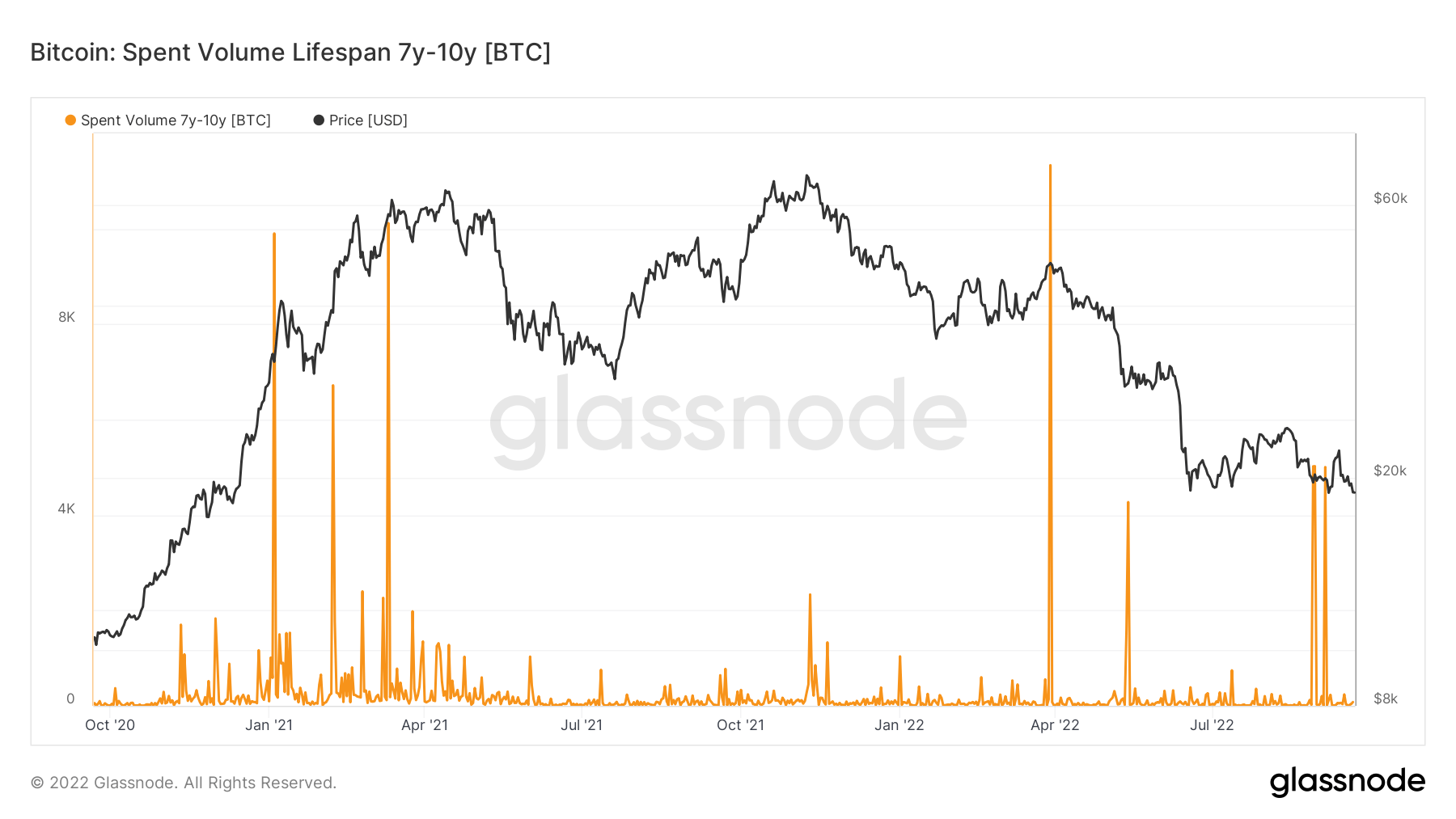

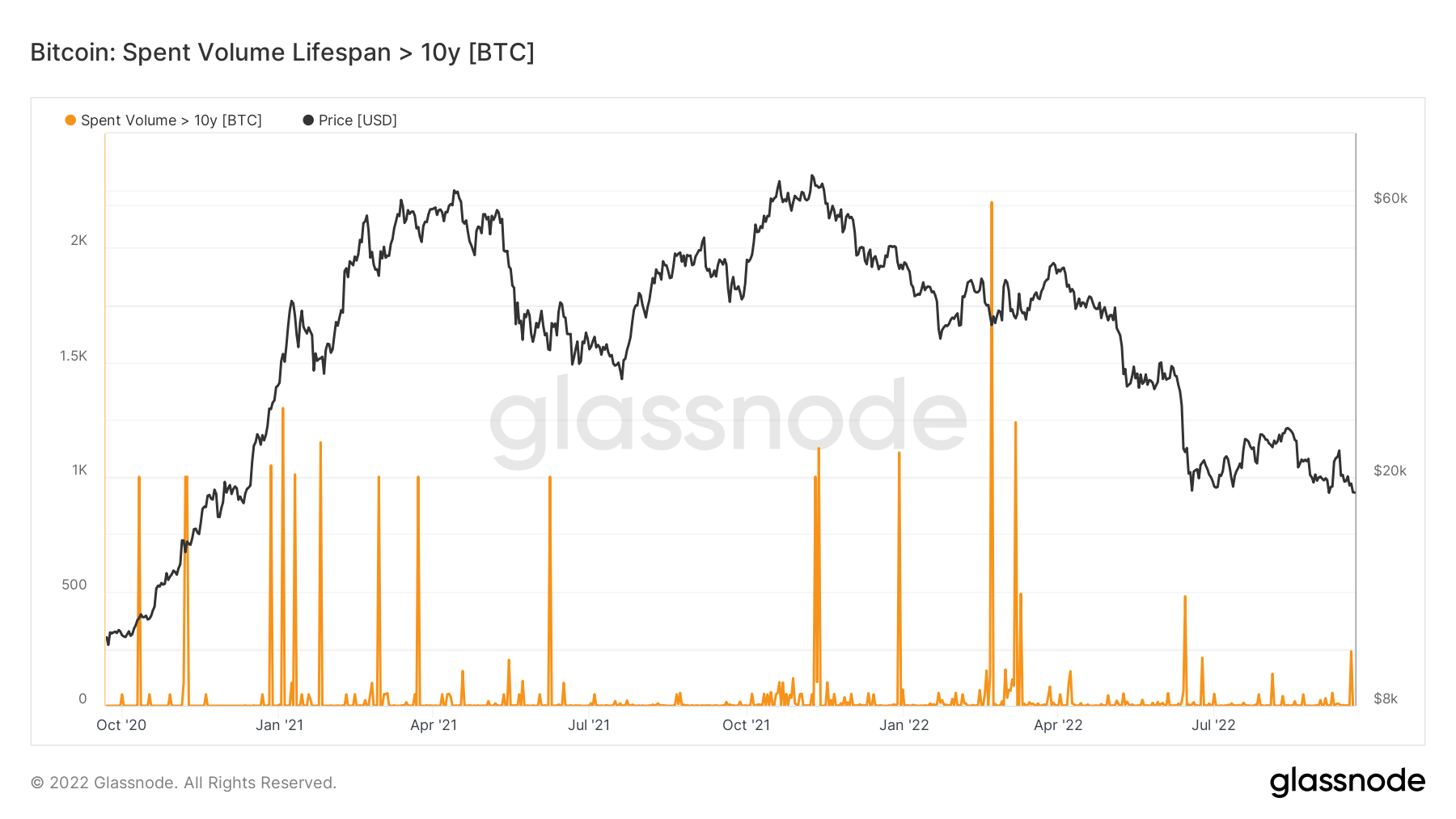

Lengthy-term whales which were holding their Bitcoins (BTC) for greater than seven to 10 years are promoting them once more for the primary time because the Terra (LUNA) collapse in Might, as Spent Quantity Age Bands (SVAB) point out.

Spent Quantity Age Bands (SVAB) is a separation of the on-chain switch quantity based mostly on the cash’ age. Every band represents the proportion of the spent quantity that was beforehand moved throughout the time interval denoted within the legend.

The chart above demonstrates the whole switch quantity of cash that had been final energetic between seven and ten years. The chart under, however, exhibits the identical information for cash which were stagnant for over ten years.

Each charts begin from October 2020 and exhibit the sell-offs on a month-to-month foundation. The results of the Terra disaster will be seen on each charts, with the spike in spent volumes throughout Might. The identical spike will also be seen in September 2022, particularly for Bitcoin, which was final moved between seven and ten years in the past.

Are whales quitting?

Whales are thought-about sensible cash throughout the Bitcoin ecosystem since they’ve managed to carry by means of virtually each bear market cycle. As well as, these holders have survived numerous blocksize wars and FUD assaults.

Whales which might be seven to 10 years previous recorded their fifth and sixth-highest transaction of the 12 months throughout September.

Regardless that whales older than ten years didn’t file annual highs, the chart exhibits a noticeable improve within the sell-offs. Since whales older than a decade can perceive the market cycles higher than any cohort, their sell-offs point out bearish sentiment.

