Be a part of Our Telegram channel to remain updated on breaking information protection

America Securities and Trade Fee (SEC), the highest regulator on Wall Road, has made one other run on its regulatory crackdown. Within the newest improvement, the federal regulator has charged in opposition to Coinbase, America’s largest cryptocurrency change. The SEC alleges that Coinbase has acted as an unregistered dealer, evading the disclosure regime established by Congress for securities markets.

Immediately we charged Coinbase, Inc. with working its crypto asset buying and selling platform as an unregistered nationwide securities change, dealer, and clearing company and for failing to register the supply and sale of its crypto asset staking-as-a-service program.

Coinbase Turns into Newest Sufferer Of SEC, After Binance

In a grievance filed on Tuesday in federal court docket, the SEC said:

Coinbase has by no means registered with the SEC as a dealer, nationwide securities change, or clearing company.

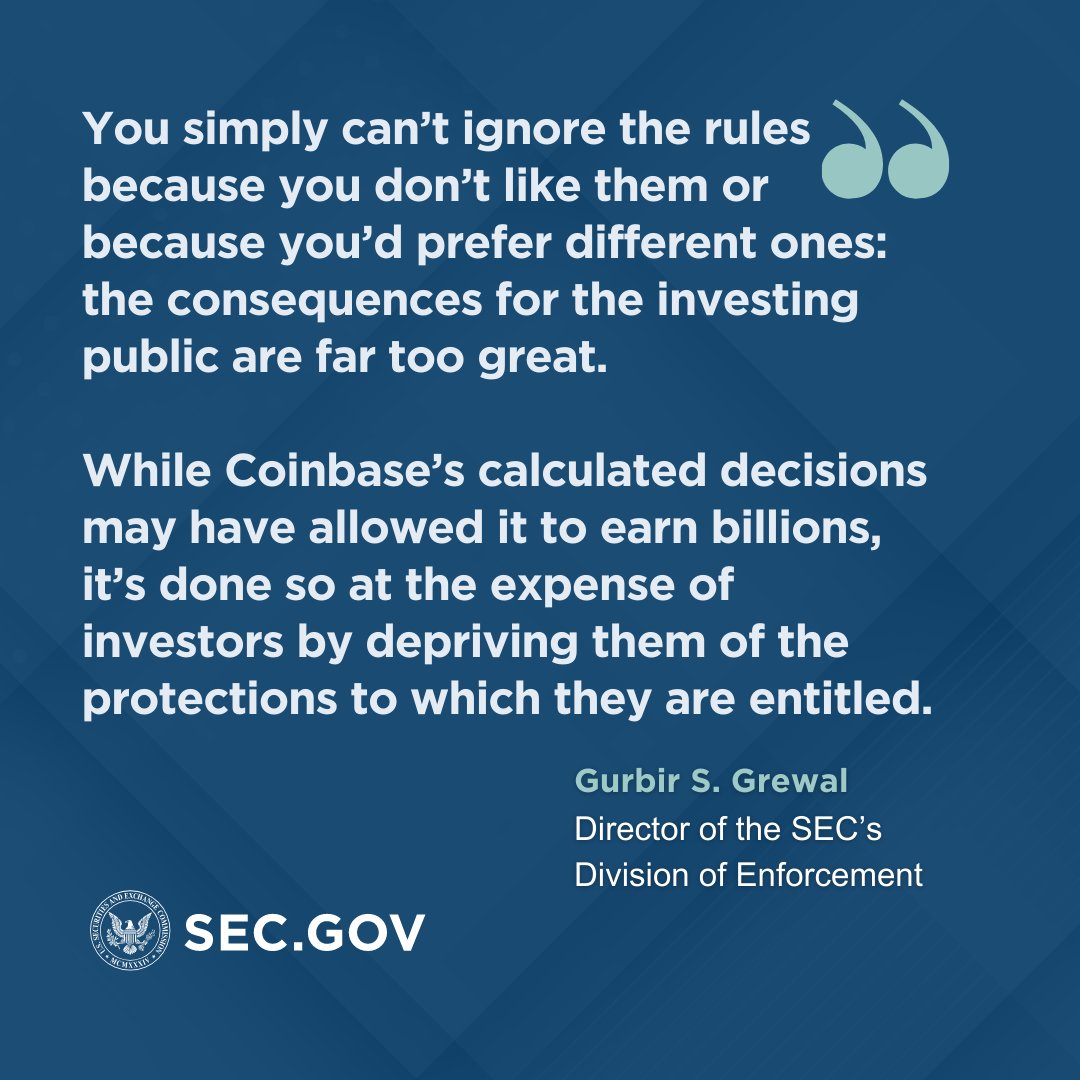

In line with the regulator, this made the change evade the disclosure regime that Congress has established for the securities markets. The grievance additional alleges that Coinbase has collected important revenues via transaction charges. This occurred whereas they disadvantaged traders of obligatory disclosures and protections related to registration, thereby exposing them to substantial dangers.

Immediately we charged Coinbase, Inc. with working its crypto asset buying and selling platform as an unregistered nationwide securities change, dealer, and clearing company and for failing to register the supply and sale of its crypto asset staking-as-a-service program.https://t.co/XPG2gDkxtV pic.twitter.com/hCdVMw8B2v

— U.S. Securities and Trade Fee (@SECGov) June 6, 2023

The information has had a stark affect on Coinbase, with premarket buying and selling shares of the cryptocurrency change tumbling a staggering 16%. This displays the market’s concern over the potential penalties of the SEC’s allegations.

Notably, the lawsuit comes solely 24 hours after the SEC filed a related grievance in opposition to Binance, a outstanding abroad competitor to Coinbase and the world’s largest cryptocurrency change. The regulatory motion equally despatched shockwaves via the trade. This resulted in important repercussions for Binance, with traders withdrawing roughly $790 million from the platform. The identical was witnessed in its US affiliate in response to the SEC expenses. Binance witnessed web outflows of $778.6 million in crypto tokens on the Ethereum (ETH) blockchain, with its US counterpart, Binance.US, reporting web outflows of $13 million. Equally, the native token for the Binance ecosystem, Binance Coin (BNB), slumped 10% as reported.

TODAY I LOST A 1 WHOLE LAMBO

THANKS TO BINANCE FUD

