April was a month crammed with vital exercise and volatility for Bitcoin miners. A lot of the month was spent anticipating Bitcoin’s halving and the launch of Runes, with many analysts and market specialists warning in regards to the outsized affect they might have on the mining sector.

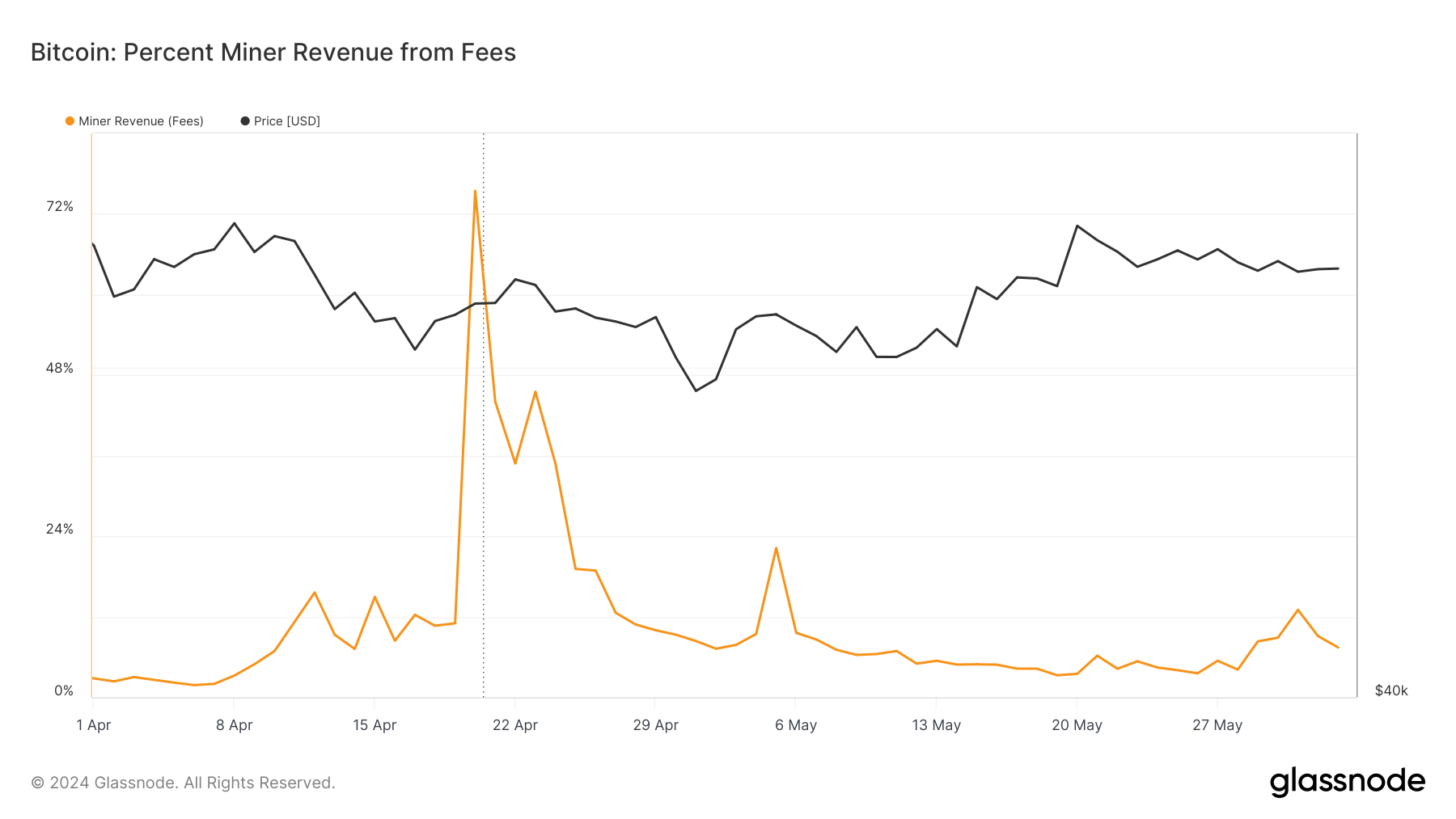

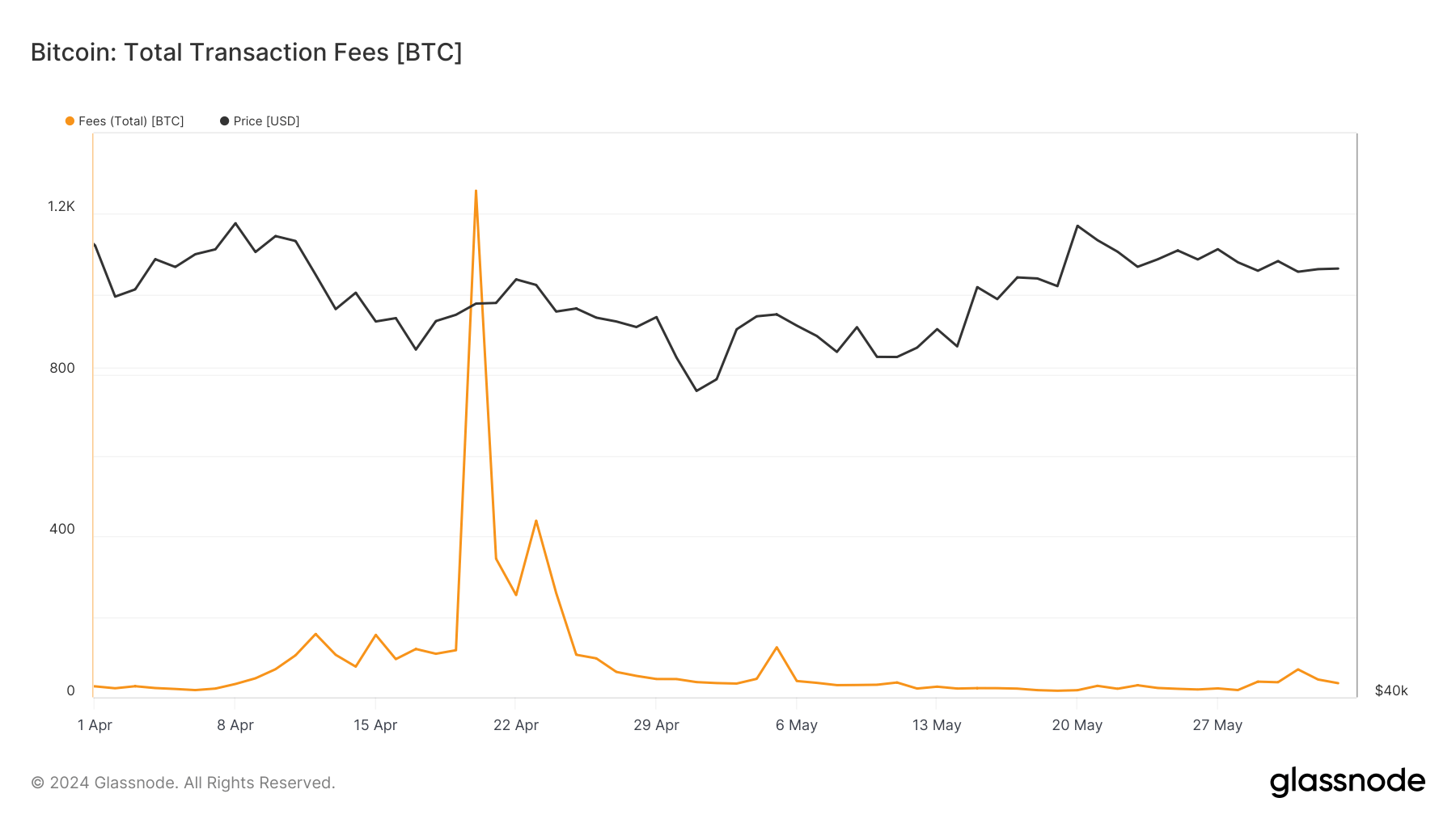

As anticipated, the mix of the halving and Runes propelled transaction charges and miner revenues to unprecedented heights. A complete of 1,257 BTC in charges was paid to miners, bringing their complete income from charges to 75.44%.

