On-chain data shows the Bitcoin derivatives exchange reserve has surged up recently, a sign that the crypto may face more volatility in the near future.

Bitcoin Derivatives Exchange Reserve Observes Uplift Over Last Two Days

As pointed out by an analyst in a CryptoQuant post, conditions seem to be brewing up in the BTC market that could lead to higher volatility in the price.

The “derivatives exchange reserve” is an indicator that measures the total amount of Bitcoin currently sitting in the wallets of all derivatives exchanges.

When the value of this metric goes up, it means investors are depositing their coins into these exchanges right now. Since BTC going up on derivatives generally leads to an increase in leverage, such a trend can result in higher volatility in the price of the crypto.

On the other hand, the value of the indicator registering a decline implies coins are exiting derivatives exchanges as holders are withdrawing them. This kind of trend may precede a more calmer BTC price.

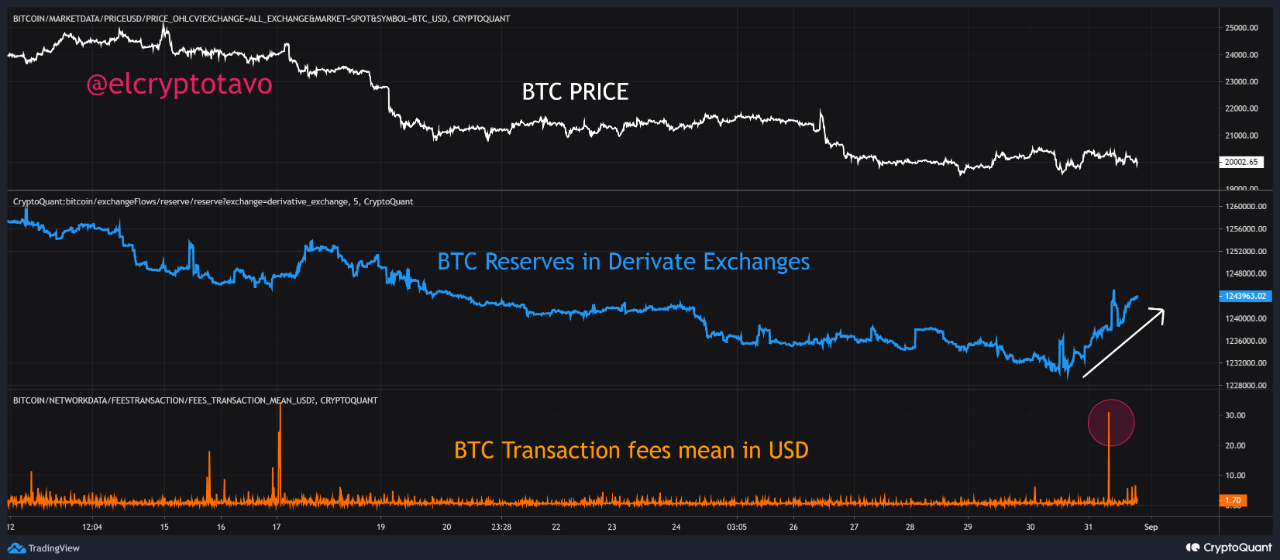

Now, here is a chart that shows the trend in the Bitcoin derivatives exchange reserve over the past few weeks:

The value of the metric seems to have climbed up in recent days | Source: CryptoQuant

As you can see in the above graph, the Bitcoin derivatives exchange reserve has seen some upwards momentum during the last couple of days. This shows that leverage in the market is now going up.

The chart also includes data for the mean value of the BTC transaction fees (in USD), and it looks like this metric also saw a spike during the past day, suggesting there have been some big moves in the market.

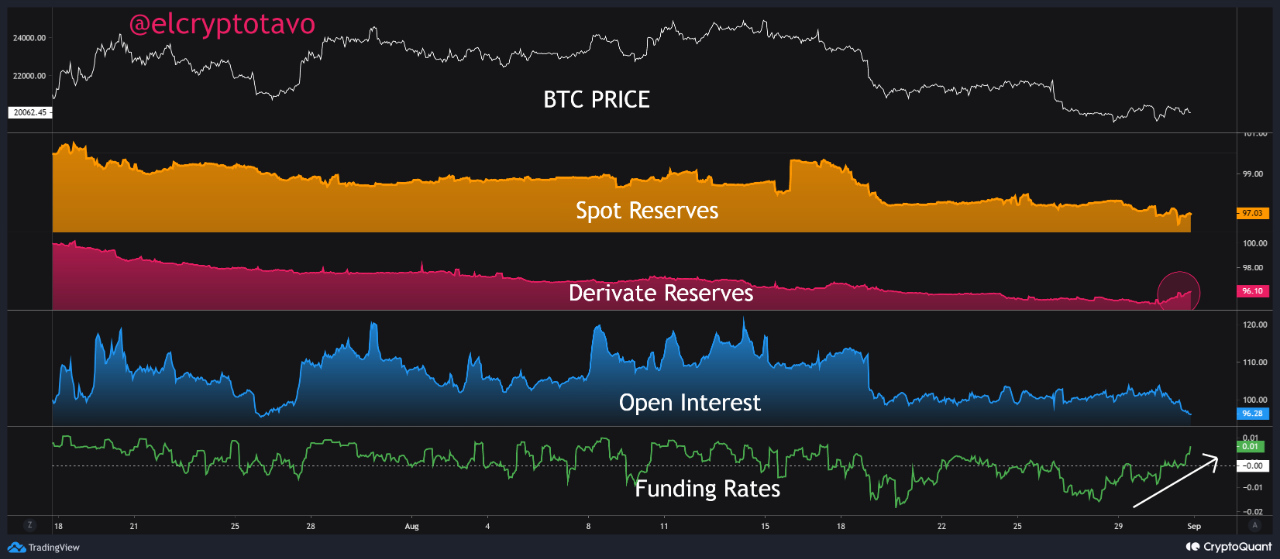

Below is another graph, this time including the trend for the BTC funding rates:

The funding rates have gone up over the past day | Source: CryptoQuant

As is apparent from the chart, the funding rates have jumped into positive values with this increase in the derivatives reserve.

This means that the investors sending coins to these exchanges have opened up long contracts, thus shifting the market balance into a long-dominant environment.

In the past, the combination of positive funding rates along with high derivatives reserve has usually meant high near term volatility for Bitcoin, with the price generally falling down.

BTC Price

At the time of writing, Bitcoin’s price floats around $20k, down 8% in the past week.

Looks like the value of the crypto has been moving sideways during the last few days | Source: BTCUSD on TradingView

Featured image from Yiğit Ali Atasoy on Unsplash.com, charts from TradingView.com, CryptoQuant.com