Arbitrum (ARB) has been making waves within the crypto world because it not too long ago grew to become the 4th largest ecosystem available in the market. Regardless of experiencing a pointy decline of 70% since its airdrop, Arbitrum’s native token has continued to achieve consideration from buyers, presently buying and selling round $1.158, down from $1.1808 on April 18th.

Arbitrum Defies The Odds

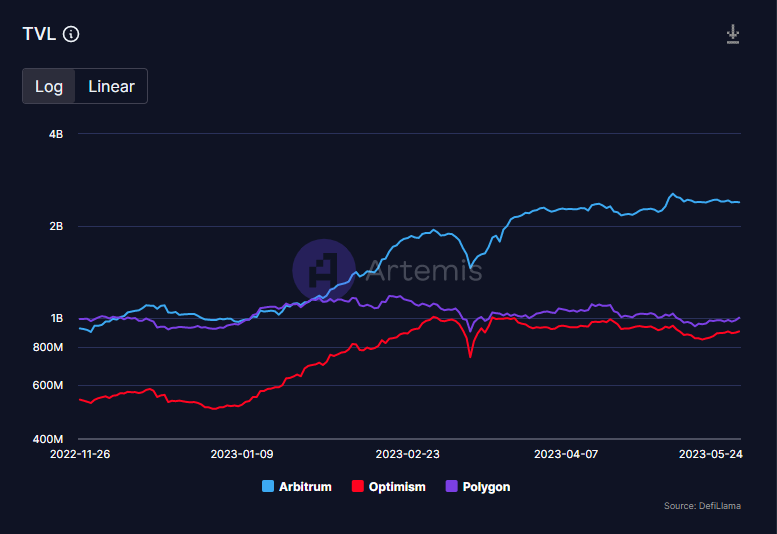

In accordance to the Decentralized Finance (DeFi) researcher Deebs, Arbitrum has emerged as a significant participant within the crypto market, with its Whole Worth Locked (TVL) hovering to a formidable $2.3 billion. This places it in 4th place by TVL, surpassing lots of its rivals.

Moreover, because the launch of Arbitrum, the worth of stablecoins has grown by over $500 million in simply two months. At its peak, the community’s energetic consumer base reached over 600,000, surpassing Optimism (OP), a quick, secure, and scalable L2 blockchain constructed by Ethereum builders, and almost overtaking the blockchain platform designed to host decentralized, scalable functions Solana (SOL).

Regardless of these spectacular metrics, ARB’s worth has skilled a big drop of 70% since its airdrop and has had little or no optimistic worth motion since. Nonetheless, DeFi researcher Deebs believes that this dip in worth could also be an indication of a hidden gem within the crypto market.

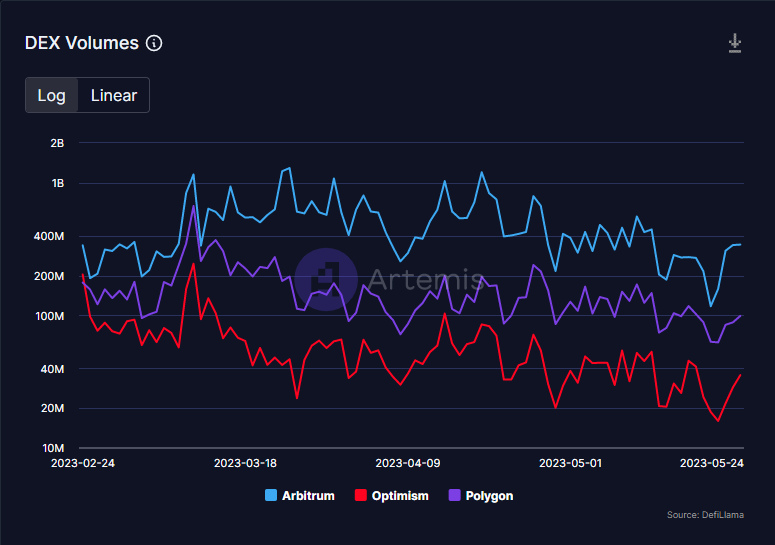

One of many essential components that make Arbitrum a lovely funding alternative is its excessive TVL, consumer base, and liquidity. Actually, since its launch, Arbitrum has maintained the very best liquidity of all Layer 2 (L2) networks and is the third highest of all chains on DeFi Llama.

Moreover, whereas many different chains have a market capitalization to TVL ratio above 1, Arbitrum boasts one of many smallest ratios at 0.6. Which means the potential worth upside for ARB is considerably greater than its rivals, making it an attractive funding alternative for these searching for long-term positive aspects.

Moreover, ARB’s know-how has been praised for its means to deal with a number of the key points dealing with the crypto trade, comparable to scalability and excessive transaction charges. ARB’s use of cutting-edge know-how comparable to Optimistic Rollups gives an answer to those issues, making it a lovely choice for buyers searching for a dependable community with nice potential.

One other optimistic signal for ARB is the quantity of assist it has acquired from main gamers within the crypto trade. This contains partnerships with well-known crypto initiatives comparable to Uniswap, Aave, and Chainlink. These collaborations reveal that the trade acknowledges the worth of ARB’s know-how and the potential it holds for the way forward for decentralized finance.

Total, regardless of the current drop in worth, ARB’s sturdy fundamentals and rising community utilization recommend that it’s a hidden gem within the crypto market. Its partnerships with main gamers within the trade, in addition to its progressive know-how, make it a promising funding alternative for these trying to capitalize on the potential of decentralized finance.

Featured picture from Unsplash, chart from TradingView.com