By inspecting particular metrics, on-chain analysis revealed on Aug. 21 instructed that the Bitcoin backside was shut however not in but.

Revisiting these metrics a month later exhibits it’s all modified. Nevertheless, buyers ought to be conscious that this doesn’t essentially imply the value of Bitcoin can’t fall farther from present costs.

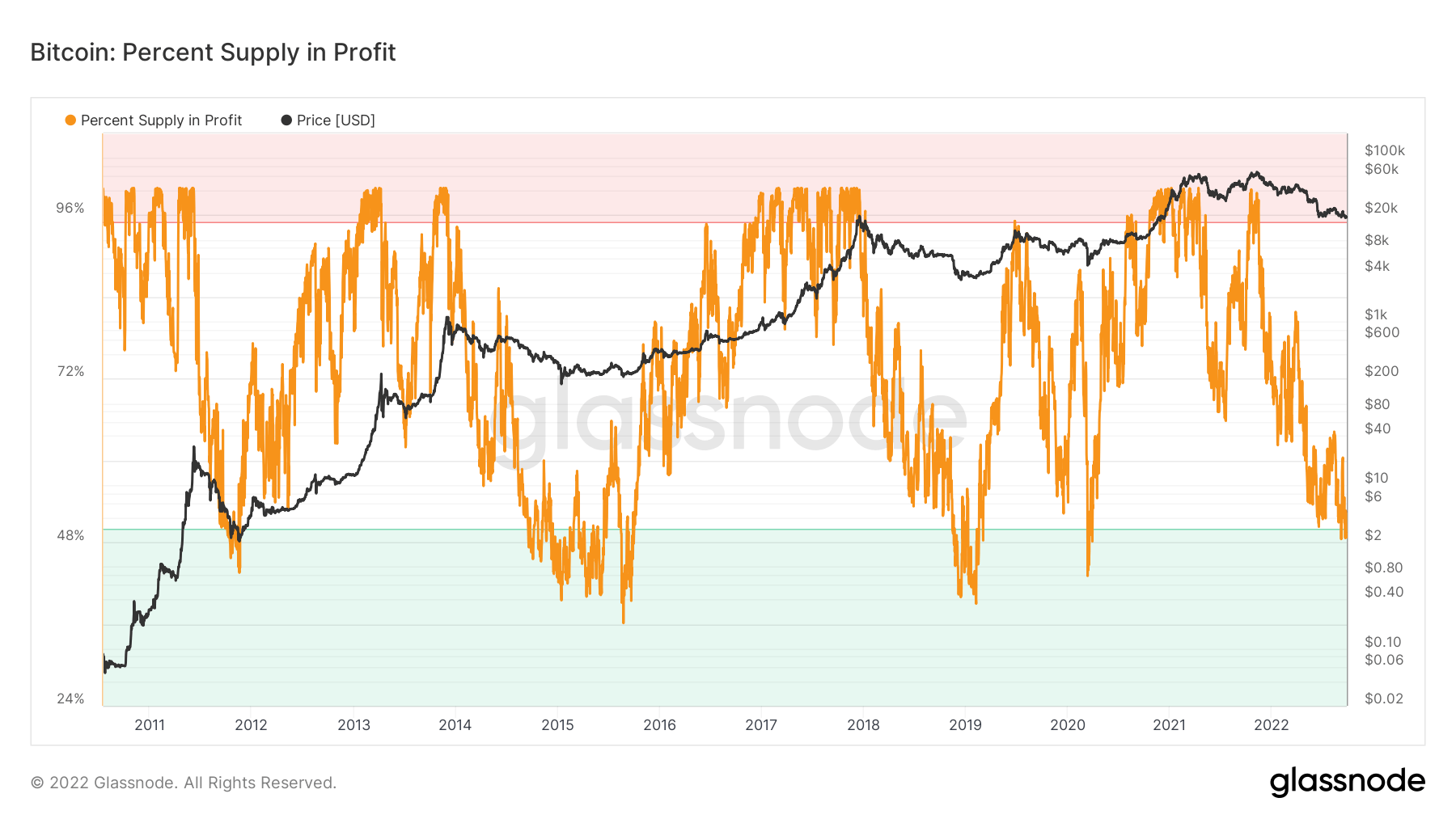

Share of Bitcoin addresses in revenue

The share of Bitcoin addresses in revenue refers back to the proportion of distinctive addresses whose funds have a mean purchase worth decrease than the present worth.

In earlier bear markets, the share of Bitcoin addresses in revenue had all the time dropped beneath 50%, with final month’s studying hovering round 55%.

The up to date chart beneath exhibits the share of addresses in revenue is now beneath the 50% threshold, giving a present studying of roughly 48% in revenue.

Nevertheless, as famous within the 2015 bear market, when this metric dipped as little as 30%, there’s each risk that investor capitulation can proceed for a lot of months earlier than that is mirrored in a worth pattern reversal.

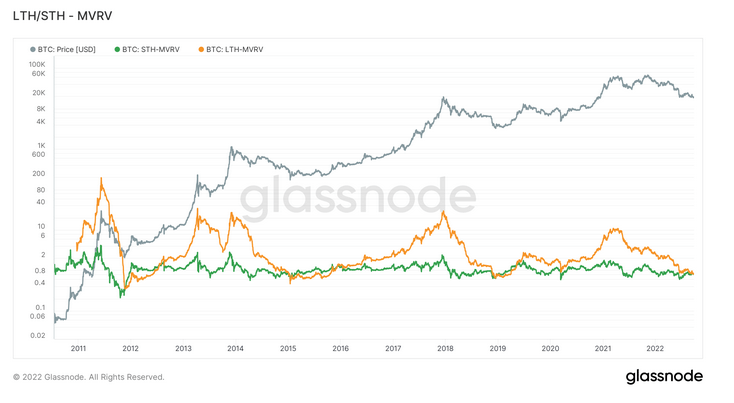

Market Worth to Realized Worth

Market Worth to Realized Worth (MVRV) refers back to the ratio between the market cap (or market worth) and realized cap (or the worth saved). By collating this data, MVRV signifies when the Bitcoin worth is buying and selling above or beneath “honest worth.”