Lower in whales

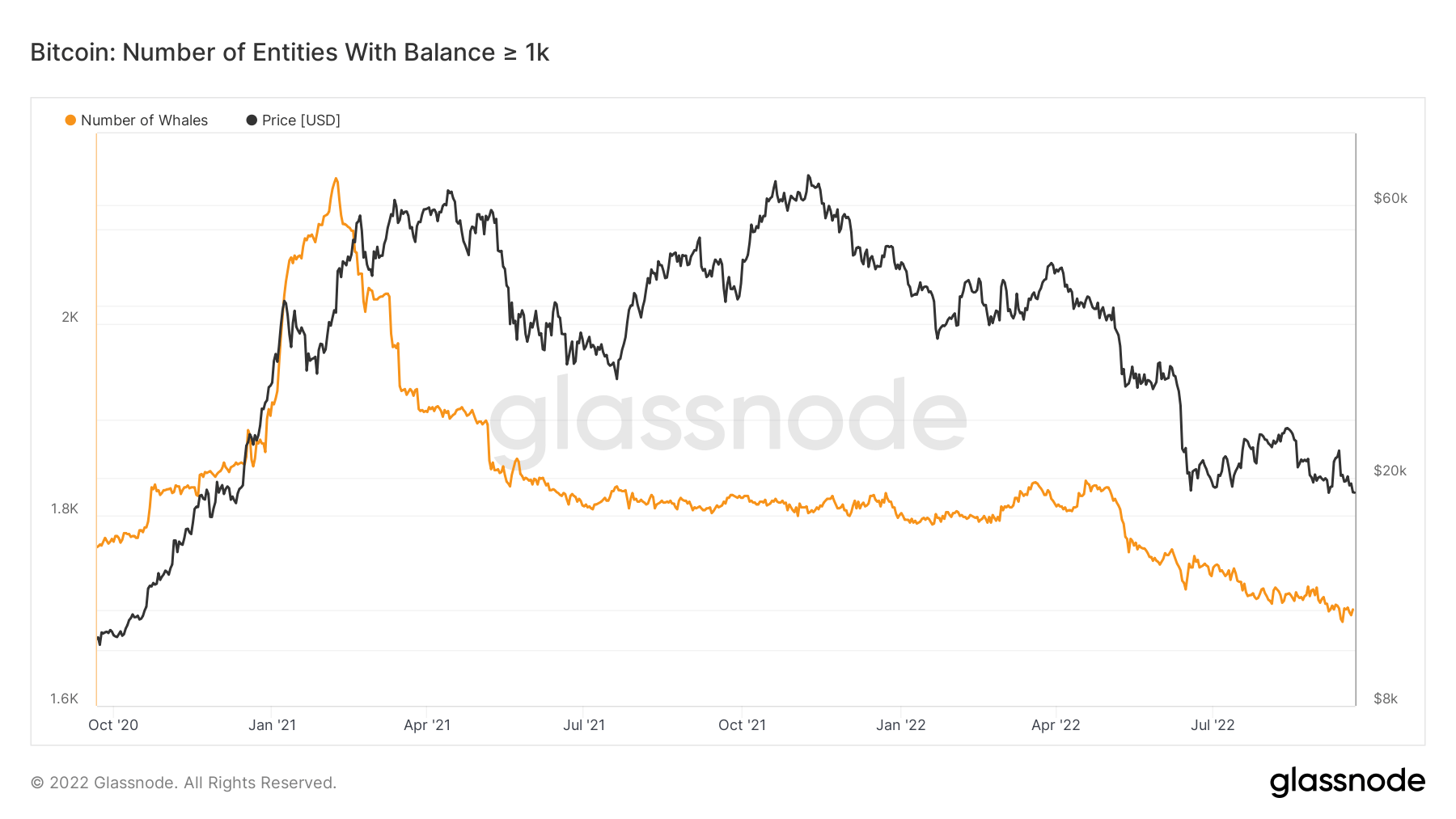

Along with sell-offs, the numbers additionally present a lower within the variety of whales.

People who maintain not less than 1,000 Bitcoins are known as whales, and their quantity has decreased because the peak of the 2021 bull cycle, which happened on January 2021. Regardless that it was the height, January was only the start of the bull run. Nonetheless, most whales cashed out throughout January.

The lower recorded within the variety of whales from January 2021 to July 2021 is comprehensible as a result of 2021 bull run. Between July 2021 and April 2022, the variety of whales elevated as Bitcoin worth additionally turned considerably secure between $60,000 and $40,000.

The lower recorded within the variety of whales from January 2021 to July 2021 is comprehensible as a result of 2021 bull run. Between July 2021 and April 2022, the variety of whales elevated as Bitcoin worth additionally turned considerably secure between $60,000 and $40,000.

Nevertheless, Bitcoin stored falling after April 2022. Even with lowering costs, the variety of whales dropped from 2,150 to 1,695. The final half is especially fascinating as whales have a tendency to attend out the winter costs.

On the brilliant aspect

The lower in whales and the excessive variety of sell-offs, regardless of low costs, point out bearish sentiment, however there’s a silver lining. The sell-offs and disappearing whales imply that their Bitcoin is distributed to multiple particular person.

Because of this Bitcoin is concentrated amongst fewer and fewer people. In the long run, having a extra distributed Bitcoin advantages the retailer and will increase the safety of the community.