Come Could, the mining business entered a relaxed and uneventful interval. Knowledge from Glassnode confirmed stability throughout a number of miner metrics regardless of the broader market experiencing vital volatility.

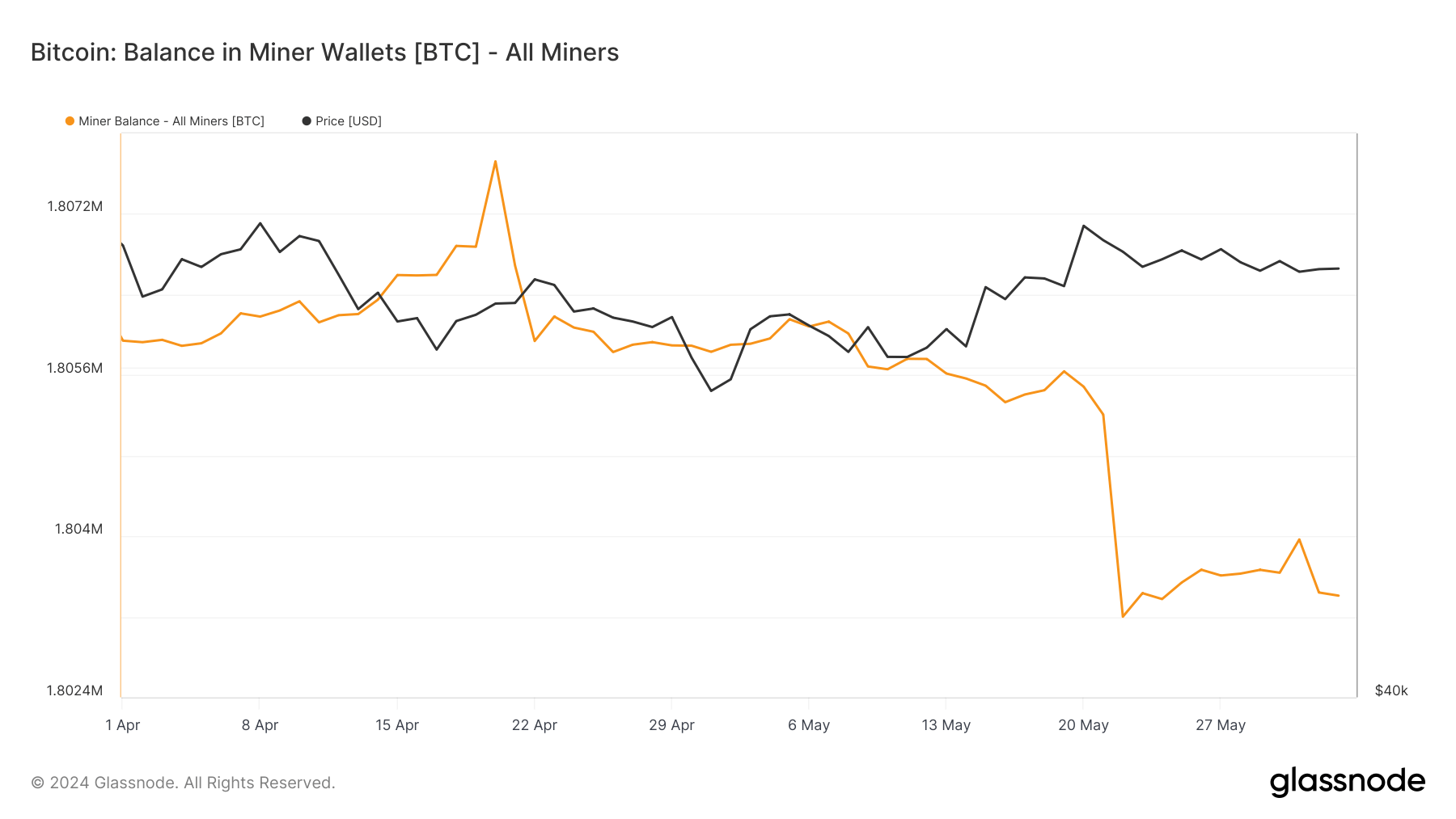

The quantity of BTC held in miner wallets noticed a vertical spike on April 20, passing 1.807 million BTC. Nevertheless, this spike was short-lived as miners offloaded a lot of their newly obtained revenue. Balances reverted to 1.805 million BTC by the top of April, remaining secure all through Could. We noticed a slight lower to 1.803 million BTC by June 3. This steadiness stability exhibits a interval of equilibrium and decreased exercise in comparison with April. It signifies that miners had been neither aggressively promoting their holdings nor considerably accumulating new cash, preferring as a substitute to take care of their positions and solely cowl working prices.

Transaction charges, a vital indicator of miner income and community exercise, additionally mirrored this shift. The explosive charge improve to 1,257.71 BTC on April 20 was short-lived, dropping to 253.93 BTC by April 22 and additional declining to a mere 16.35 BTC by the second half of Could. By June 2, charges had risen barely to 35.13 BTC, however this was nonetheless a far cry from the peaks seen in April. This charge discount can largely be attributed to the waning consideration for Runes and an total lower in community congestion and transaction volumes.

