Crypto platform Midas Funding will shut operations due to the numerous losses it incurred in 2022, in keeping with a Dec. 27 assertion.

CEO Iakov “Trevor” Levin mentioned the Midas DeFi Portfolio misplaced 20% of its $250 million ($50 million) in property underneath administration. Trevor added that customers withdrew round 60% of its AUM following the collapse of crypto companies like FTX and Celsius.

Liabilities exceed $100 million

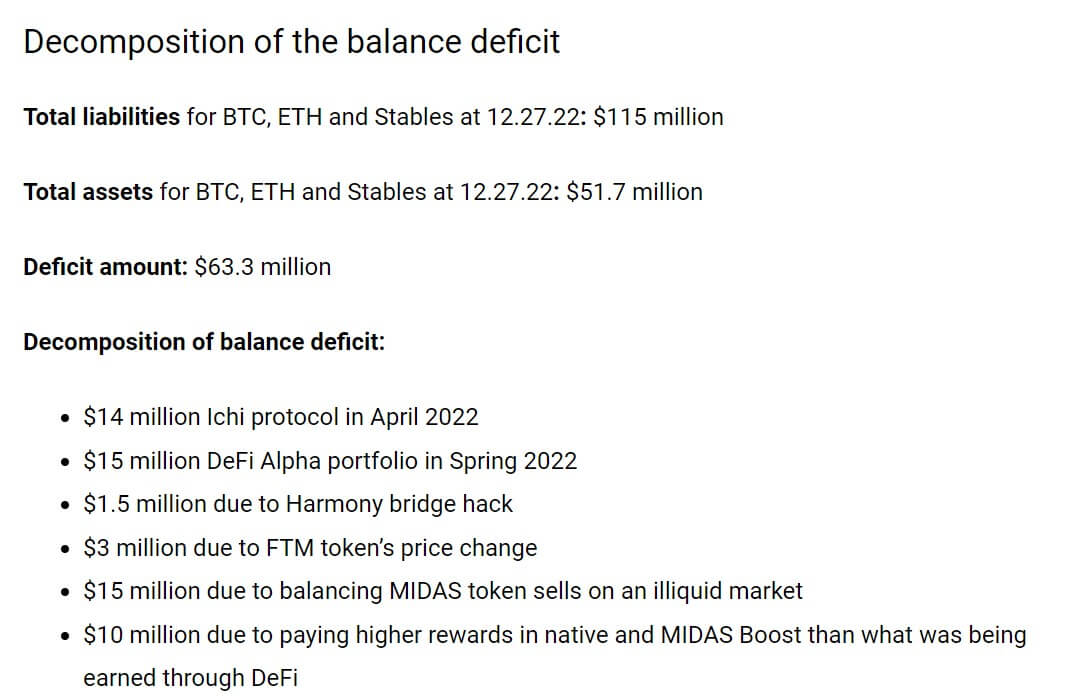

As of Dec. 27, Midas’ whole liabilities have been $115 million in Bitcoin (BTC), Ethereum (ETH), and stablecoin. Nevertheless, the platform holds roughly $51.7 million of those property, making a deficit of $63.3 million. He added that solely C-level executives of the agency have been conscious of the asset deficit.

“The asset deficit was attributable to the long-term threat of DeFi funding, the instability of our enterprise mannequin after the lack of property, and the illiquidity of the Midas token.”

In the meantime, Trevor highlighted that Midas misplaced $58.5 million to a number of DeFi-related safety breaches and overpaid curiosity in its native MIDAS token.

What subsequent?

CEO Trevor mentioned Midas would rebalance its customers’ accounts by deducting 55% from it and their rewards earned. The transfer would permit customers to withdraw 45% of their property.

In line with him, customers whose balances are lower than $5000 would have solely their earnings deducted. He added that Midas would pay for the variations in its native tokens that will be exchanged for the token of its new mission.

The Midas CEO wrote that the platform would look to pivot its companies into centralized, decentralized finance (CeDeFi). He mentioned:

“This mission can be totally clear, on-chain, and constructed with the purpose of providing a brand new and improved funding expertise.”