This has been the 12 months of mining problem and hash fee, as they saved growing to file new all-time highs (ATH) regardless of the declining development in Bitcoin (BTC) value, in keeping with knowledge analyzed by CryptoSlate.

Mining problem refers to miners’ likelihood of discovering the required hash code to mine one block. Hash fee, then again, measures the computational energy required to search out one hash code. Subsequently, growing the mining problem pushes the hash fee up and vice versa.

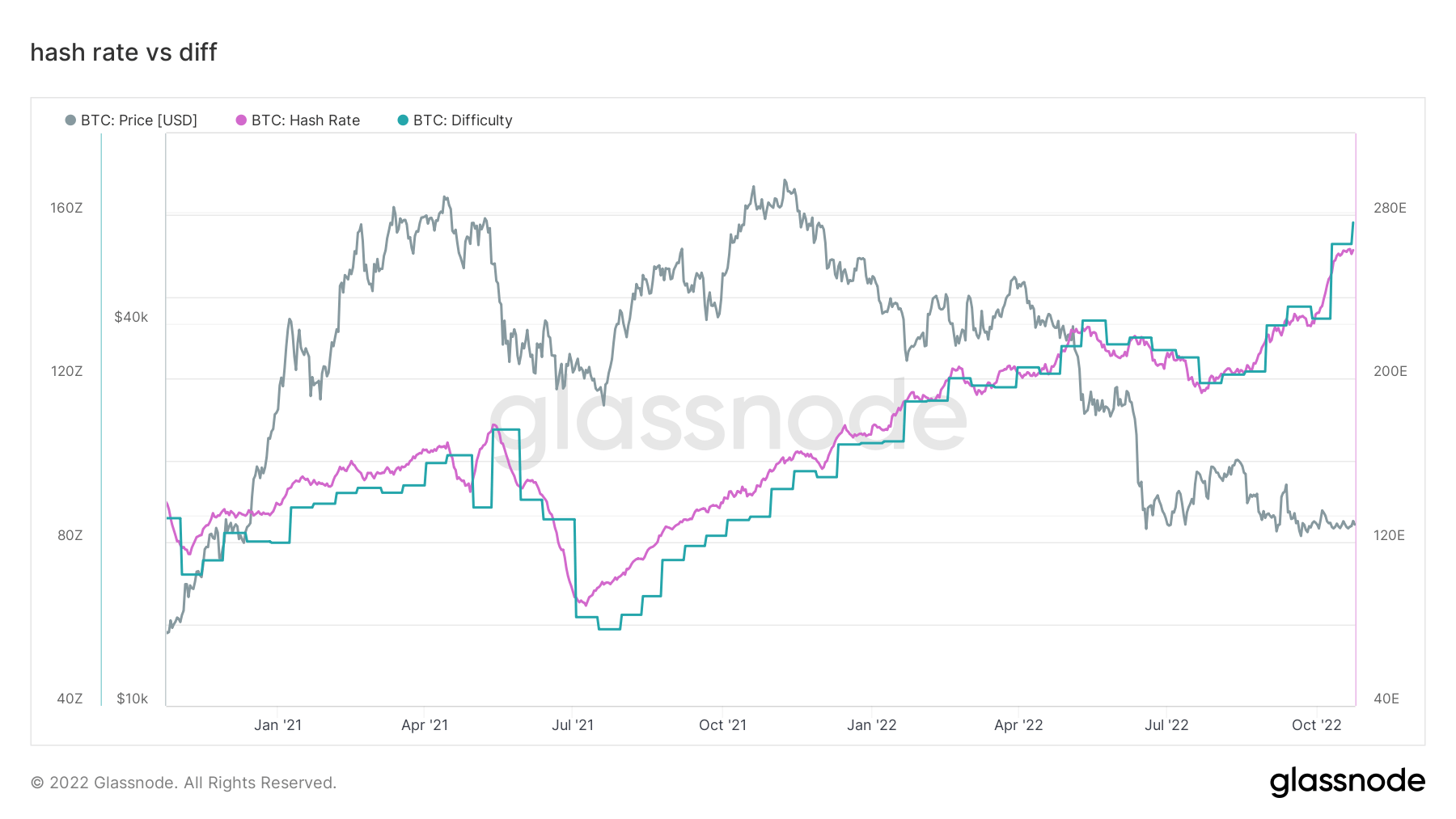

Hash fee and problem have elevated exponentially because the 12 months’s starting. The chart above reveals the hash fee with the pink line and the mining problem with the turquoise one.

