Be a part of Our Telegram channel to remain updated on breaking information protection

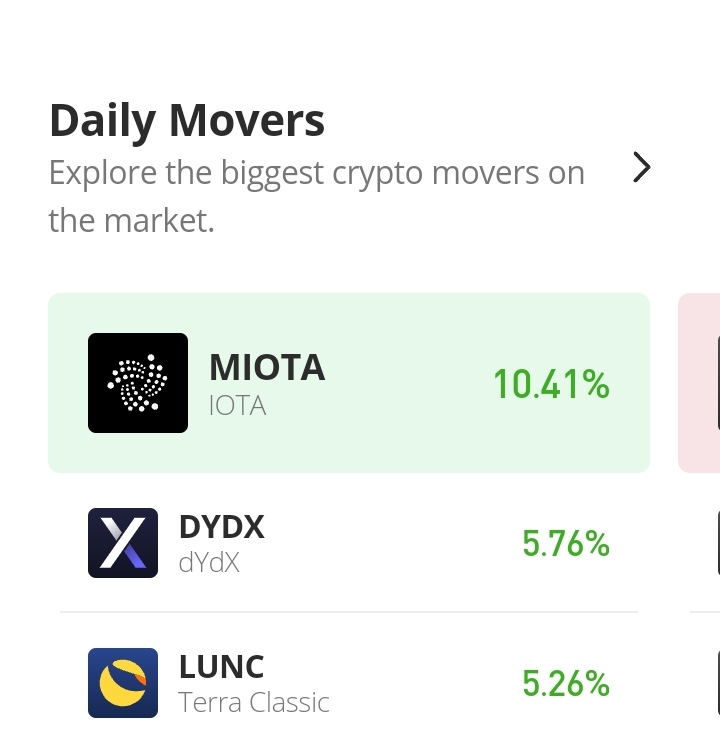

After a quick consolidation within the DYDX/USD market that got here to an finish on the eleventh of August, the market started to pattern downward for 10 days after which bulls’ try to push up the market failed and resulted in one other sideway-ranging market. The market consolidating interval portrays a really excessive degree of indecision, however in some unspecified time in the future sellers’ aggression made the market value fall. However the bearish transfer didn’t final for greater than only a day on every of the events. Nonetheless, Out there right this moment, we see that bulls are making a formidable effort to push the worth up. As the worth is presently balanced at $1.323, there’s nonetheless extra land to cowl if consumers will take right this moment’s market into the bullish pattern.

DYDX Market Worth Statistic:

- DYDX /USD value now: $1.323

- DYDX/USD market cap: $ 86,708,495

- DYDX/USD circulating provide: 65,569,295

- DYDX/USD whole provide:1,000,000,000

- DYDX/USD coin market rating: #255

Key Ranges

- Resistance: $1.50000, $2.0000, $2.5000

- Assist: $1.0000, $0.50000, $0.25000

Your capital is in danger

DYDX Market Worth Evaluation: The Indicators’ Level of View

The market was static for five days. The consumers and sellers didn’t bid the worth in any of the 2 market instructions. However on the twenty third of September, we noticed the signal of a really small market value pull – an try to interrupt out from the ranging market. Nonetheless, it was not till right this moment that we start to see a decisive market motion to an higher value degree.

The MACD portrays a bearish market ranging under degree zero of the Indicator. The MACD line is now rising above the sign line because the histogram top will increase upward. The Relative Energy Index additionally confirms that the market is recovering from the bearish zone. Its RSI line is rising and is now at 41%. Just like the indication of the MACD, the RSI line is under the 50% degree of the indicator.

DYDX/USD 4-Hour Chart Outlook

The 4-hour timeframe isn’t a lot of a distinction from the Each day chart timeframe. As we will see from the chart, one session is lacking. The primary buying and selling session didn’t seem right here on the chart. Shopping for actions solely began within the third buying and selling session. The candlestick that represents the third buying and selling could be very bullish. For now, we aren’t seeing promoting actions available in the market in any respect. The RSI and the MACD indications are fairly much like that of the each day session. The market is going through an upward course, however the momentum is poor.

Tamadoge – Play to Earn Meme Coin

- Earn TAMA in Battles With Doge Pets

- Capped Provide of two Bn, Token Burn

- Presale Raised $19 Million in Below Two Months

- Upcoming ICO on OKX Trade

Be a part of Our Telegram channel to remain updated on breaking information protection