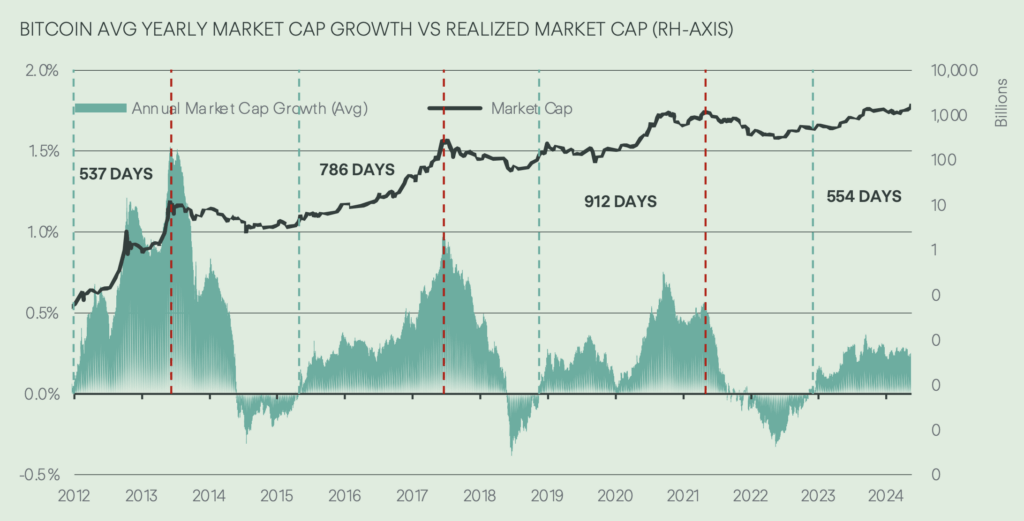

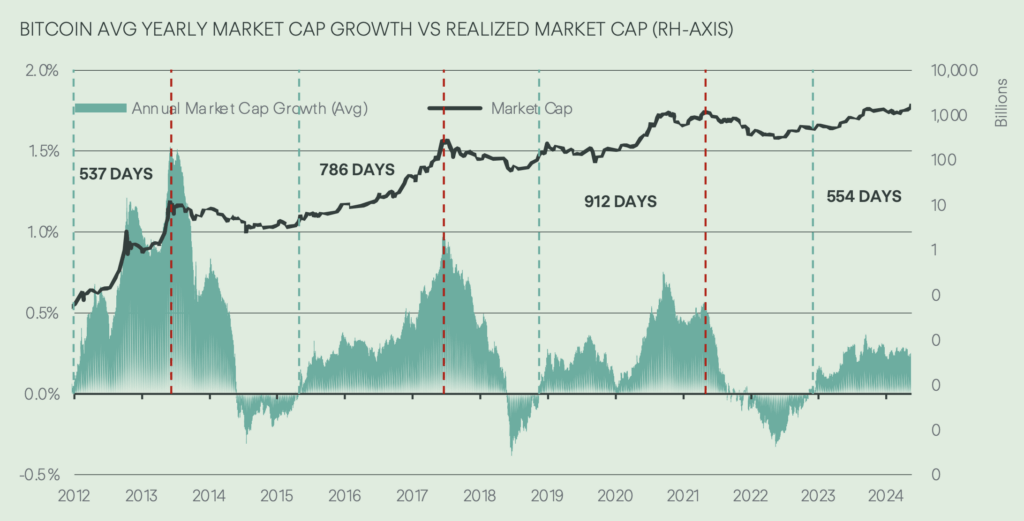

Bitcoin’s present market cycle signifies a possible peak in about 200 days, coinciding with forecasts of a potential US recession by mid-2025. In keeping with latest analysis from Copper.co, this alignment emerges as Bitcoin reaches day 554 of its cycle.

Traditionally, Bitcoin’s market cycles common 756 days from the purpose when the annual common development of its market capitalization turns optimistic till it hits a worth peak. Copper.co assesses that the current cycle started round mid-2023, shortly earlier than BlackRock filed for a Bitcoin exchange-traded fund. Bitcoin may peak round mid-2025, roughly 200 days from now, if the sample holds.

Copper.co makes use of JPMorgan’s estimate of a forty five% likelihood of a US recession occurring within the second half of 2025 to showcase a possible overlap of Bitcoin’s peak with financial downturn predictions, including a layer of complexity to market expectations. Traders might discover this intersection important when contemplating portfolio methods amid macroeconomic uncertainties.

Realized volatility for Bitcoin at present stands at 50%, reflecting the usual deviation of returns from the market’s imply return. Implied volatility, which gauges market expectations for future volatility, just lately hit its highest stage of the yr. This means ongoing market turbulence as 2025 approaches, with a potential bullish undertone influencing buying and selling behaviors.

Bitcoin’s Relative Power Index (RSI) is at 60, considerably decrease than earlier bull market highs. Copper.co’s report highlights that by extending the RSI’s look-back interval to 4 years—a timeframe that reduces short-term noise—the indicator reveals substantial room for development. This metric implies that Bitcoin may construct momentum into the brand new yr, doubtlessly reaching larger valuation ranges.

Inactive Bitcoin provide, representing cash held with out motion for prolonged durations, is growing amid document costs. This development signifies that long-term holders keep their positions, however vigilance is suggested. Ought to these buyers start to maneuver belongings, it may sign shifts in market forces or profit-taking actions.

Per Copper.co’s evaluation, combining these elements paints a nuanced image of Bitcoin’s trajectory. The interaction between market cycles, volatility measures, and macroeconomic forecasts illustrates the significance of monitoring a number of indicators.