This 12 months’s first ATH in mining problem was recorded on Jan. 21, when it elevated by 9.32 % and reached 26.64 trillion. Nearly two weeks later, on Feb. 18, one other spike in problem recorded a brand new ATH at 27.97 trillion. Regardless of falling Bitcoin costs and the tumbling market, the hash fee and mining problem continued its enhance on the identical tempo, recording a brand new ATH nearly each few weeks till Could 2022.

For a brief interval between Could and September, each the hash fee and problem fell. Nonetheless, they remained above the 12 months’s first ATH stage at 26.64 trillion. In September, an upwards surge in each indicators began once more when the mining hash fee elevated by 60% in 24 hours. It continued to extend and recorded new ATH ranges on Oct. 3 ct. 5. This enhance was adopted by a 13.5% surge in mining problem on Oct. 10.

The ultimate enhance of the 12 months was recorded on Oct. 24, when Bitcoin mining problem elevated one other 3.4% and recorded a brand new ATH at 36.84 trillion. The hash fee is holding at 260 EH/s on the time of writing and is but to reply to the hovering mining problem.

Causes behind the hash fee enhance

There isn’t any one purpose behind the rise within the hash fee. Basically, the hash fee will increase on account of a rise within the variety of miners, a few causes will be listed when explaining the exponential progress of the variety of miners.

One of many causes might be due to the Ethereum (ETH) merge, which occurred on the finish of September. With the merge, the Ethereum community switched its Proof-of-Work system to a Proof-of-Stake one, which left Ethereum miners out of labor. Most Ethereum miners probably switched to Bitcoin mining, which might have recorded a major enhance within the variety of Bitcoin miners.

Through the 2021 bull run, the vast majority of the Bitcoin miners have ordered new mining rigs to broaden their companies, that are being shipped now. As increasingly more mining rigs attain their locations, extra are being plugged in and begin mining, which will increase the variety of miners within the community.

As well as, because of the bear market costs, mining gear older than 2019 lost profitability as soon as Bitcoin fell under the $22,600 restrict. The business realized the issue and rolled its sleeves to develop higher mining rigs with extra environment friendly chips. To compensate for the loss, a new era of mining gear is being bought at reasonably priced costs, which additionally pushes the variety of miners increased, ensuing within the hash fee spiking much more.

These info are only a few of the numerous elements that trigger the spike in hash charges. Since these elements are extra like developments than one-time occasions that enhance the variety of miners, there isn’t any method of realizing in the event that they’ll enhance the variety of miners sufficient to trigger one other spike within the hash charges.

Penalties of the excessive hash fee

Rising hash fee and mining problem make Bitcoin mining extra aggressive, which places immense strain on all miners. Particularly inefficient ones couldn’t deal with the growing charges left the community.

Throughout 2021, a development of going public emerged amongst miners to gather simple funding. Most of them expanded their operations on the time with the funding they collected. Nonetheless, after the bear market began in Could, most of their share costs fell by 80%. This fall was accompanied by lots of speak about attainable insolvencies.

