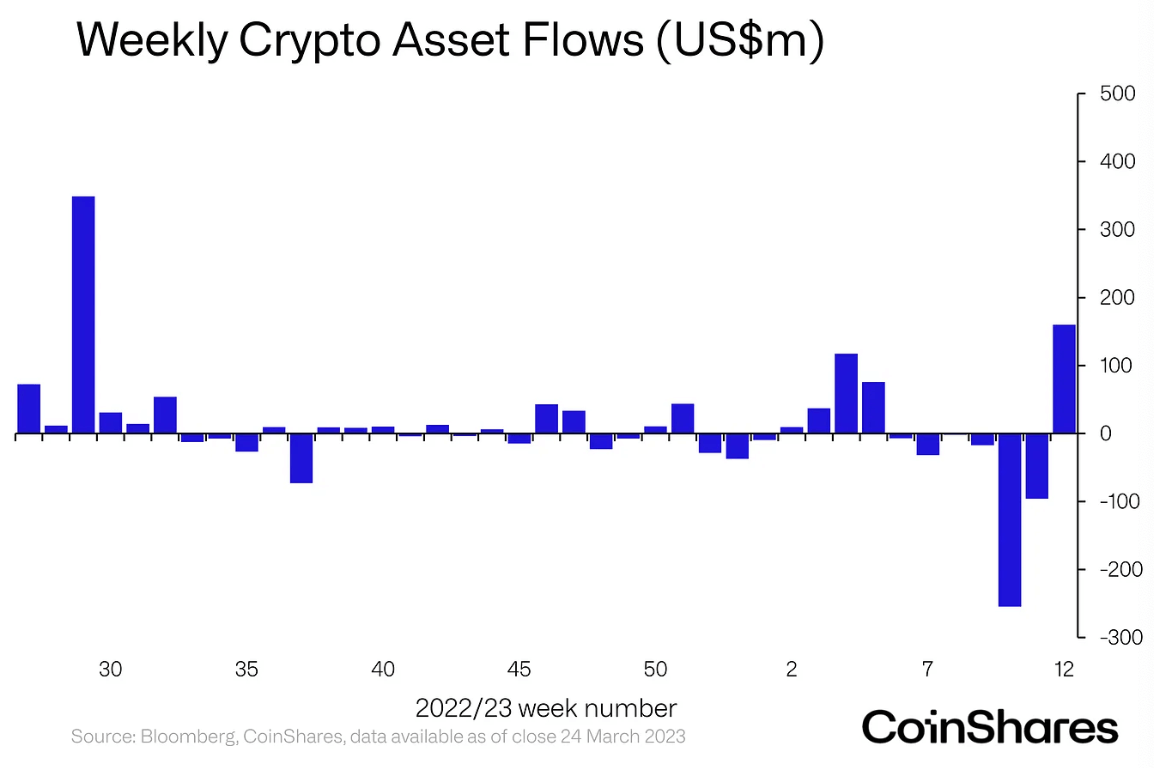

Digital asset funding merchandise broke its six-consecutive-week of outflows strike and recorded $160 million in inflows throughout the week of March 20, in accordance with CoinShares report.

Final week’s inflows mark probably the most vital optimistic motion since July 2022, because the CoinShares information signifies. Crypto-based funding merchandise have been recording outflows for the reason that starting of February — with combination worth reaching $408 million.

The report acknowledges that the inflows have been seen comparatively late in comparison with the broader crypto market. It notes that it is likely to be on account of “rising fears amongst traders for stability within the conventional finance sector.”

The largest outflow was recorded throughout the week of March 6 at a complete of $255 million in outflows. On the time, this quantity represented 1% of the market and worn out inflows recorded for the entire yr.

