The most important information within the cryptosphere for Oct.6 contains the arrest and launch of Do Kwon’s aide, the EU’s crypto sanctions on Russia, and 0.03 Bitcoin distributed to 3 winners by Michael Saylor by means of the Lightning Community.

CryptoSlate Prime Tales

South Korea tightens circle on Do Kwon, arrests his aide

Terraform Labs founder Do Kwon’s aide Yoo Mo turned the primary particular person to be arrested within the ongoing Terra-Luna investigation. Mo was the Head of Common Affairs at Terraform Labs and bought arrested on Oct. 6, someday after South Korean authorities launched an arrest warrant on Oct. 5.

Within the meantime, South Korea issued a separate warrant requesting Kwon at hand in his passport inside 14 days. If he fails to take action, his passport shall be invalidated by the authorities.

South Korean courtroom dismisses arrest warrant for Do Kwon’s aide

Practically 12 hours after Mo’s arrest, native information sources reported {that a} South Korean District Courtroom has denied the arrest warrant in opposition to Mo. The preliminary arrest warrant wished Mo handcuffed for violating the Capital Market Act.

Nonetheless, the deciding Choose Jin-Pyo argued that LUNA hadn’t been labeled as a safety, which meant that Mo might not have violated the Capital Market Act.

EU narrows Russia’s choices additional with crypto sanctions

The European Union (EU) introduced a brand new set of sanctions that banned all crypto asset wallets, accounts, or custody companies belonging to Russian customers.

Earlier sanctions allowed the above companies to function in the event that they held funds decrease than €10,000.

Saylor offers away BTC through lightning community

Michael Saylor despatched 0.03 Bitcoin (BTC)in sats to 3 winners of his Lightning meme contest utilizing Lightning Community.

The proper reply is Sure, and I’ll make three extra transactions of 1,000,000 sats every to the three posters of essentially the most preferred #Lightning⚡️ memes within the feedback under. https://t.co/qXZ90q4Ly9

— Michael Saylor⚡️ (@saylor) October 4, 2022

The competition ended on Oct. 5, and Twitter customers ShireHODL, NEEDcreations, and publordhodl obtained 1 billion sats every.

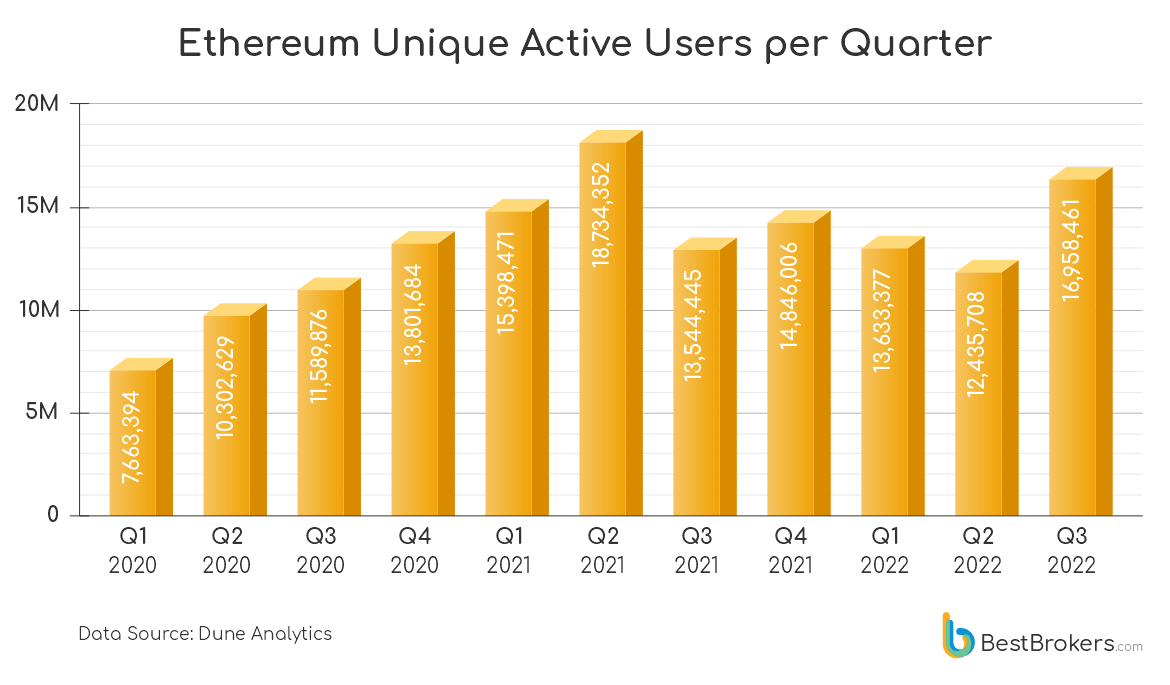

Variety of lively Ethereum customers elevated 36% in Q3 regardless of bear market

Ethereum (ETH) gained greater than 4.5 million new lively customers throughout the third quarter of 2022, as the information from Dune Analytics signifies. This improve equates to a 36% progress within the lively person base.

Ethereum lively customers have recorded a gentle lower for the reason that fourth quarter of 2022. Some analysts claimed that his sudden improve might signify that the crypto market is returning to its constructive pattern.

Decentraland has simply 30 every day lively customers regardless of billion greenback market cap – DappRadar knowledge

In accordance with knowledge from DappRadar, Decentraland solely has 30 every day lively customers regardless of its $1.2 billion valuation.

Decentraland’s native token MANA has a every day quantity of $121 million with a market cap of $1.31 billion.