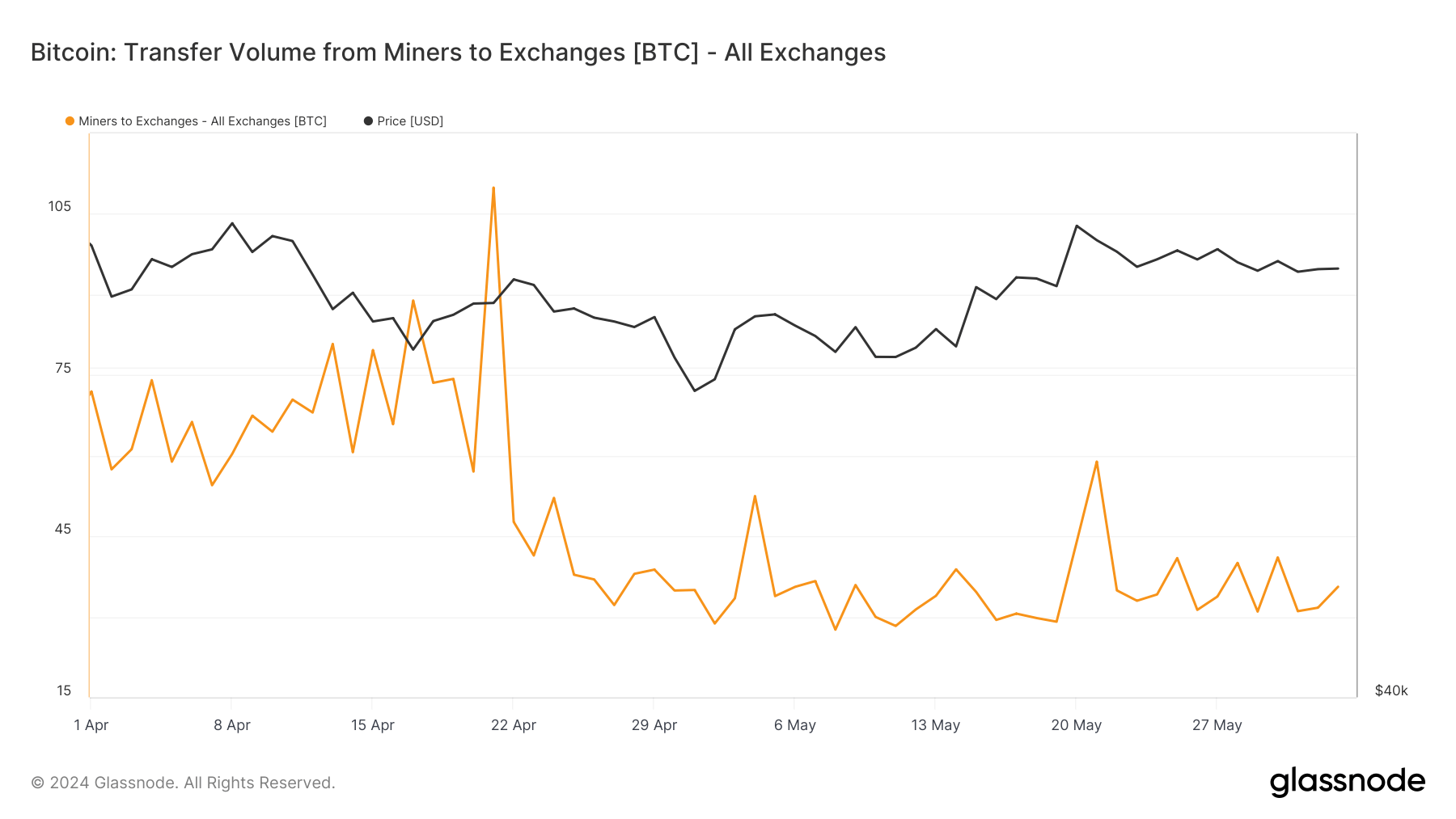

Analyzing miner transfers to exchanges additional exhibits simply how calm Could was. Early April noticed transfers of 71.95 BTC, which decreased to 57.03 BTC by April 20 and continued to say no, reaching 29.08 BTC by Could 19. This metric remained comparatively secure, with 34.90 BTC transferred by Could 22 and 35.59 BTC by June 2. The decreased motion of BTC from miners to exchanges means that miners weren’t pressured to liquidate their holdings.

The web move of cash into and out of miner addresses encapsulates the general sentiment and exercise. April’s internet flows had been extremely unstable, peaking at 848.35 BTC on April 20 earlier than plummeting to -748.18 BTC by April 22. Could exhibited a extra tempered dynamic, with a internet influx of 187.24 BTC on Could 19, adopted by a big outflow of -2,007.13 BTC on Could 22, and settling at -31.15 BTC by June 2. It suggests sporadic promoting stress however not at a stage that signifies panic or a bearish outlook.

This contrasts with the volatility we noticed in Bitcoin costs final month. Whereas the market reacted to cost fluctuations with typical volatility, miners adopted a extra measured strategy, probably indicating confidence within the longer-term prospects of Bitcoin. This measured strategy by miners may very well be interpreted as an indication of stability and maturation within the mining sector, the place short-term worth actions are much less impactful on operational methods.

Trying ahead, the relative stability in miner balances and decreased transaction charges counsel that miners are doubtless anticipating a interval of consolidation and are probably gearing up for future worth will increase. The low ranges of BTC transfers to exchanges point out that miners aren’t underneath fast monetary stress, permitting them to carry their property and probably profit from increased costs down the road.

These metrics might additionally counsel that community exercise and transaction volumes may stay subdued until catalyzed by vital market occasions or technological developments. This might end in decrease transaction charges and probably decreased miner revenues until offset by a considerable improve in Bitcoin’s worth.

The put up A flat month for miners after a unstable April appeared first on CryptoSlate.