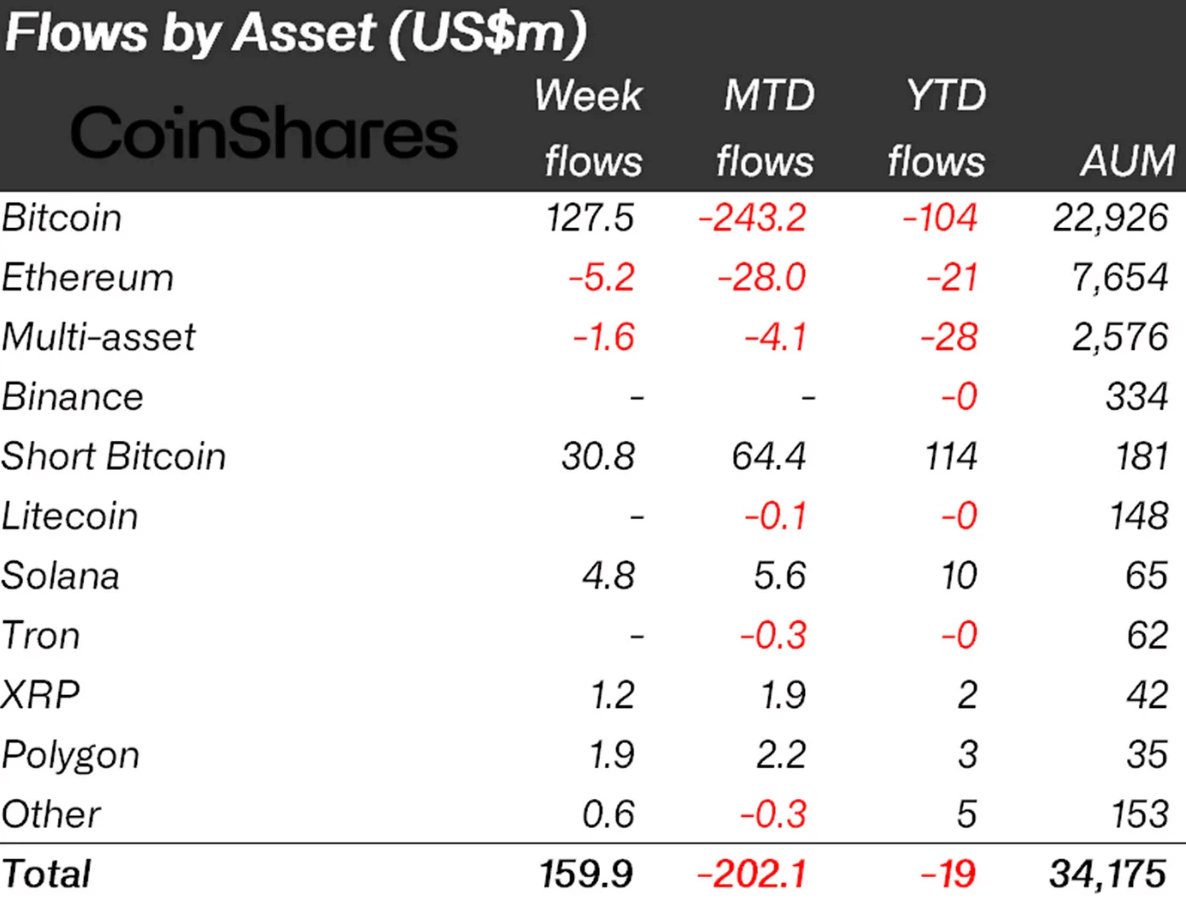

Flows by asset

Bitcoin (BTC) primarily based funding merchandise recorded probably the most appreciable inflows with $127.5 million — accounting for nearly 80% of the whole quantity.

Quick-BTC and Solana (SOL) primarily based funding merchandise collected the second and third most important inflows with $30.8 million and $4.8 million, respectively. Quick-BTC has been recording inflows even throughout the six-week-outflow strike — indicating that the funding product collected probably the most inflows for the reason that starting of the yr.

Ripple (XRP) and Polygon (MATIC) additionally recorded inflows price $1.2 million and $1.9 million, respectively.

In the meantime, Ethereum (ETH) primarily based funding merchandise noticed $5.2 million in outflows. This marked the third consecutive week of outflows for ETH-based merchandise. The report states that ETH’s Shanghai improve is anticipated to happen on April 12 — which might trigger “traders’ jitters.”