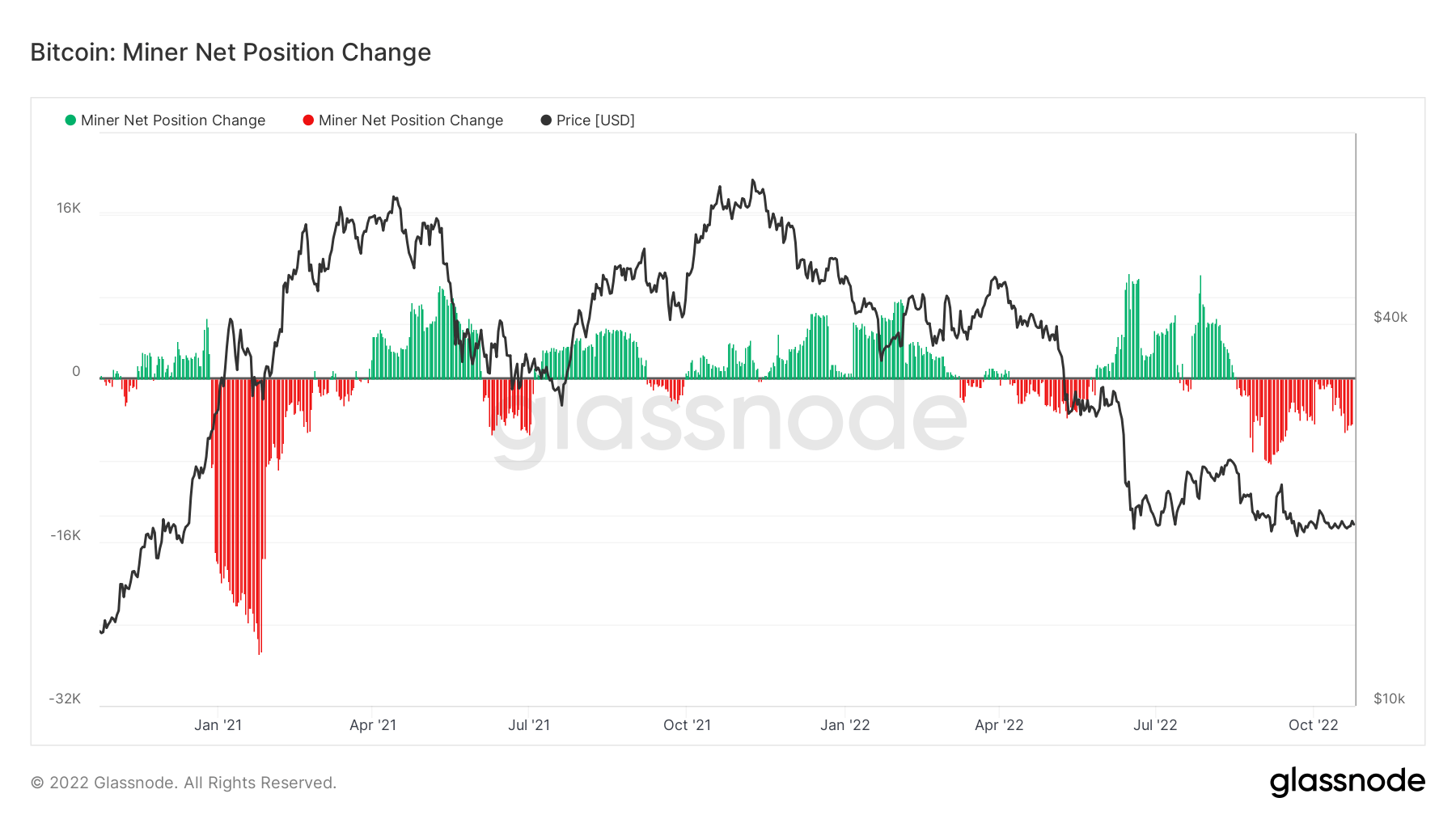

The Miner Internet Place Change knowledge additionally signifies that miners have been promoting on the most aggressive charges of the previous two years since September. The Miner Internet Place Change demonstrates the 30-day fee of change in Bitcoin miners’ unspent provide. The pink areas within the under chart point out miner sellouts, whereas the inexperienced ones present token accumulation in miners’ accounts.

Excluding the January 2021 bull market, miners have been promoting on the highest charges since 2021. Miners have a tendency to carry and wait till the value recovers earlier than promoting. Nonetheless, the present fee of sellouts happens out of miners’ want for funding to maintain their operations going.

A research from June revealed that public mining corporations bought over 30% of the Bitcoin reserves solely through the first 4 months of 2022. Compass Mining and Core Scientific are solely two examples of mining corporations that had been in bother. Core Scientific needed to promote out 79% of its Bitcoin reserves to pay its money owed, whereas Compass Mining needed to shut down certainly one of its mining amenities, unable to pay the electrical energy invoice.