Definition

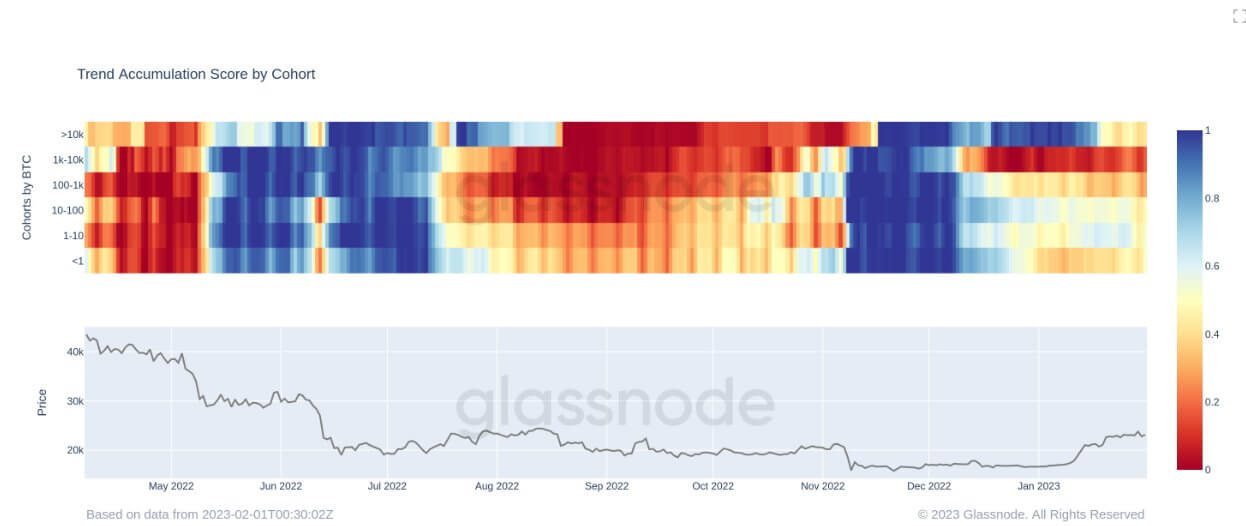

The Accumulation Development Rating (ATS) is an indicator that displays the relative measurement of entities which might be actively accumulating cash on-chain by way of their BTC holdings. The size of the ATS represents each the scale of the entities steadiness (their participation rating), and the quantity of latest cash they’ve acquired/bought over the past month (their steadiness change rating).

An ATS of nearer to 1 signifies that on mixture, bigger entities (or an enormous a part of the community) are accumulating, and a price nearer to 0 signifies they’re distributing or not accumulating. This gives perception into the steadiness measurement of market members, and their accumulation conduct over the past month.

Fast Take

- At the moment, the Bitcoin (BTC) community is seeing heavy distribution from all cohorts; this conduct was final seen after the Luna collapse in mid-2022, circled beneath.

- This comes after aggressive shopping for through the FTX collapse in November 2022, as all cohorts noticed nice worth within the BTC value.

- The identical conduct occurred after earlier bear market bottoms in 2015, 2019, 2020, and 2022. Although distribution begins to happen as traders take earnings, reluctance to proceed accumulating can seem if traders specific worry of a bull entice.

Accumulation development rating: (Supply: Glassnode)

Accumulation development rating by cohort: (Supply: Glassnode)

The publish Important distribution within the Bitcoin community from all cohorts – comparable sample happens after bear market bottoms appeared first on CryptoSlate.