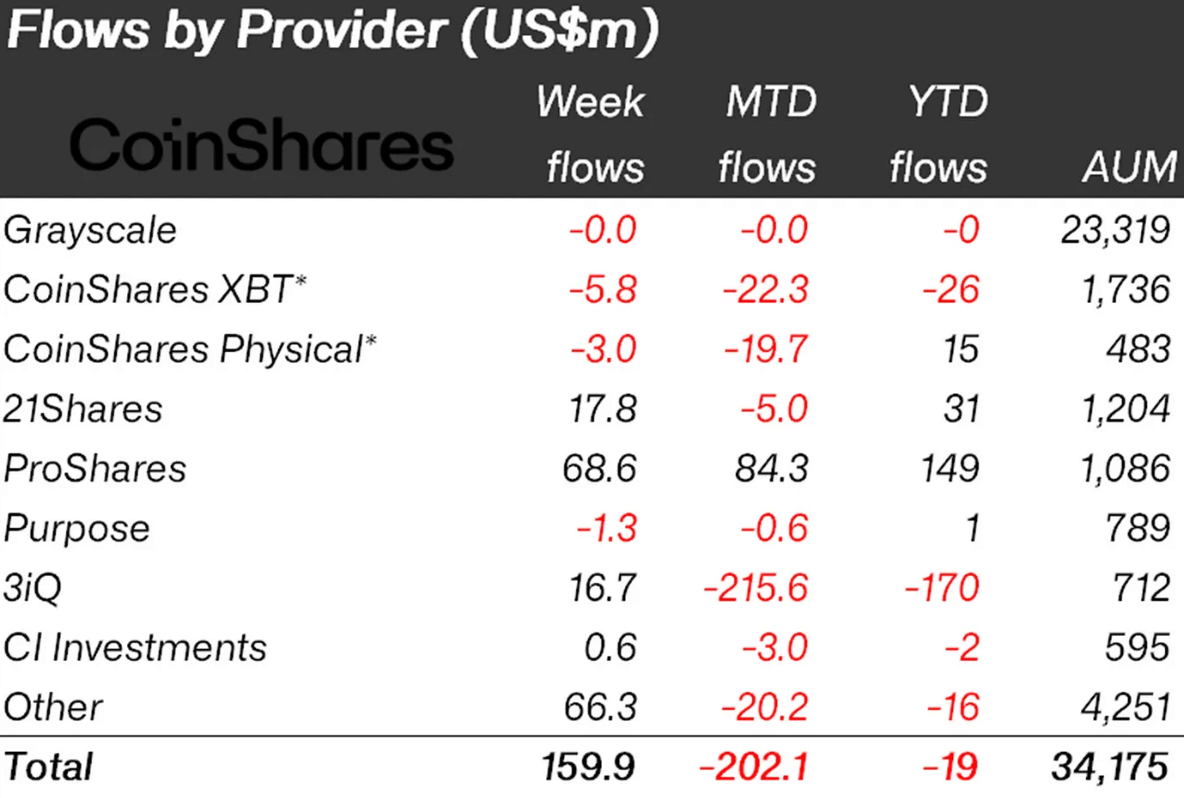

Flows by supplier

Concerning the movement of funds primarily based on the suppliers, ProShares comes ahead because it noticed $68.6 million in inflows — accounting for 42% of the whole quantity.

21Shares and 3iQ carefully observe because the second and the third by recording $17.8 million and $16.7 million in inflows, respectively.

In the meantime CoinShares Bodily and CoinShares XBT misplaced an combination of $8.8 million — whereas Objective noticed one other $1.3 million in outflows.

The US invests probably the most

The report additionally famous that the usrecorded an immense quantity of inflows — contributing $69.1 million by itself which accounted for 43% of the whole $160 million.

Germany, Canada, and Switzerland adopted the U.S. — recording the second, third, and fourth most important inflows with $57.8 million, $26.1 million, and $16.6 million, respectively.

In the meantime, Sweden, Brazil, and France recorded outflows price $5.8 million, $3.9 million, and $100,000, respectively.