Ripple slams SEC for opposing amicus briefs, XRP up 3.6%

The Securities and Alternate Fee (SEC) bought publicly criticized by Ripple over its opposing standing to the amicus briefs filed by I-Remit and TapJets. The “slam” was publicized on Twitter by the protection lawyer James Filan.

Following this, Ripple’s native token XRP recorded a rise of three.6% over the past 24 hours.

Marathon Digital invested over $30 million in bankrupt Compute North

Bitcoin mining firm Marathon Digital revealed its investments. The agency mentioned it invested $10 million in convertible most well-liked inventory and one other $21.3 million in unsecured senior promissory notes in Compute North.

The announcement additionally disclosed that Marathon held 10,670 Bitcoins, which roughly equates to $207.3 million on the present costs.

Tuttle Capital recordsdata Inverse ETFs to commerce in opposition to Jim Cramer’s suggestions

Tuttle Capital filed two ETFs to take a position on the reverse place of any shares really useful by the Mad Cash host Jim Cramer.

Jim Cramer is thought for his contradicting funding technique, which regularly proved him fallacious in crypto. The latest instance got here in July when Cramer mentioned he was promoting all his Bitcoin after the market cap fell under $1 trillion. He mentioned Bitcoin had no actual worth. Bitcoin responded to that by spiking quick and gaining 17% on the finish of the month.

Regardless of Twister Money fiasco, Bitcoin SV launches ‘Blacklist Supervisor’ software

Bitcoin SV (BSV) launched a brand new software known as “Blacklist Supervisor” that permits miners to freeze tokens.

Although the subject of sanctions is scorching after the OFAC’s ban on Twister Money, Bitcoin SV claims that Blacklish Supervisor can be utilized to freeze misplaced or stolen tokens or to “adjust to courtroom orders.”

Calls mount for Louisiana state to purchase Bitcoin following BlackRock divestment

Louisiana State introduced pulling round $794 million from BlackRock in relation to Environmental, Social, and Governance (ESG) ideas. Upon the announcement, Bitcoin maximalists known as for the State Treasury to purchase Bitcoin.

Outstanding names joined the stress as properly. A pacesetter on the Canadian Affiliation of Neighborhood Well being Centres, Scott A. Wolfe, tweeted his assist and mentioned:

“Put 1-5% of that in Bitcoin, for the individuals of Louisiana and future generations!“

SEC workers reportedly sad with Gensler over Kim Kardashian’ publicity stunt’

SEC’s enforcement workers are reportedly uncomfortable with the media consideration Chairman Gary Gensler attracted with the fining of Kim Kardashian.

SEC workers mentioned Gensler violated protocol along with his “publicity stunt” concerning the scenario.

Analysis Spotlight

Analysis: After September massacre, traditionally bullish This fall might ease the ache

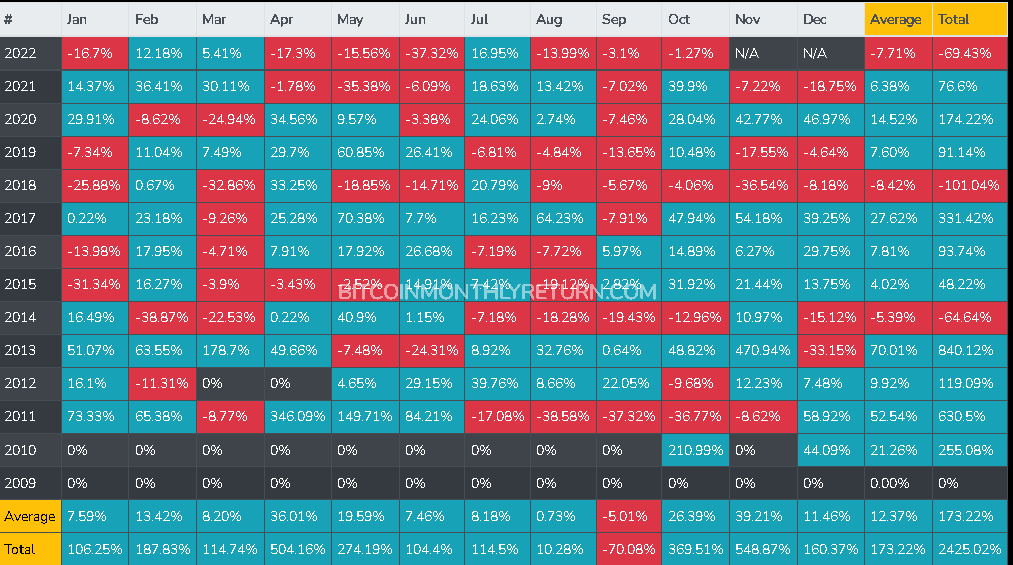

Crypto historical past confirmed that September bloodbaths are a recurring theme for the crypto markets and are adopted by a haling spike throughout the fourth quarter.

September 2022 was notably bloody for Bitcoin. For the primary time since 2016, it failed to shut the month within the inexperienced.

October, nonetheless, has been exhibiting indicators that historical past might repeat itself and observe the bloody September with a constructive uptrend within the crypto markets all through the fourth quarter.

Bitcoin’s month-to-month common for October closes at 26.39%, which marks the second-best month in Bitcoin’s historical past.

Information from across the Cryptoverse

South Korean watchdog reiterates assist for crypto protections

The Chairman of South Korea’s Monetary Companies Fee (FSC) spoke publicly on Oct. 6 to reiterate the establishment’s assist for blockchain know-how and person protections, in line with Yahoo Finance.

Crypto Market

Bitcoin (BTC) recorded a lower of 0.59 % to fall to $20,035 within the final 24 hours, whereas Ethereum (ETH) spiked by 0.56% to be traded at $1,358.