUSD).

The Hong Kong Financial Authority (HKMA) just lately printed its regulatory plans that required stablecoin issuers to get licensed and prevented the proliferation of algorithmic stablecoins. HKMA mentioned:

“Stablecoins that derive their worth primarily based on arbitrage or algorithm won’t be accepted. Stablecoin holders ought to be capable to redeem the stablecoins into the referenced fiat forex at par inside an affordable interval.”

Over the previous yr, the Asian nation, alongside the U.S., the European Union, Singapore, and Japan, have launched varied regulatory measures to forestall one other Terra-like collapse.

In the meantime, CZ mentioned he was trying ahead to the proposals of the Financial Authority of Singapore (MAS) and the worldwide monetary physique, the Monetary Stability Board (FSB).