Definition

An inverted yield curve is when rates of interest on long-term bonds fall decrease than these of short-term bonds. This will signify an impending recession; an inverted yield curve emerges roughly 12-18 months earlier than a recession.

Fast Take

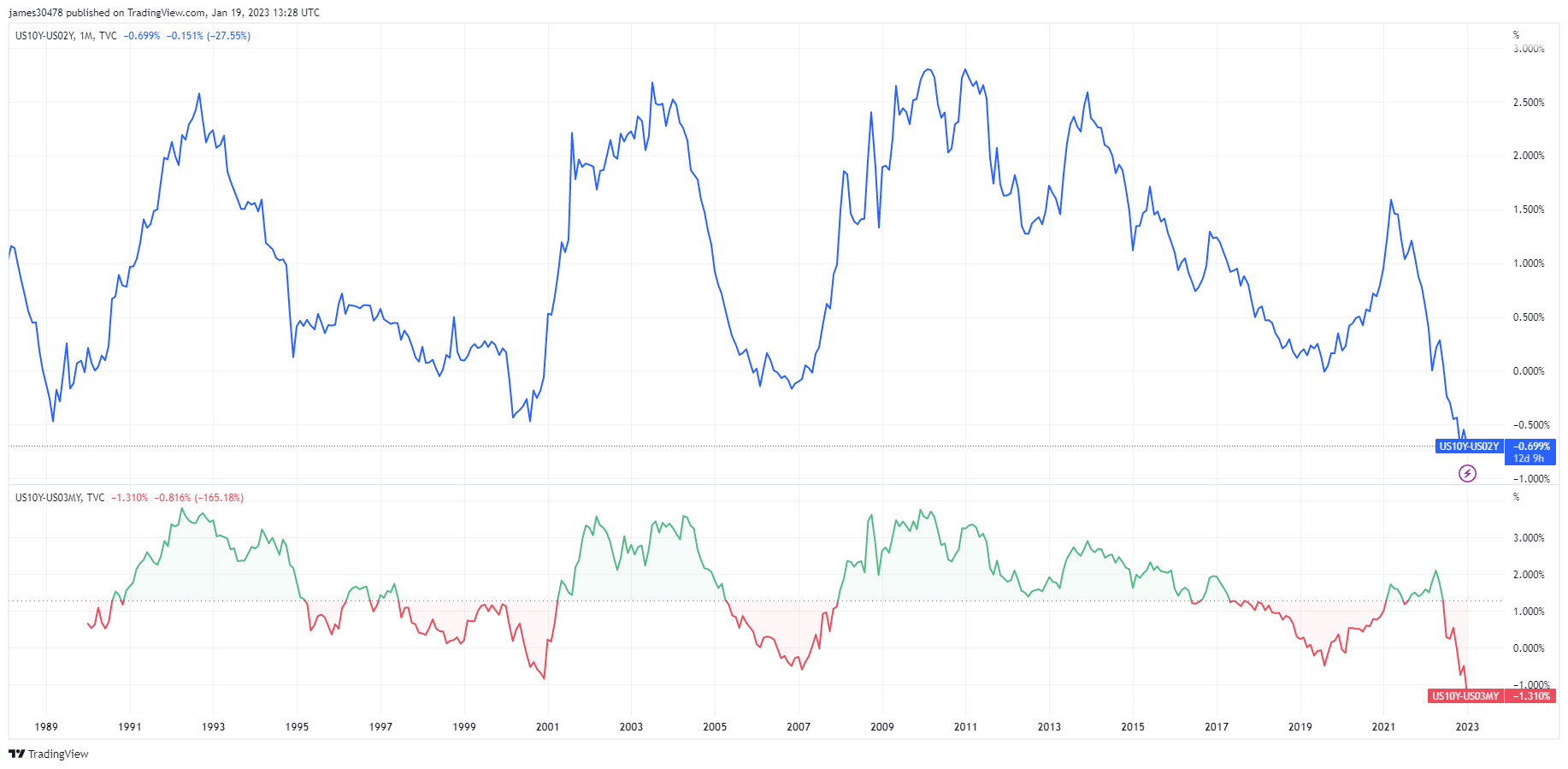

- Many alternative inversions have occurred throughout the yield curve, with the US10Y – US02Y deeply inverted as little as the Eighties.

- The two/10 unfold has inverted virtually 30 occasions since 1900; in 22 cases, a recession has adopted.

- As well as, the 3m10y unfold has reached a -100 bps inversion, the deepest in a number of a long time.

- This inversion factors out the fed coverage error that the fed will break inflation however might additionally break the financial system.

The submit Deepest inversion since 1981, excessive chance of recession 2H 2023 or early 2024 appeared first on CryptoSlate.