Glassnode knowledge analyzed by CryptoSlate exhibits that the U.S.-based crypto alternate Gemini and its stablecoin Gemini Greenback (GUSD) are beginning to lose followers and the group’s belief as metrics fall to all-time lows.

GUSD holders and alternate volumes

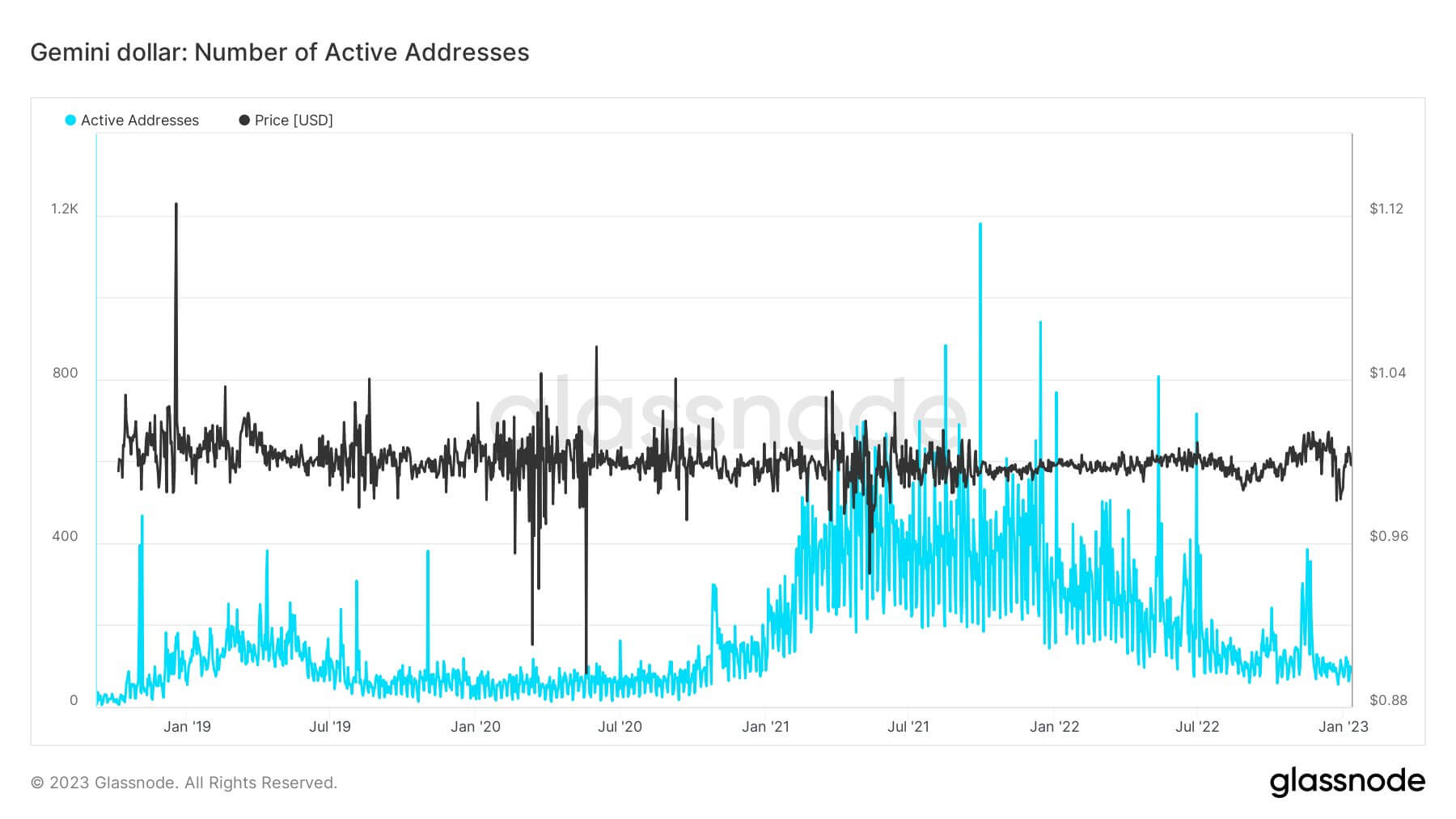

The variety of energetic addresses that maintain GUSD has slumped again to its 2020 ranges. The chart under represents the energetic pockets quantity for the reason that starting of the yr 2019.

