Fast Take

The present buying and selling place of Bitcoin paints a relatively bearish image because it lingers beneath a number of shifting averages and value foundation.

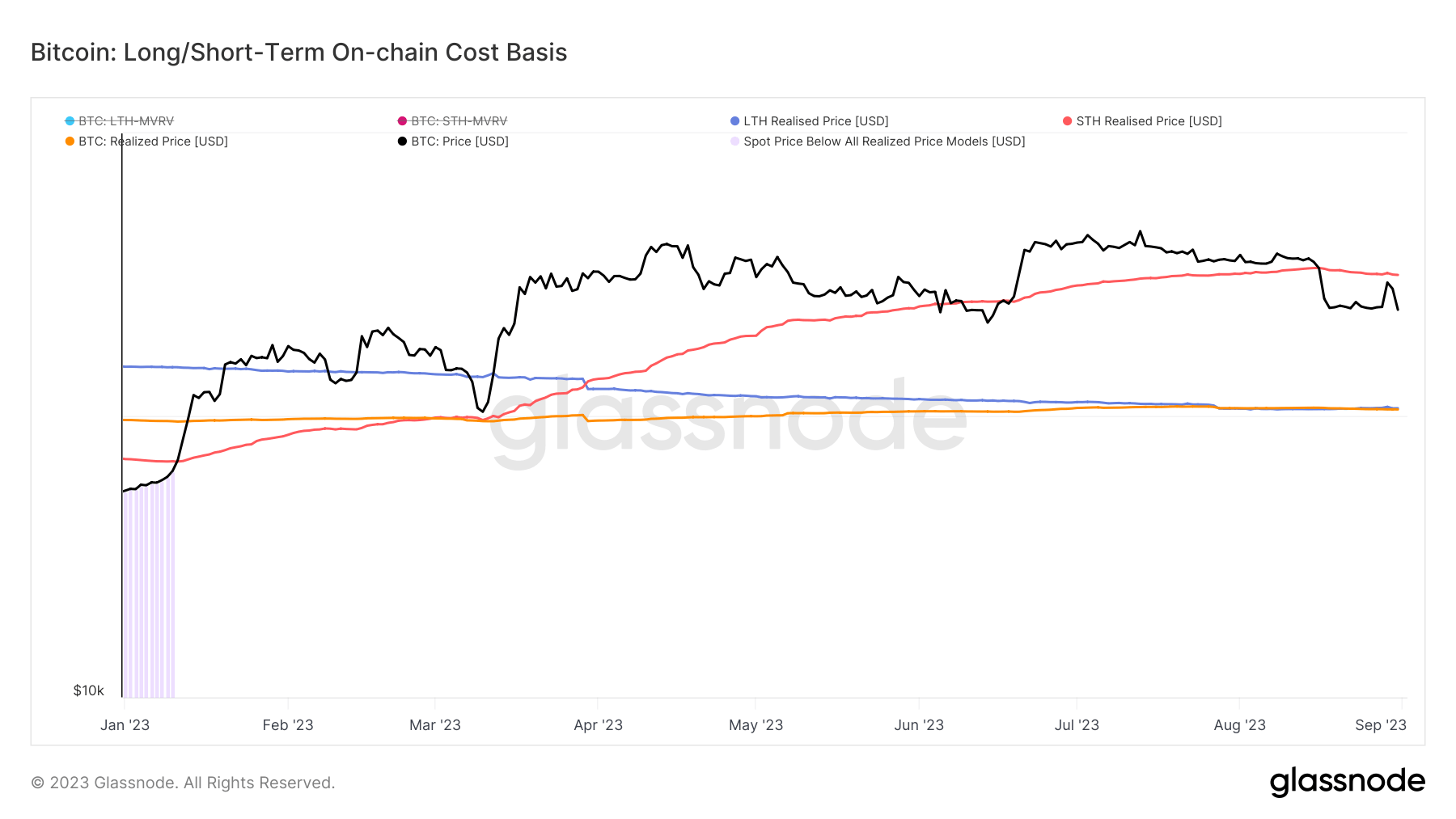

Hovering across the $26,000 mark, Bitcoin is buying and selling beneath the short-term holder value foundation of $28,247. This value foundation is critical as it’s the common on-chain acquisition worth for cash saved outdoors trade reserves and moved throughout the final 155 days.

These cash are more than likely to be spent on any given day, indicating a heightened stage of potential market exercise.

