Fast Take

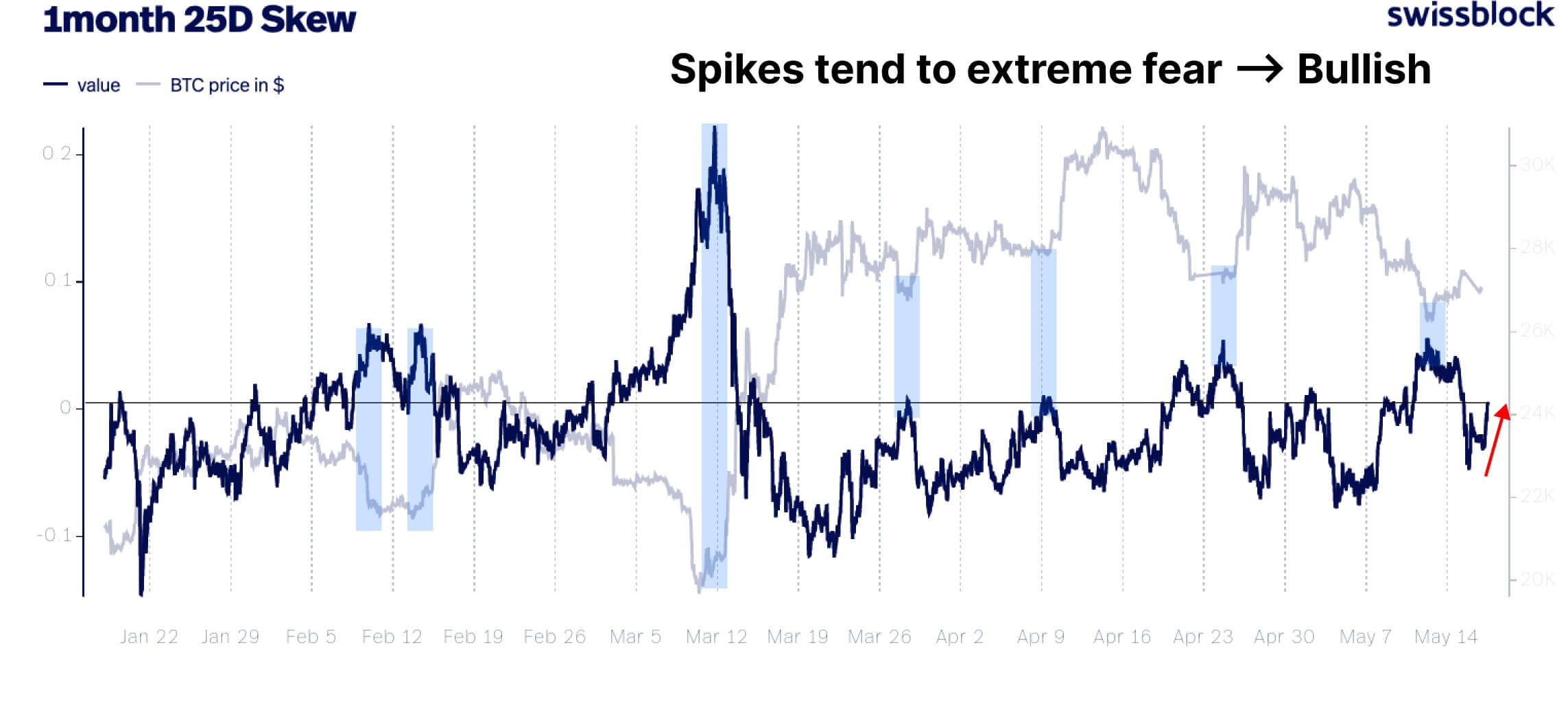

- Skew is the relative richness of put vs name choices, expressed when it comes to Implied Volatility (IV). For choices with a selected expiry, 25 Delta Skew refers to places with a delta of -25% and calls with a delta of 25% to exhibit this distinction available in the market’s notion of implied volatility.

- The Bitcoin 1-month 25D Skew suggests a “Put Premium”; the demand for places will increase as buyers search protection to the draw back.

- Nonetheless, throughout the complete curve, the put-to-call ratios’ total place within the choices market is skewed to the upside.

- This has been a bullish indicator this yr.

A breakdown of the curve

- 1 Week: -0.496%

- 1 Month: -0.293%

- 3 Months: -0.212%

- 6 Months: -3.156%

The put up Bitcoin 1-month 25D Skew suggests a “Put Premium” appeared first on CryptoSlate.