FTX CEO Sam ‘SBF’ Bankman-Fried has taken to Twitter to name out a “competitor” for “attempting to go after us” and reassured the business that regardless of the try, “FTX is okay. Property are tremendous.”

2) FTX has sufficient to cowl all shopper holdings.

We do not make investments shopper property (even in treasuries).

We’ve been processing all withdrawals, and can proceed to be.

Some particulars on withdrawal pace: https://t.co/tSjhJW3JlI

(banks and nodes may be gradual)

— SBF (@SBF_FTX) November 7, 2022

The tweet risk seems to be a response to rumors and hypothesis of liquidity points at FTX and Alameda Analysis. The rumors could have performed a task in Binance’s current resolution to liquidate its $500 million in FTT tokens over the weekend.

SBF expanded additional by claiming that FTX “has sufficient to cowl all shopper holdings” and can proceed to course of all withdrawals. He closed his thread with the next assertion, implying that the aforementioned “competitor” might be Binance:

4) I might adore it, @cz_binance, if we may work collectively for the ecosystem.

— SBF (@SBF_FTX) November 7, 2022

CZ had posted over the weekend that he deliberate to liquidate Binance’s FTT tokens as a result of “current revelations which have come [sic] to mild” however wished to verify the “market impression” is minimal.

Cope, a content material creator at The Block, responded to SBF with a picture of a meme exhibiting a home on hearth alongside the caption, “FTX is okay,” as a major instance of the group’s view on SBF’s assertion.

Curiously, a lot of the dialog round liquidity points centered on Alameda Analysis slightly than FTX. SBF’s current assertion didn’t reference Alameda, as a substitute specializing in making certain the crypto group obtained the message that “FTX is okay.”

Questions of Alameda’s solvency standing could proceed till additional proof is introduced to showcase that the corporate has adequate property to help its loans ought to the FTT token proceed to fall in worth.

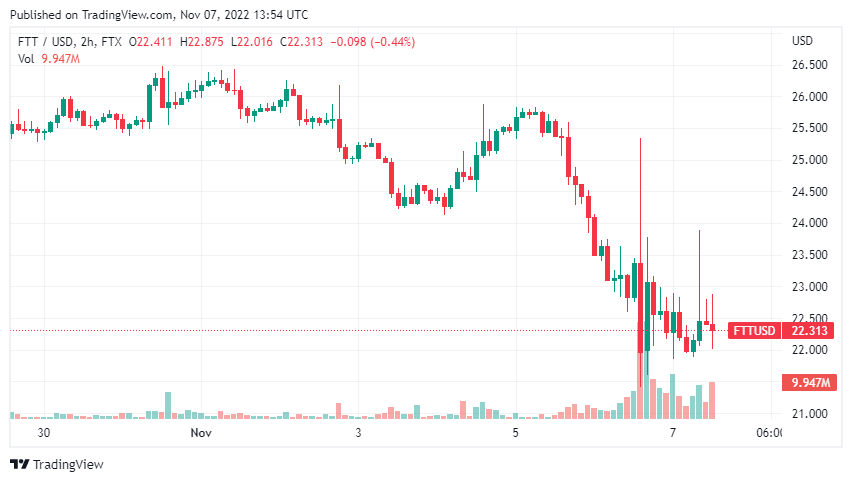

The worth of the FTT token continued to fall going into the U.S. market open on Nov. 7, hitting $22 within the early hours. The token worth recovered on Nov. 6 following Ellison’s bullish assertion that Alameda may purchase all of Binance’s FTT tokens at $22. Nevertheless, any restoration has since been thwarted as the value struggles to carry $22.

As of press time, CZ has not publicly commented on SBF’s assertion.