The downfall of FTX has underscored the counter-party dangers that exchanges can impose in the marketplace. As merchants and traders tread with heightened warning, there’s an evident demand for dependable metrics to judge the well being of those platforms.

Utilizing the FTX information set as a benchmark, Glassnode has rolled out three progressive indicators designed to pinpoint high-risk situations among the many main exchanges: Coinbase, Binance, Huobi, and the now-defunct FTX.

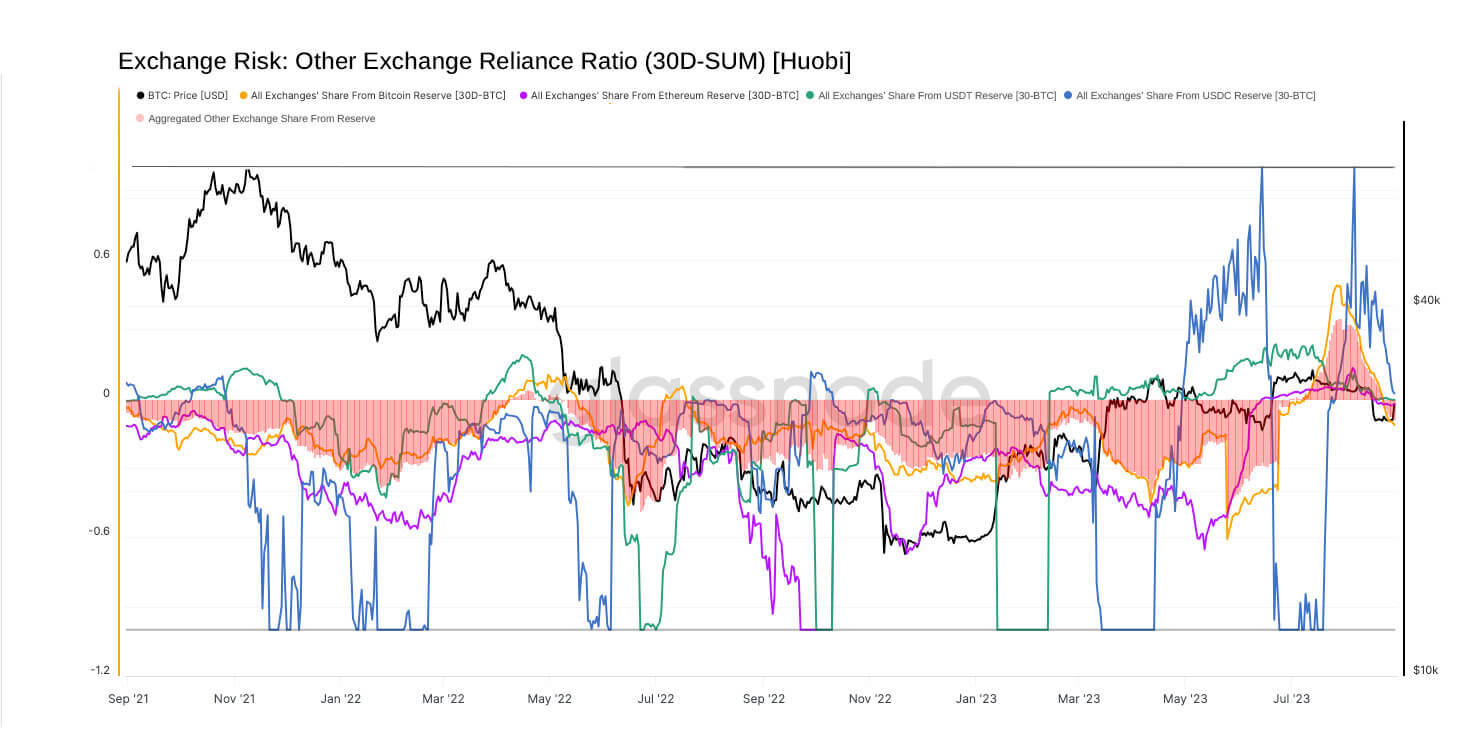

One of many indicators is the change reliance ratio, which reveals when a good portion of an change’s steadiness is often transferred to or from one other change. A good portion of an change’s steadiness being constantly moved to or from one other platform may counsel a deep reliance or co-dependence on liquidity.

