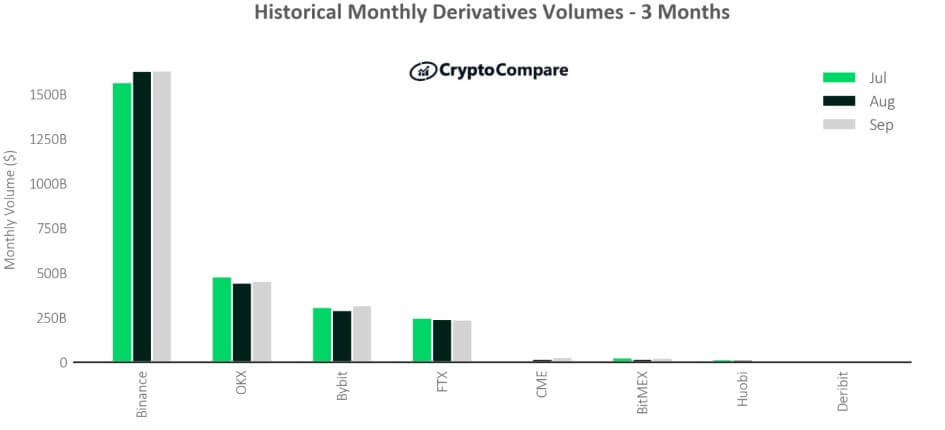

Crypto derivatives buying and selling was answerable for 63.4% of your complete crypto market in September as its buying and selling elevated by 1.54% month over month to achieve $2.71 trillion, in keeping with CryptoComapre information.

Changpeng Zho-led Binance accounted for 60.1% of this derivatives buying and selling quantity amongst exchanges in September. This development continued from July and August when its quantity dwarfed different rival exchanges.

OKX is second because it controls 16.8% of the market share, whereas Bybit rounds up the highest three, controlling 11.7% of the market share.

In line with the report, the best every day buying and selling quantity was on thirteenth September, when derivatives exchanges traded $136 billion.

In the meantime, spot buying and selling actions elevated by 3% in the identical month to $1.56 trillion.

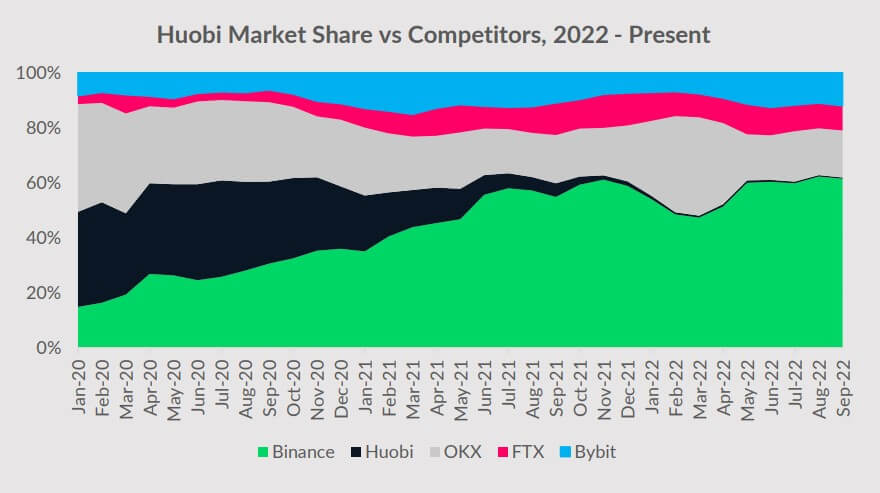

Huobi’s fall from grace

Huobi has seen its inventory fall as its derivatives buying and selling quantity for September plunged 27.9% to $9.56 billion, persevering with its freefall from the beginning of the 12 months.

In line with the CryptoCompare report, Huobi was the largest buying and selling platform for derivatives buying and selling, however its numbers have declined by 77% on the year-to-date metric. Its market share has plunged from 34.6% in January 2020 to 0.36% by September 2022.

The trade has confronted elevated market competitors and regulatory challenges that pressured it out of its largest consumer base, China, in December 2021.

The trade’s makes an attempt to develop geographically have yielded a lot fruit because the regulatory bottlenecks from these locations have been an obstacle.

In the meantime, the trade introduced its acquisition by Hong Kong funding fund supervisor, About Capital. Tron Community founder Justin Solar is an investor within the fund and can now function International Advisor for the trade.

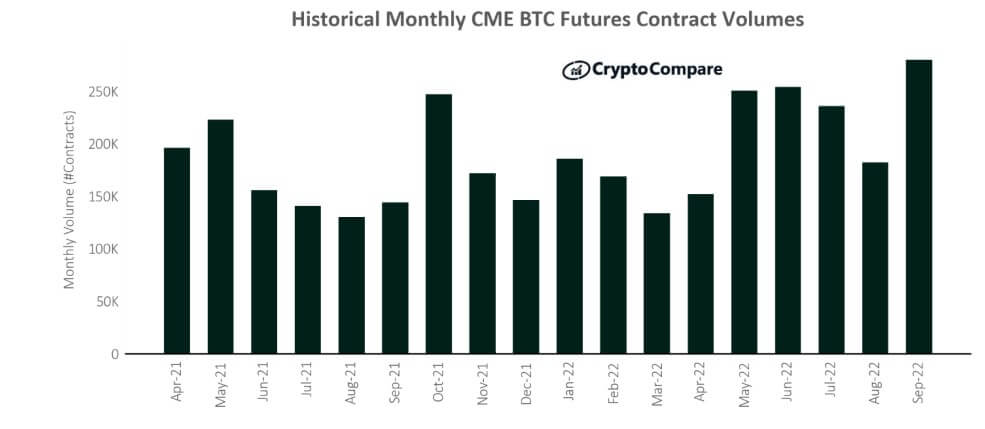

CME sees BTC futures buying and selling enhance

The Chicago Mercantile Change (CME) noticed the primary enhance in Bitcoin futures buying and selling quantity in 4 months, with a 37.3% rise to $27.4 billion. The surge signifies that institutional curiosity in BTC futures is returning.

In line with CryptoCompare, CME recorded the best variety of traded BTC futures contracts in September for this 12 months. The report revealed a 53.8% rise within the month-over-month metrics whereas BTC choices contracts quantity additionally rose 5.46% in the course of the month.

“By way of whole USD buying and selling quantity, CME’s ETH futures reached $11.9 billion in September (up 32.6% since August). In the meantime, CME’s BTC futures volumes elevated by 37.4% to $27.4 billion. On combination ETH + BTC futures volumes rose 35.9% to $39.3 billion.”