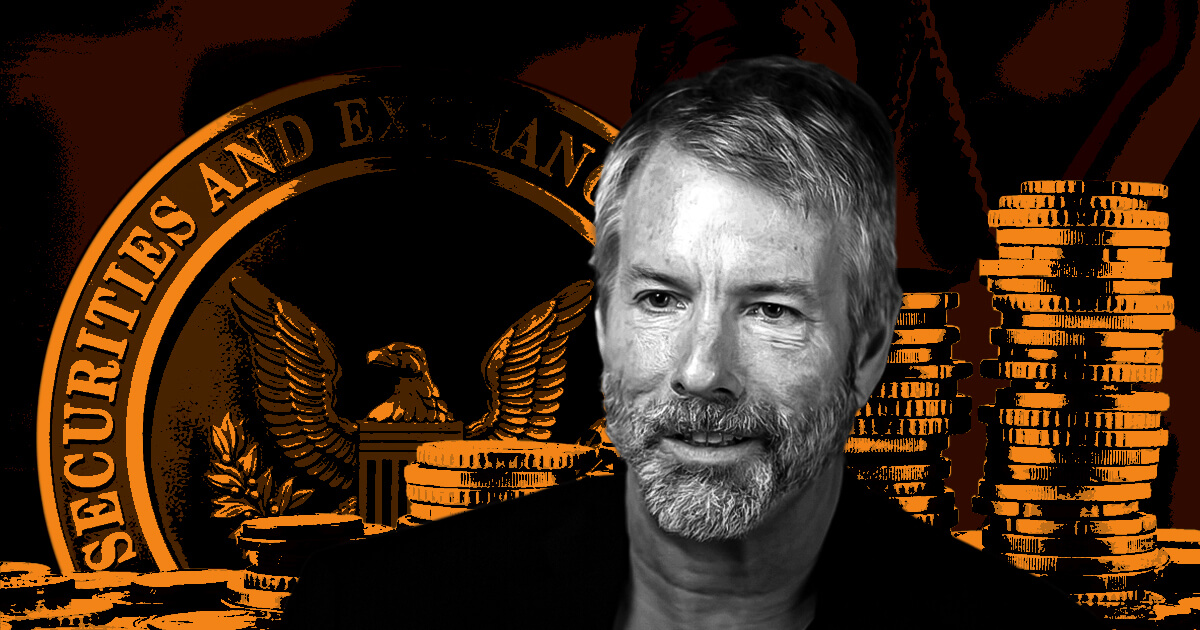

Washington, D.C. Legal professional Basic Brian Schwalb introduced a historic $40 million tax fraud restoration settlement with Michael Saylor and his firm, MicroStrategy, in line with a June 3 press launch.

Schwalb mentioned:

“Michael Saylor – billionaire tech govt and investor – can pay $40 million to the District within the largest earnings tax fraud restoration in DC historical past. Saylor not solely broke the legislation, he brazenly bragged about his tax evasion scheme and inspired others to observe his instance.”

Regardless of the settlement, Saylor and MicroStrategy have denied any wrongdoing. They mentioned the settlement was made to keep away from additional authorized problems and scale back litigation burdens.

Saylor is a vocal proponent of Bitcoin, and MicroStrategy holds greater than 200,000 BTC, valued at round $14 billion.

Tax fraud

The settlement arises from allegations that Saylor evaded over $25 million in earnings taxes whereas residing in Washington, D.C.

The lawyer basic’s workplace accused Saylor of collaborating with MicroStrategy to submit fraudulent tax paperwork between 2005 and 2021, the place they falsely reported that he was residing in Virginia or Florida, states with decrease earnings tax charges.

Nonetheless, Schlabb claimed that Saylor resided “in a 7,000 sq. foot Georgetown penthouse and docked a number of yachts at Washington Harbour” and additional asserted:

“Saylor illegally pretended to stay in lower-tax jurisdictions to keep away from paying taxes on tons of of thousands and thousands of {dollars} of earnings – all whereas residing in a 7,000 sq. foot Georgetown penthouse and docking a number of yachts at Washington Harbour.”

MSTR shares up

The settlement settlement has not affected shares of the Bitcoin improvement firm.

Yahoo Finance information exhibits that MSTR’s shares have been up by round 7% on the day and buying and selling at $1,615 as of press time. This continues a development of constructive runs for a BTC-related inventory that has risen by 133% on the year-to-date metric.

Notably, the corporate’s inventory was added to the MSCI World Index, with BlackRock—the world’s largest asset administration agency—buying 4,020 shares of MSTR, valued at roughly $6.1 million.

The submit Michael Saylor and MicroStrategy settle $40 million tax fraud case with out act of contrition appeared first on CryptoSlate.