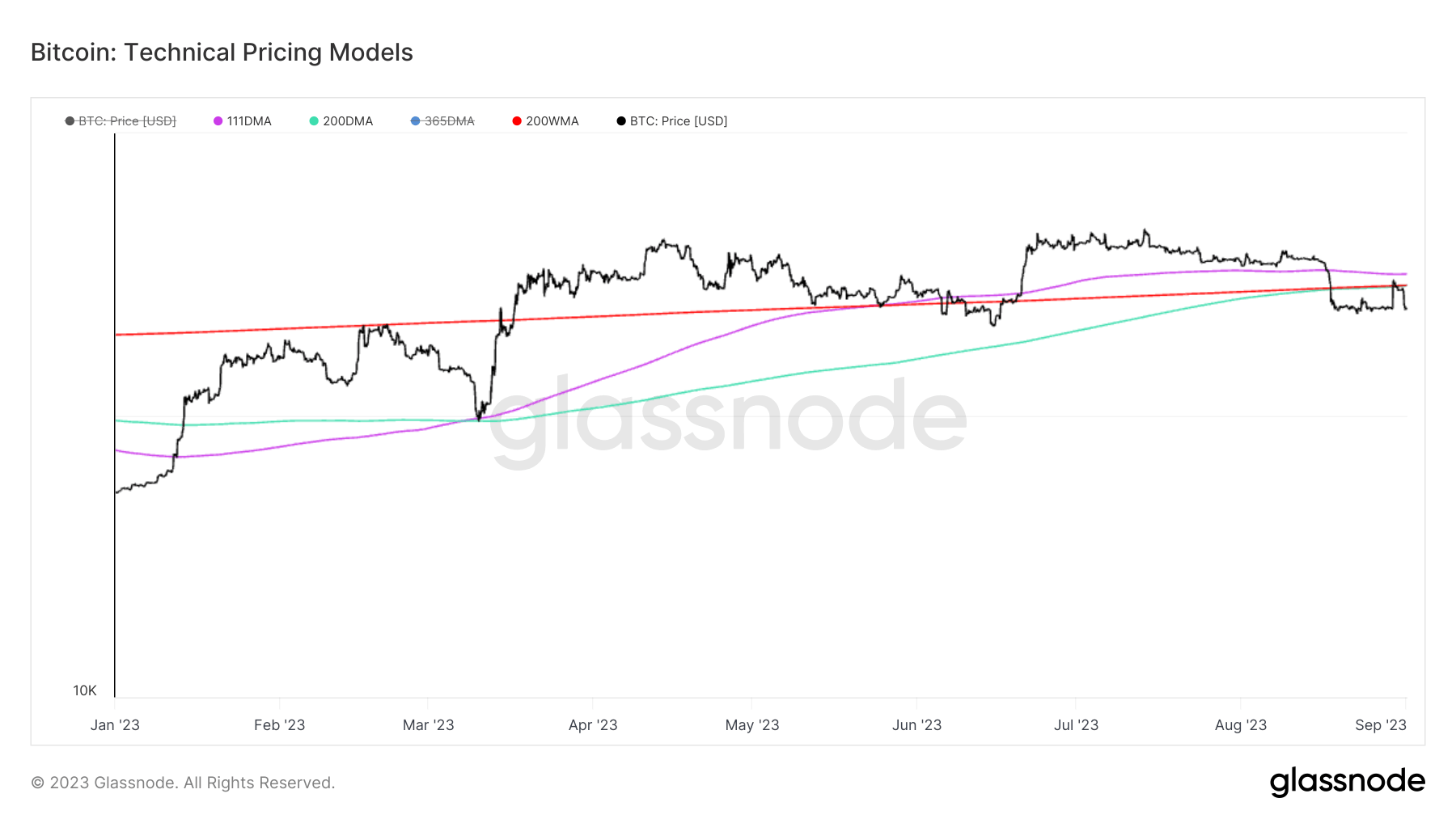

As well as, Bitcoin can be buying and selling beneath the 111 Day Transferring Common (DMA), which is priced at $28,302.

The 111 DMA is a key indicator capturing the short-to-mid-term market momentum, additional highlighting the bearish place of Bitcoin. The 200-day shifting common, standing at $27,510, and the 200-week shifting common, at $27,251, are different benchmarks that Bitcoin at present fails to surpass, reinforcing the bearish situation.

The submit Bitcoin’s bearish stance underlines market disquiet because it trails key averages appeared first on CryptoSlate.