MVRV is additional cut up by long-term and short-term holders, with Lengthy-Time period Holder MVRV (LTH-MVRV) referring to unspent transaction outputs with a lifespan of at the least 155 days, and Brief-Time period Holder MVRV (STH-MVRV) equating to unspent transaction lifespans of 154 days and beneath.

Earlier cycle bottoms had been characterised by a convergence of the STH-MVRV and LTH-MVRV traces. This intersection has now occurred, suggesting long-term holder capitulation has been reached.

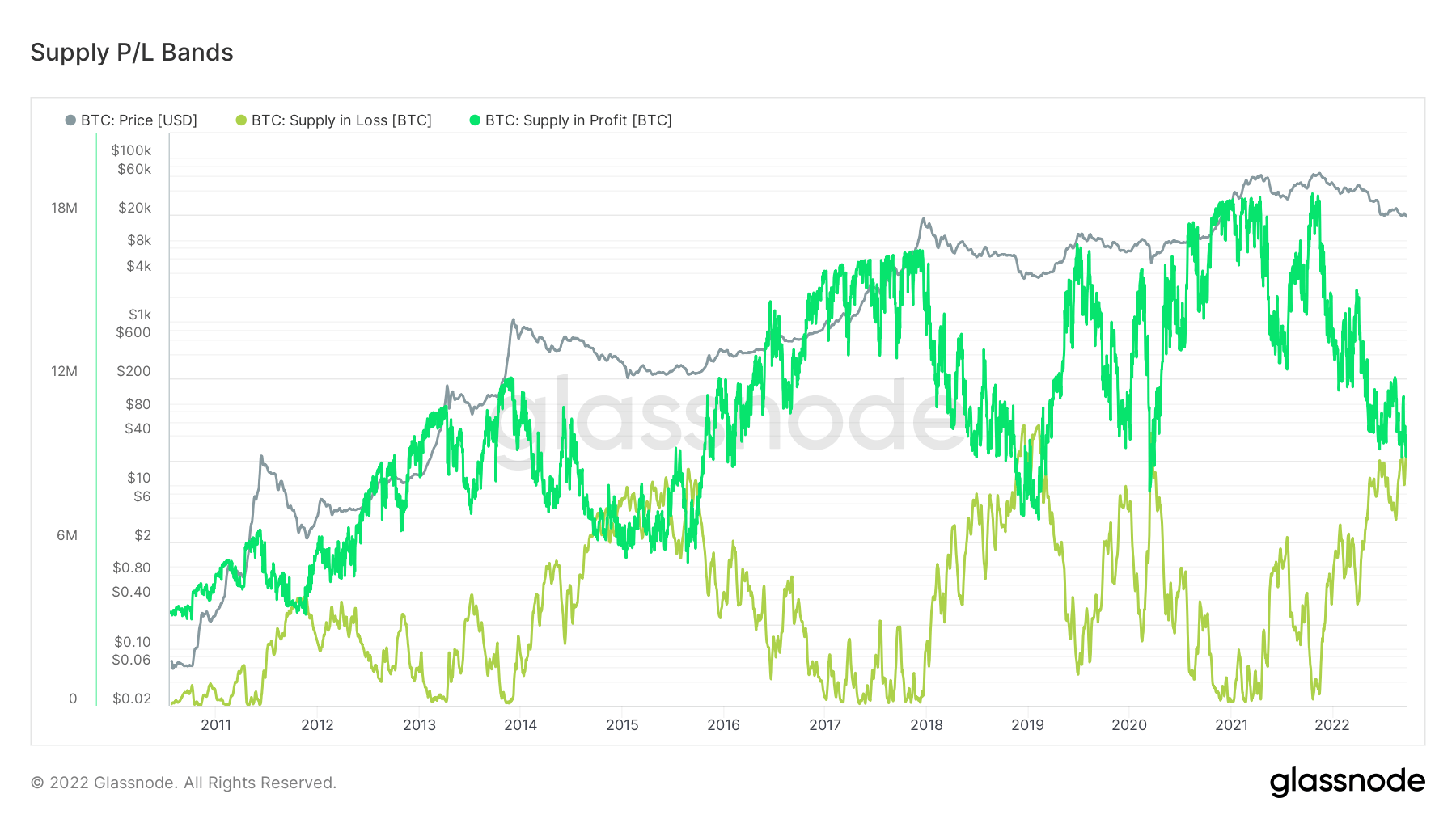

Provide in Revenue and Loss

By analyzing the variety of BTC tokens whose worth was decrease or larger than the present worth when final moved, the Provide in Revenue and Loss (SPL) metric exhibits the circulating provide in revenue and loss.

Market cycle bottoms coincide with the provision in revenue and provide in loss traces converging. The chart beneath exhibits this phenomenon has occurred, which means the vast majority of the circulating provide is at a loss.

Though the above metrics have flashed the underside is in, you will need to understand that bottoming can prolong over months.

As well as, the macro panorama stays an unknown issue that was not current in earlier situations of bear-to-bull flips.