TLDR

- On the upcoming Federal Open Market Committee (FOMC) assembly on March 22, a 25 foundation level charge hike is the favored likelihood.

- A terminal fed funds charge of 5.50% with a 25bps lower on the finish of the yr

- The Unemployment Price went as much as 3.6% from 3.4%

- GBTC low cost narrows after SEC listening to, up 7% prior to now 5 days

- Second largest Bitcoin liquidation this yr that despatched Bitcoin down under $20,000

US

SVB Financial institution Run

SVB Monetary Corp (SIVB) noticed a 60% decline in share worth on March 9 whereas seeing shares plummet an extra 40% on March 10. A deposit run that led to the compelled promoting of property after a tax lack of $1.8 billion. The financial institution is in search of over $2.25 billion, which had a knock-on impact on the banking sector as the highest 4 largest banks noticed $52 billion worn out of the market cap.

This contagion unfold to many different banks, together with First Republic and Signature Financial institution, that have been all halted on the change.

SVIB was closed by California Regulators; this was the biggest financial institution failure because the Nice Recession. It was additionally the 18th largest financial institution within the U.S. by whole property.

Consequently, the 2-year treasury yield dropped 45 bps from yesterday’s excessive, the largest drop since 2008.

Unemployment Price

The unemployment charge got here in barely greater at 3.6% than the estimated 3.4%, whereas the U.S. economic system created +311,000 jobs however was forecasted at +205,000.

Fed Funds Price

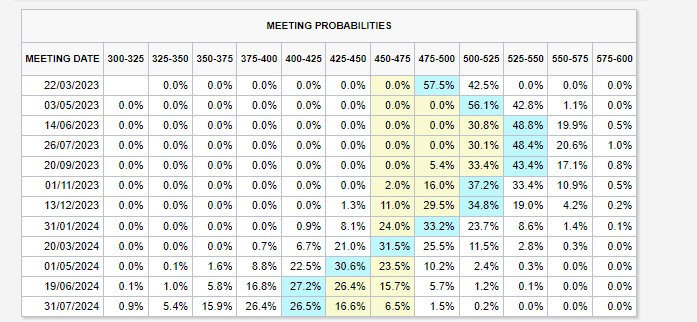

On account of the above, on prime of Powell testifying to each the Senate and the Home, the markets flopped between 25 and 50 bps for the upcoming FOMC assembly and a terminal charge that continued to vary. Ending the week, the market is pricing in a 25bps charge hike with a terminal charge of 5.50% after which a 25bps lower on the finish of the yr.

All eyes flip to a Shopper Worth Index (CPI) print looming on Tuesday.

UK

Indecisive BOE

The Financial institution of England (BoE) continues to flip-flop between overtightening and inflation working riot. To indicate how break up the BoE is, BoE policymaker Catherine Mann spoke in regards to the risks of a falling forex which is able to see a danger of importing inflation. Whereas Swati Dhingra, one other BoE policymaker, warned in regards to the problems with “overtightening” and believed a greater technique can be the maintain coverage regular.

Consequently, the pound went to year-to-date lows in opposition to the greenback at 1.18 however did rally to 1.20 on the finish of Friday’s shut.

China

Final weekend’s announcement of China focusing on a 5% development goal was disappointing. Many analysts anticipated one thing nearer to six%, as 5% was the bottom projection in over 1 / 4 of a century.

China, like Japan, has additionally been a proponent of stimulus, however that is to maintain the true property market intact. Native governments and builders face extreme debt masses whereas property valuations deflate.

The Wall Avenue Journal reported {that a} third of main cities battle to handle enormous curiosity funds whereas excellent debt exceeds over 120% of final yr’s earnings.

Japan

Friday was Governor Kuroda’s remaining assembly; The Financial institution of Japan (BOJ) left coverage unchanged, giving the brand new governor, Ueda, an extremely tough process of the long-standing stimulus insurance policies. Modified governor, however coverage stayed the identical,

Japan’s fourth quarter GDP confirmed the economic system had stagnated, taking any rapid strain off the BOJ to make any adjustments to the coverage.