The variety of wallets began to extend on the finish of 2020 and reached nearly 1200 in direction of the top of 2021. Since then, energetic addresses that maintain GUSD fell by 91.6% and retreated again to 100 in January 2023.

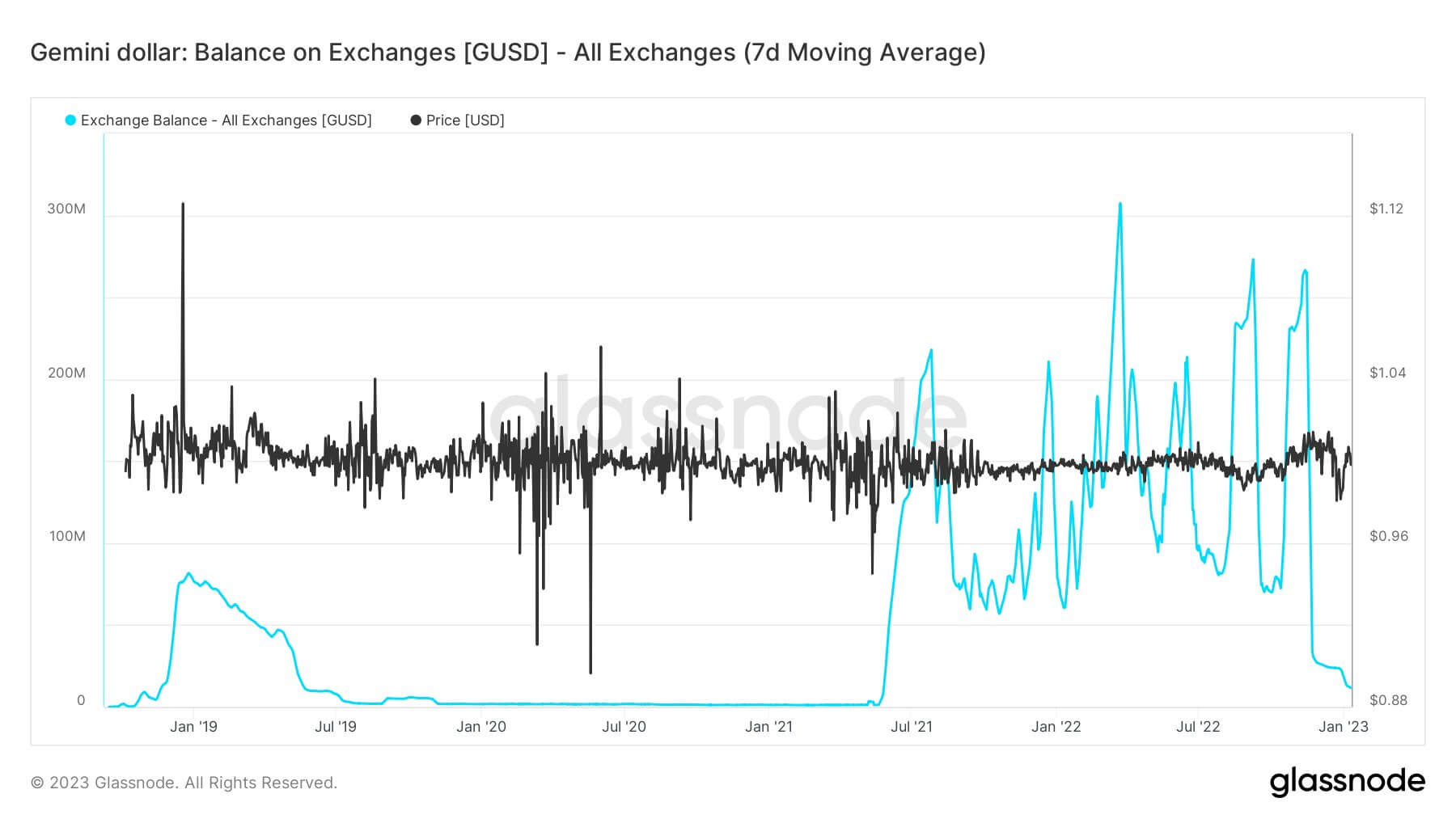

BUSD steadiness on exchanges additionally recorded a big lower. The chart under demonstrates the BUSD steadiness held on exchanges for the reason that starting of 2019.

The BUSD quantity on exchanges began to develop exponentially in July 2021 and breached 300 million in Might 2022, simply earlier than the FTX collapse.

Nonetheless, the BUSD quantity began to report ups and downs after the FTX catastrophe and eventually recorded a 96% lower in January 2023, falling from round 260 million to only above 10 million.

What occurred?

The title Gemini has been on the headlines for the reason that Terra-Luna collapse. As quickly because the winter market began, Gemini laid off 10% of its workers in June 2022, which marked the alternate’s first layoff resolution. In July 2022, Gemini went for the second spherical of layoffs and let 15% of its workers go. In each selections, the alternate pointed on the market turmoil and repeated that it needed to handle prices. On the time, nonetheless, most crypto firms have been shedding workers, so Gemini didn’t actually stick out.

Gemini Earn

The actual chain of occasions that harm the group’s belief in Gemini began on Nov. 16, 2022, when Gemini’s Earn program halted withdrawals attributable to market turmoil. Addressing the customers, the alternate stated it will attempt to meet clients’ withdrawal requests as quickly as doable.