A constructive ratio signifies web inflows to the change, whereas a adverse one signifies web outflows. Extended durations of enormous adverse values generally is a pink flag, indicating property quickly departing the change in favor of one other platform.

Whereas Binance and Coinbase exhibit a comparatively low reliance ratio, indicating minor fund actions in comparison with their huge balances, Huobi’s information paints a special image. Current figures confirmed pronounced adverse reliance ratios throughout all Huobi property, indicating a marked enhance in transfers from Huobi to different exchanges.

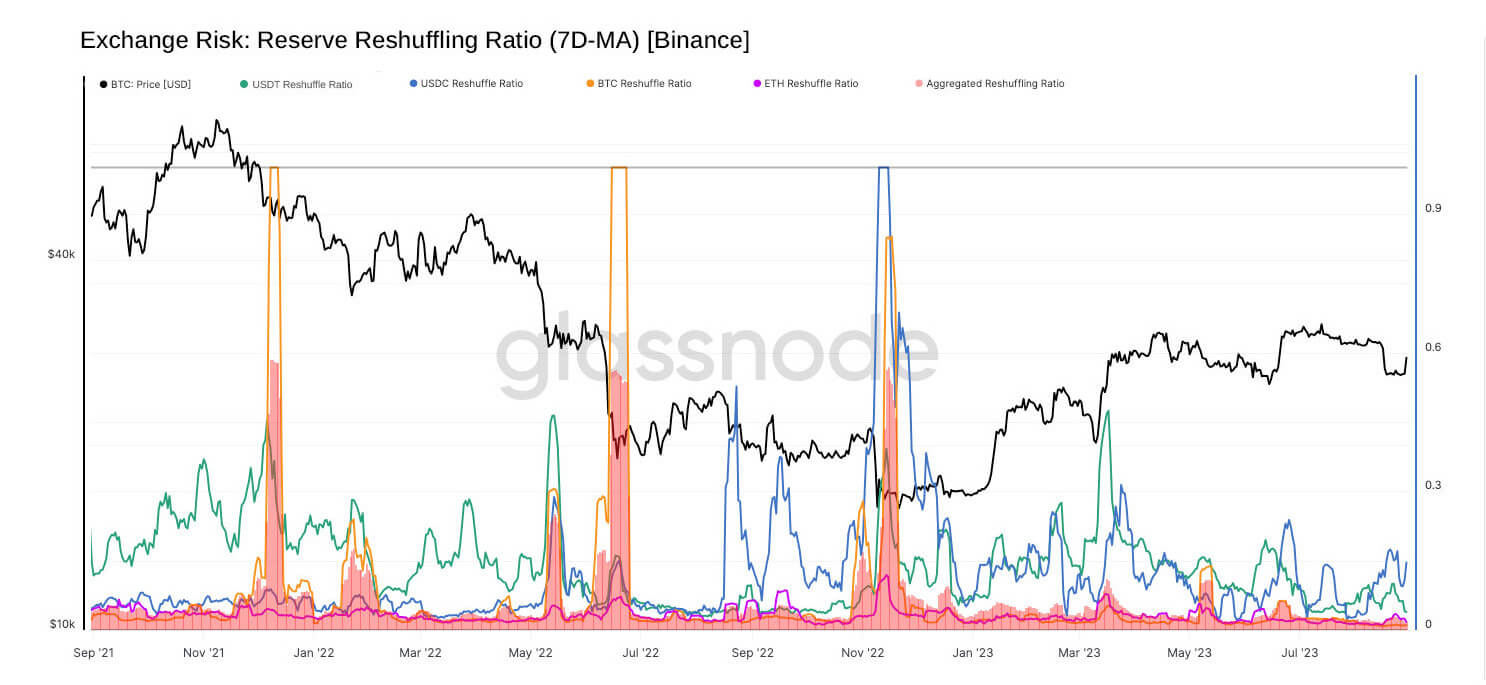

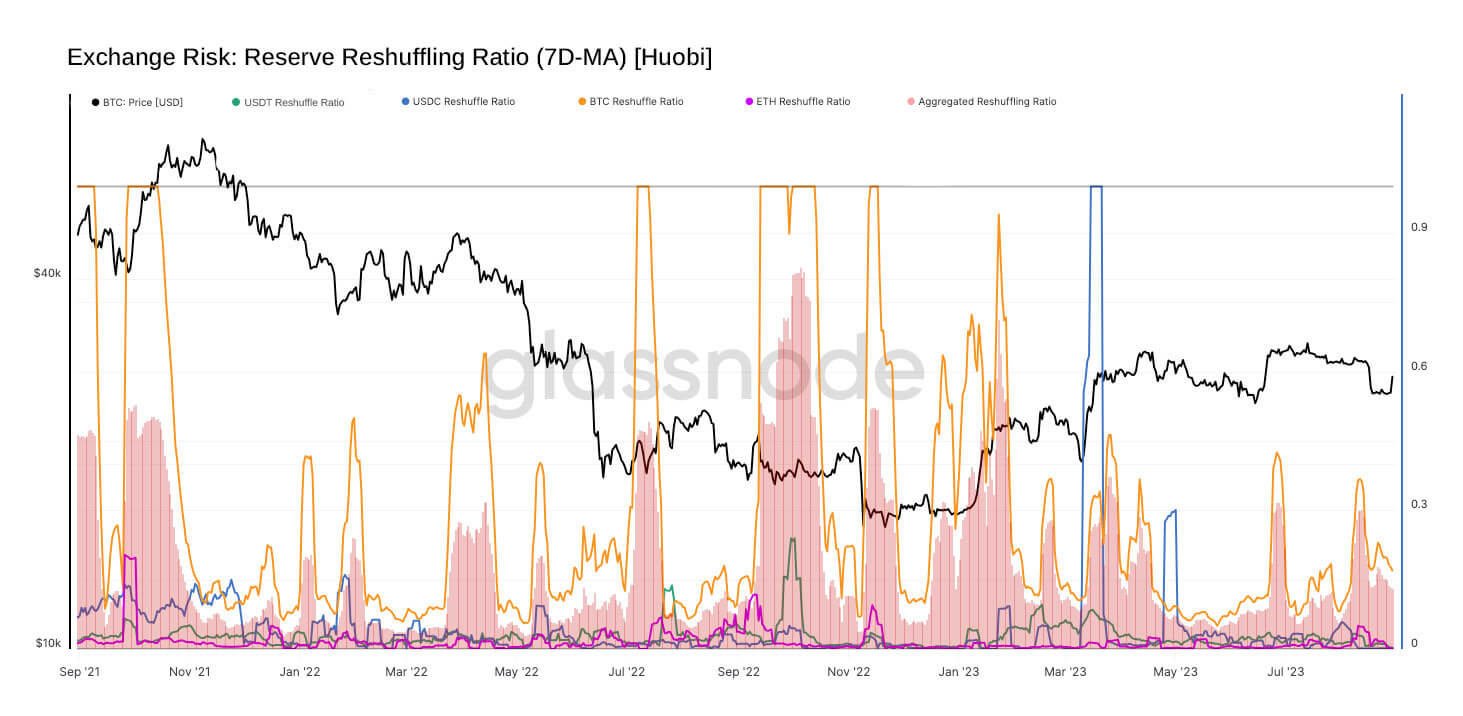

Huobi’s inside reshuffling ratio, which reveals the proportion of an change’s steadiness transacted internally over a set interval, mirrors that of Binance.

