On-chain information exhibits Bitcoin has damaged above these three key ranges in a way harking back to the rally in April 2019.

Bitcoin Breakout Reveals Preliminary Similarities To April 2019 Rally

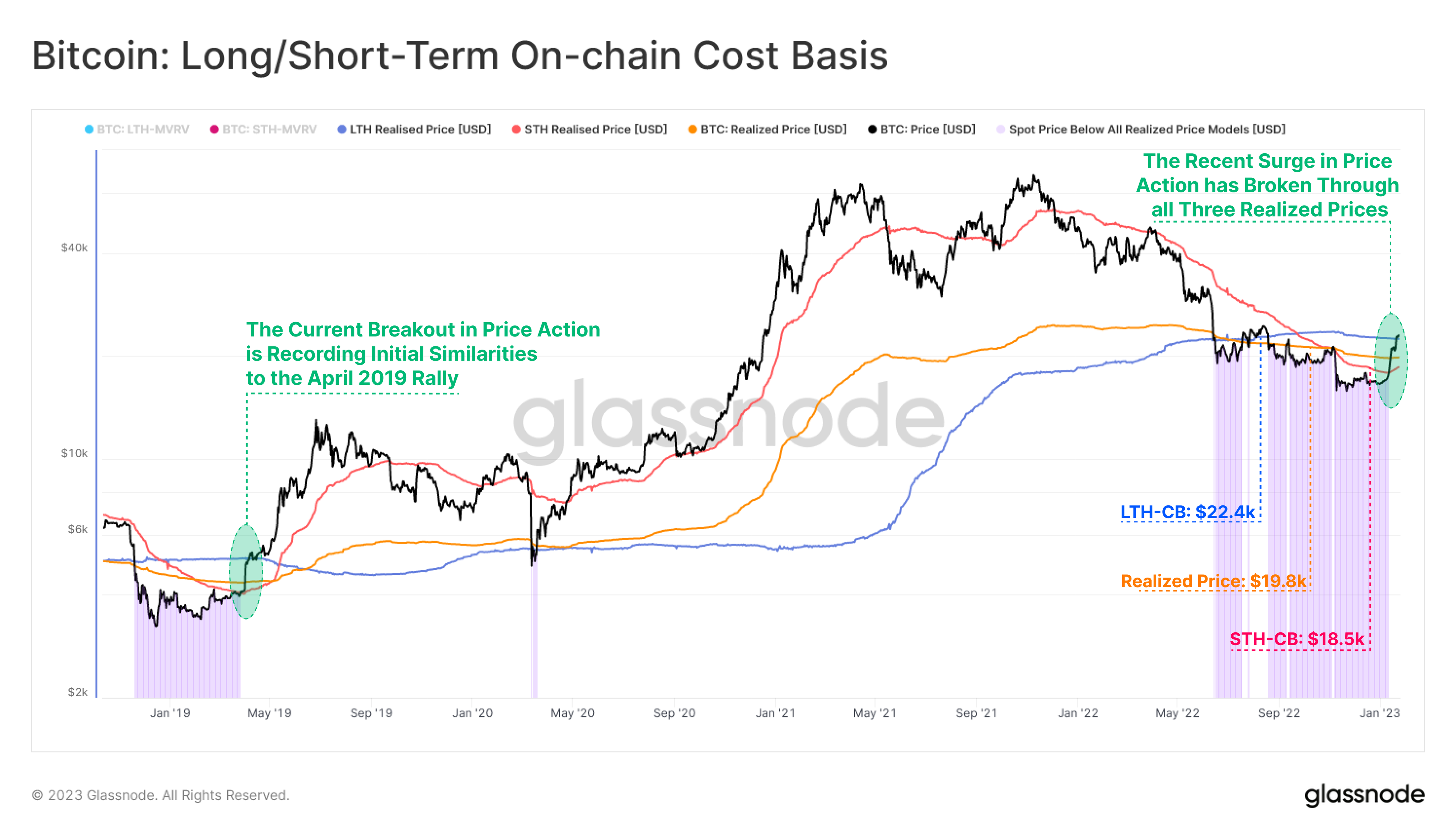

In line with information from the on-chain analytics agency Glassnode, BTC has damaged above the three investor cost-basis ranges for the primary time for the reason that COVID-19 crash and the 2018-2019 bear market. The related indicator right here is the “realized worth,” to know the idea of the “realized cap” it must be checked out first.

The realized cap is a capitalization mannequin for Bitcoin that assumes that every coin within the circulating provide has its actual worth as the worth at which it was final moved slightly than the present BTC worth (which the conventional market cap makes use of for its calculation).

Now, from the realized cap, a “realized worth” might be obtained by dividing the metric by the full variety of cash in circulation. For the reason that realized cap accounted for the costs at which buyers purchased their cash (which is to say, their price foundation), the realized worth might be considered the common acquisition worth out there.

Because of this if the conventional worth of Bitcoin dips under this indicator, the common holder might be assumed to have entered a state of loss. Whereas this realized worth is the common price foundation for your complete market, the metric can be outlined for under particular teams of buyers.

The BTC market might be divided into two major cohorts: short-term holders (STHs) and long-term holders (LTHs). Buyers who purchased their cash throughout the final 155 days fall into the STHs, whereas these holding them since earlier than that threshold are included within the LTHs.

Here’s a chart that exhibits the development within the Bitcoin realized worth for your complete market, in addition to for these two holder teams individually, over the previous couple of years:

BTC appears to have damaged above all these ranges not too long ago | Supply: Glassnode on Twitter

Because the above graph exhibits, Bitcoin had damaged above the STH price foundation and your complete market’s realized worth earlier within the newest rally, suggesting that the common STH and the general common investor was again in revenue.

In the newest continuation to the rally, the crypto has now surged above the LTH price foundation of $22,400. Because of this the common investor in each phase is now within the inexperienced.

The final time Bitcoin displayed a breakout above all these ranges was following the black swan COVID-19 crash, which had briefly taken the coin under these costs.

An identical development additionally fashioned in April 2019, when the bear market of that cycle ended, and a bullish transition happened. Although it’s early to inform proper now, this similarity between the 2 rallies might trace concerning the path that the present one may additionally find yourself following.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $22,900, up 8% within the final week.

Seems to be like BTC has been transferring sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com