Gemini Earn is a program that permits particular person buyers to lend their crypto belongings to institutional debtors in alternate for a specific amount of curiosity. To facilitate these providers, Gemini partnered with third-party crypto lenders, together with Genesis, which suspended withdrawals for its personal clients on Nov. 16, the identical day as Gemini Earn. Genesis stated it’s experiencing irregular quantities of withdrawal requests which exceed the corporate’s liquidity. It additionally added that its mother or father firm, Digital Forex Group (DCG), can also be doing all the things in its energy to clean out the scenario.

The discussions between DCG, Genesis, and Gemini, together with DCG’s CEO Barry Silbert and Gemini CEOs Cameron and Tyler Winklevoss, have been persevering with since then, and the stress has been climbing each day. On Dec. 5, Gemini shaped an ad-hoc committee to provide you with an answer to the liquidity disaster.

On Jan. 2, Cameron Winklevoss wrote an open letter addressed to Silbert and claimed that Gemini Earn’s liquidity disaster is attributable to Genesis, and Genesis is having issues as a result of Sibert owes his subsidiary $1.675 billion. Cameron Winklevoss gave Silbert time till Jan. 8 to make up for his debt and due to this fact resolve Gemini’s liquidity disaster. Silbert responded to the open letter quickly after it was revealed, saying that neither he nor DCG has any debt to Genesis.

Gemini Earn customers filed a category arbitration swimsuit towards Genesis and DCG on Jan. 3, claiming that Genesis breached its settlement with Gemini Earn customers. On Jan. 4, Genesis CEO launched a assertion saying that the agency is targeted on fixing the issue, nevertheless it wants extra time.

The issue remained unsolved, and Gemini introduced that it’s formally discontinuing its Earn program on Jan. 11, 2023. The alternate added that returning its customers’ funds is at the moment the very best precedence whereas additionally reminding that Genesis was chargeable for repaying all belongings to customers.