A current survey tapped right into a crypto-native group to find out what might be in retailer for the business this 12 months. Figuring out high-quality cryptocurrencies and blockchain functions requires each guts and foresight, which is why early crypto adopters might be gauge of what’s to return in 2023.

Over 1,000 individuals participated within the survey and shared what they had been apprehensive about and enthusiastic about this 12 months.

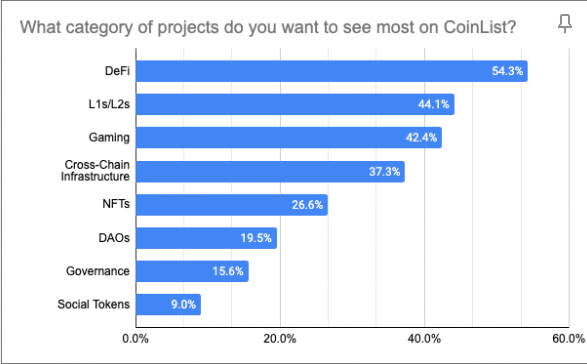

Greater than half of respondents recognized DeFi because the class of initiatives they need to see most on CoinList. Layer-1 and layer-2 blockchains had been the second most in-demand class, adopted by gaming. Cross-chain infrastructure ranked fourth, with round 37% of respondents selecting it, whereas NFTs had been requested by simply over 26% of respondents.

DAOs, which noticed a large leap in recognition final 12 months, noticed lower than 20% of help amongst CoinList‘s customers. On the identical time, governance tokens, touted as one of the crucial progressive makes use of of crypto, had been requested by solely 15% of respondents.

These findings, analyzed by CryptoSlate, affirm the present market sentiment. Regardless of its large hunch final 12 months, the DeFi sector remains to be one of many most important driving forces of the crypto market and might be poised for a restoration in 2023.

In a separate however associated query, virtually half of the respondents stated that they believed DeFi and gaming can be the 2 megatrends driving widespread crypto adoption.

Diving deeper into these sectors signifies that seasoned crypto customers have eye for rising networks.

When requested what blockchain they plan to work together most with exterior of Ethereum, the highest-ranking selections had been among the many highest-ranking cryptocurrencies available on the market. The blockchains of selection for CoinList’s respondents had been Cosmos (ATOM), Binance Sensible Chain (BSC), and L2 rollups and sidechains Arbitrum, Polygon, and Optimism, every netting round 40% of the votes.

Final 12 months’s development champions, Solana and Avalanche, had been the blockchains of selection for under 17% and 13% of customers, respectively. Polkadot ranked barely greater and was chosen by 29% of respondents.

Newcomers to the area Sui and Aptos had been chosen by over a 3rd of respondents, exhibiting that new initiatives might need an opportunity to compete with incumbent chains for a slice of the market in 2023.

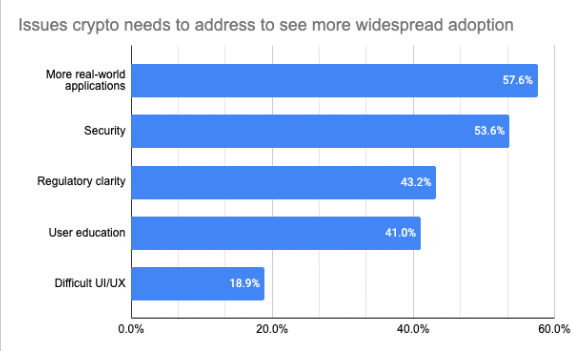

Nonetheless, capturing a good portion of the market would require launching extra real-world functions. Over half of the survey’s respondents recognized this as the principle difficulty stopping widespread adoption. Safety was additionally a major concern for greater than half of the respondents, whereas regulatory readability ranked third, with 43% figuring out it as a urgent difficulty for the business.

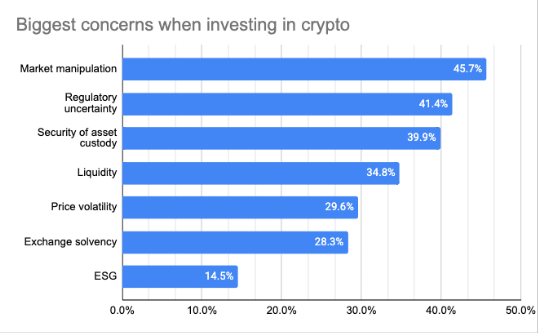

Regulatory uncertainty was a recurring motif within the survey, with over 41% of respondents saying it was their greatest concern when investing in crypto. Market manipulation ranked barely greater, with simply over 45% of respondents figuring out it as a urgent concern.

Given the variety of fiascos the business noticed final 12 months, it’s no shock the safety of funds was the largest concern for nearly 40% of respondents. Liquidity, or a scarcity thereof, was a urgent concern for round a 3rd of respondents, as was worth volatility.

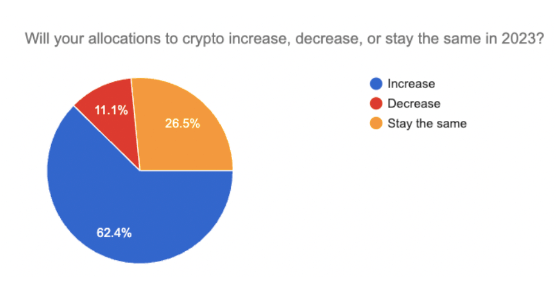

Nonetheless, over 62% of respondents stated they deliberate on growing their allocation to cryptocurrencies. A few quarter of respondents stated their allocations would stay unchanged, whereas solely 11% stated they might offload their holdings.

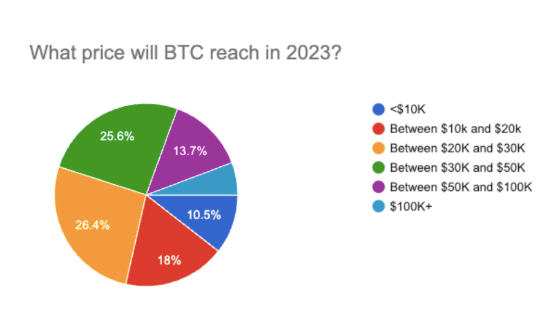

Plans to extend their allocation to cryptocurrencies don’t imply the respondents consider the market will return to its 2022 highs. Over 26% of CoinList’s respondents consider Bitcoin will hover between $20,000 and $30,000 in 2023. Simply over 1 / 4 suppose it would attain between $30,000 and $50,000, whereas lower than a fifth consider it would fall under $20,000.