Siemens, Germany’s third-largest publicly traded firm by market cap, has issued its first digital bond price €60 million ($64 million) on the Polygon blockchain.

The bond was issued in accordance with Germany’s Digital Securities Act, which got here into pressure in June 2021 and permits the sale of blockchain-based debt to happen.

Blockchain-based bonds are anticipated to scale back paperwork and allow direct attain to potential purchasers with out the necessity for intermediaries like banks.

The blockchain bond, which CoinDesk reported has a maturity of 1 yr, “makes paper-based world certificates and central clearing pointless,” the corporate mentioned within the assertion. “What’s extra, the bond could be offered on to buyers with no need a financial institution to perform as an middleman.”

The corporate didn’t specify an rate of interest for the bond however did say it hopes that this may quicken and make extra environment friendly future such transactions.

“By shifting away from paper and towards public blockchains for issuing securities, we will execute transactions considerably sooner and extra effectively than when issuing bonds prior to now,” mentioned Peter Rathgeb, company treasurer at Siemens.

Siemens, a German engineering and manufacturing large, has been actively exploring the potential of blockchain know-how in numerous areas, together with funds and debt issuance, since 2021.

In 2021, Siemens partnered with JPMorgan Chase to develop a blockchain-based system for funds, which is used to robotically switch cash between Siemens’ personal accounts. This method goals to simplify and streamline funds, lowering the necessity for intermediaries and enabling sooner and extra environment friendly transactions.

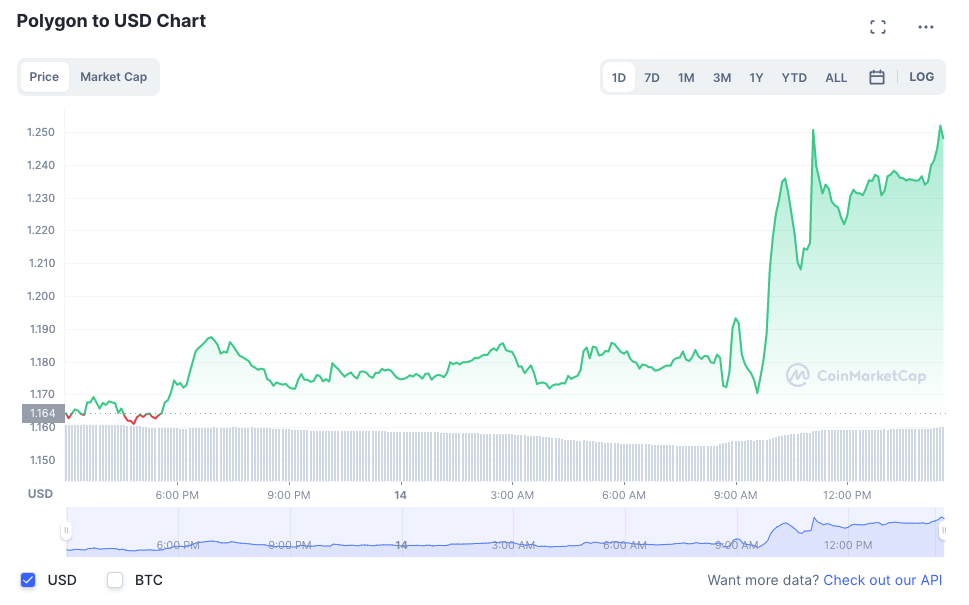

Following information of Siemens’ issuance of its first digital bond on the Polygon community, the token worth of MATIC elevated 7.21% throughout buying and selling on Feb. 14. The present worth of MATIC is $1.25.