I FEEL PROTECTED NOW pic.twitter.com/pf5ebcYEfv

— Ash Crypto (@Ashcryptoreal) June 6, 2023

Crypto Regulation Intensifies

The SEC’s strikes in opposition to Coinbase and Binance, two of the largest exchanges globally, reveal its willpower to implement securities legal guidelines within the quickly evolving digital asset area. The regulatory crackdown goals to make sure market individuals adhere to the rules in place. It is usually geared towards offering traders with the required disclosures and protections.

Because the information broke, market analysts predicted that the SEC’s actions would considerably affect the cryptocurrency market. The lawsuits in opposition to two main exchanges might immediate different regulators to extend their scrutiny and oversight of the digital asset trade. Consequently, traders and market individuals are suggested to carefully monitor regulatory developments and adapt their methods accordingly.

Whereas the outcomes of the lawsuits stay unsure, the SEC’s authorized actions in opposition to Coinbase and Binance mark a big milestone within the regulatory panorama surrounding cryptocurrencies. The circumstances will function key indicators of how regulators strategy and implement securities legal guidelines on this rising sector, doubtlessly shaping the way forward for the digital asset trade.

Ten US States Challenge Present Trigger Discover In opposition to Coinbase

Following expenses issued in opposition to the US-based change by the federal regulator, ten states throughout America have issued a present trigger discover in opposition to Coinbase. Particularly, a job pressure of US states has banded collectively to difficulty the discover to the change. The Alabama Securities Fee issued the doc, granting the corporate 28 days to show why it shouldn’t be issued a cease-and-desist order.

The ten states issuing the order to the corporate embody Alabama, California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington, and Wisconsin. Moreover, the change is now prone to receiving a cease-and-desist order for the sale of unregistered securities.

Notably, in March, the SEC issued Coinbase a Wells Discover relating to its alleged violation of federal securities regulation. Subsequently, that discover got here to fruition, with the regulator charging the corporate with violations earlier immediately. Now, it seems as if state regulators are turning their consideration to the corporate.

Notably, identical to Binance’s inventory slumped, Coinbase inventory has dropped by 17% because the SEC lawsuit was filed.

Additionally Learn:

Wall Road Memes – Subsequent Large Crypto

- Early Entry Presale Dwell Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Greatest Crypto to Purchase Now In Meme Coin Sector

- Crew Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection