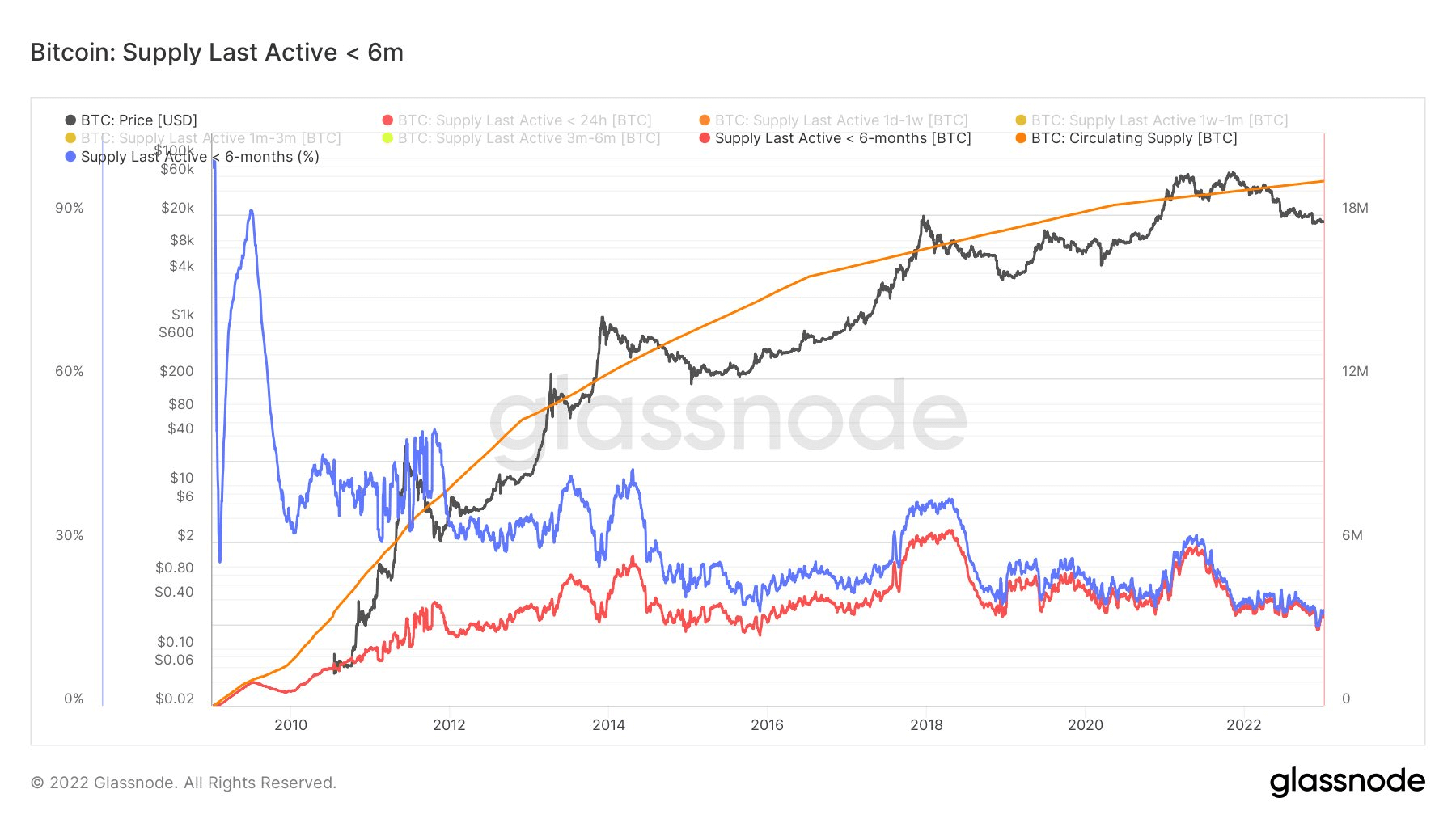

The Provide Final Energetic metric seems to be on the quantity of inactive Bitcoin over a given time interval. Analysts infer that the extra inactivity exists, the extra BTC is being hodled, thus lowering promote strain and appearing as a tailwind for bullish worth motion.

CryptoSlate’s evaluation of Glassnode knowledge confirmed the proportion of provide held for lower than six months has fallen to its lowest degree.

Bitcoin Provide Final Energetic falls to new lows

With the arrival of 2023, hopes are excessive that Bitcoin will reverse the unfavorable worth motion that characterised the earlier yr.

The cohort of Bitcoiners who held for six months or much less at the moment is available in at round three million BTC, which equates to fifteen% of the entire circulating provide – the lowest-ever proportion.

The earlier occasion of the bottom Provide Final Energetic was in the course of the backside of the 2015 bear market, which occurred in This autumn of the yr, because the metric touched 17%. From that time, over two years, the Bitcoin worth grew from $200 to $20,000.

Evaluation of previous knowledge confirmed youthful cash usually are available in quantity throughout two key occasions:

- Bull markets as longer-term traders spend and divest into market power.

- Capitulation sell-off occasions the place widespread panic brings cash of all ages again into liquid circulation.