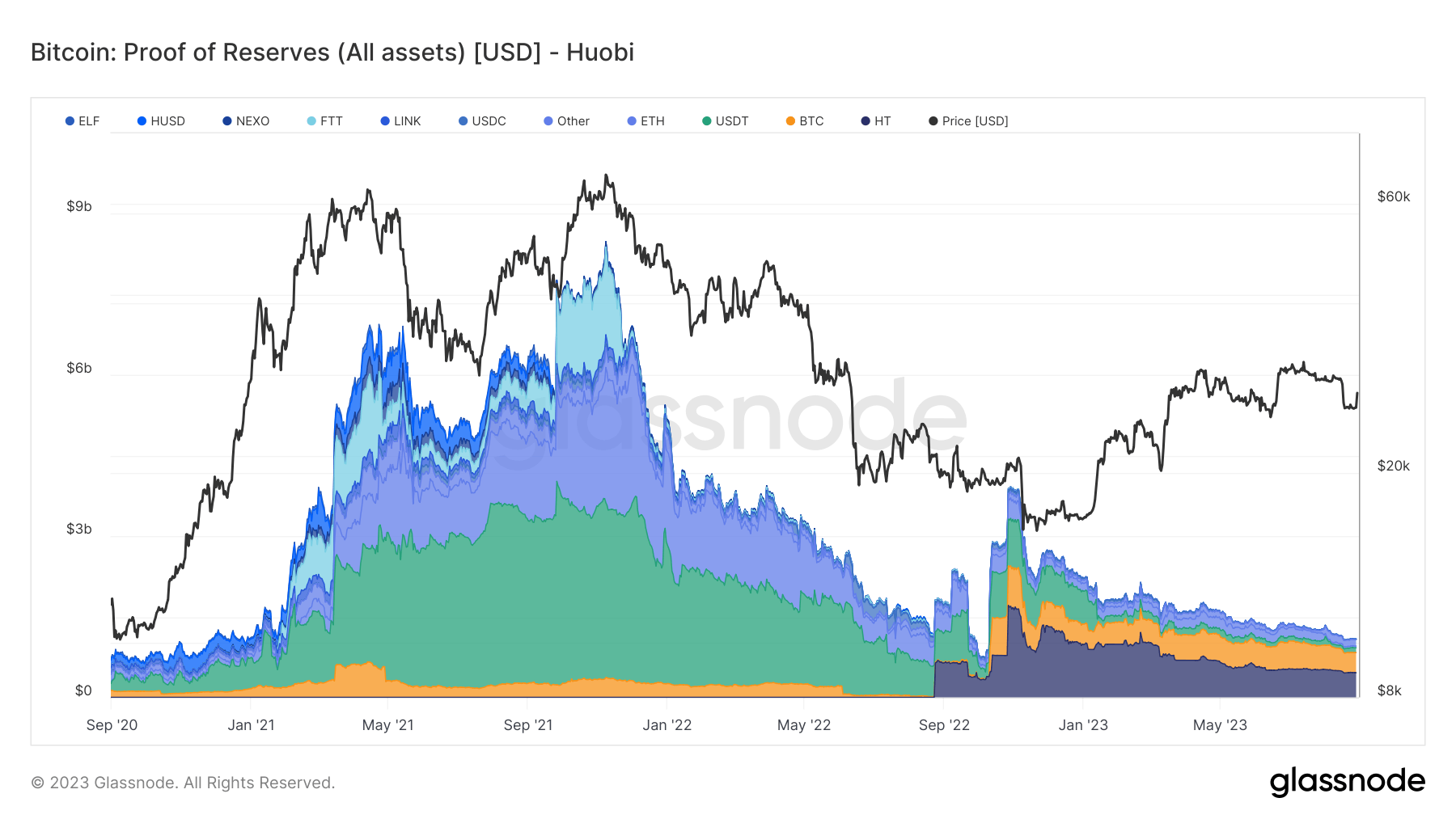

Nonetheless, context is essential right here. Binance, the biggest and hottest change in the marketplace, dwarfs Huobi in each metric. Thus, the reshuffling spikes noticed with Huobi may very well be magnified as a result of its depleting reserves.

This connection between diminishing reserves and pronounced adverse reliance ratios may very well be regarding. It means that property are being moved internally with higher frequency and being transferred out of Huobi at a rising fee.

The correlation between Huobi’s dwindling reserves and its important adverse reliance ratios may point out eroding confidence within the platform. Whereas these metrics don’t definitively label an change as high-risk, the approaching months will present if these indicators are passing anomalies or precursors to a extra profound shift.

The submit Huobi seeing elevated outflows to rivals in accordance with new reliance metrics appeared first on CryptoSlate.