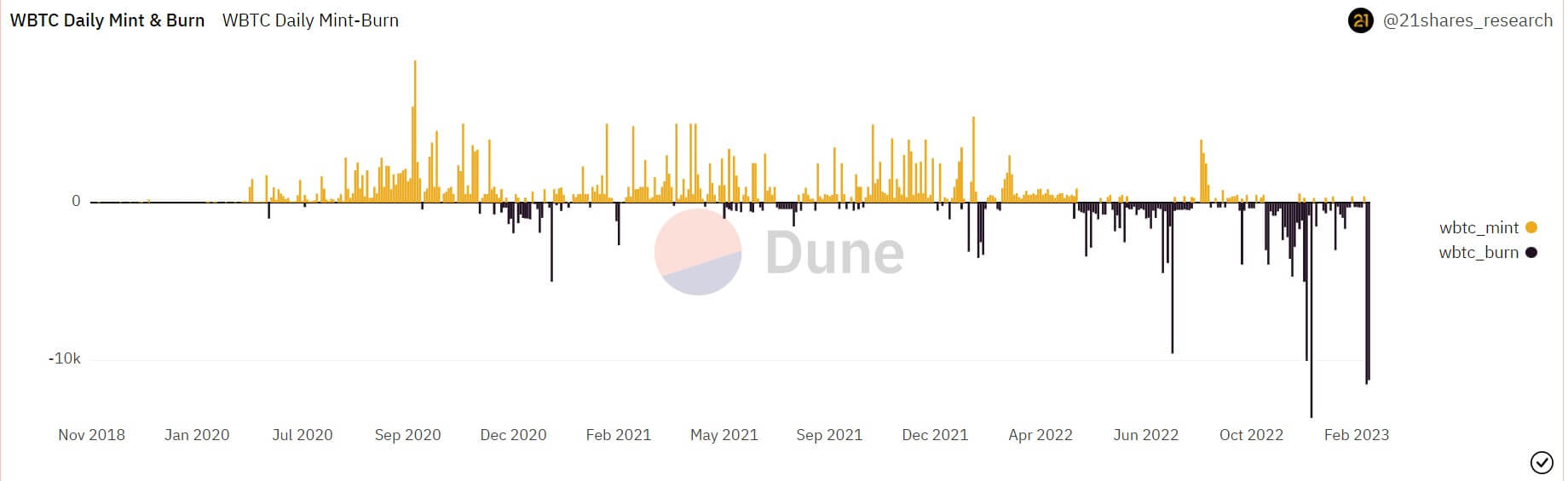

Wrapped Bitcoin’s (WBTC) provide on Ethereum shrunk by 23,384 — roughly 15% — to 153,164 in February — its lowest stage since March 2021, in response to Dune analytics knowledge.

In accordance with the asset’s order e-book, there have been ten transactions involving WBTC — eight had been burns, whereas the opposite two transactions had been a cumulative mint of 798.72 WBTC by imToken.

Bankrupt crypto lender Celsius — a significant WBTC whale — was accountable for an enormous quantity of the burns. The agency burnt 22,732 WBTC (price $533 million) in 2 days through FalconX.

The lender’s redemption is reminiscent of the burns recorded in December 2022 when the crypto market was nonetheless smarting from FTX’s collapse.

On the time, there have been fears that the crypto trade’s collapse would considerably influence WBTC’s reserves as a result of it was a high service provider of the asset.

WBTC is an Ethereum-based token that mirrors Bitcoin’s value efficiency and is pegged 1:1 with the flagship digital asset. WBTC gained reputation throughout the 2022 bull run when its provide peaked at 285,000. On the time, BTC was buying and selling for round $48,000.

At WBTC’s present value, its market cap stands at $3.63 billion, a far cry from its peak of $13.03 billion, in response to CryptoSlate’s knowledge.