Current days have seen elevated market volatility because the FTX saga blows up.

Binance’s provide to purchase FTX offers the beleaguered change a lifeline. Nonetheless, as made clear by Binance CEO Changpeng Zhao (CZ,) the deal is topic to passable due diligence.

Crypto Twitter is awash with hypothesis that after FTX’s books have been reviewed and cost-benefit evaluation has been thought-about CZ will pull out of the deal.

In the meantime, evaluation carried out with Glassnode knowledge confirmed Bitcoin derivatives markets have responded accordingly.

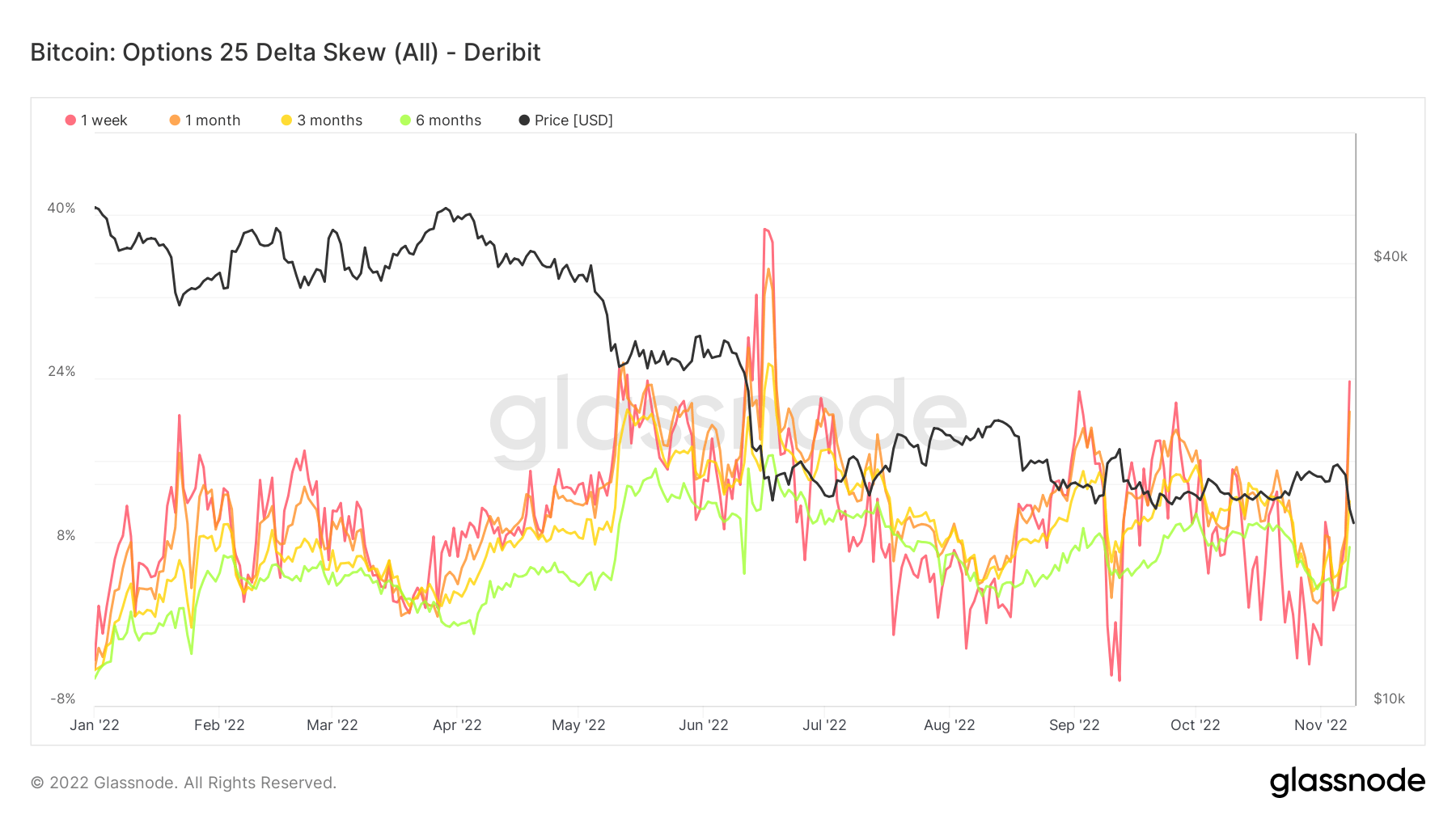

Bitcoin Open Curiosity Put/Name Ratio

A put is the proper to promote an asset at a set value by a specified expiration date. Whereas a name refers back to the proper to purchase an asset at a set value by a specified expiration date.

The Open Curiosity Put/Name Ratio (OIPCR)is calculated by dividing the overall variety of places open curiosity by the overall variety of calls open curiosity on a selected day.

Open curiosity is the variety of contracts, both put or name, excellent within the derivatives market, i.e. unsettled and open. It may be thought-about a sign of cash circulation.

The chart under exhibits the OIPCR spiked larger because the FTX state of affairs took maintain. The swing in direction of shopping for places suggests bearish market sentiment amongst choices merchants.

Crucially, the OIPCR has not (but) reached the extremes seen in June, through the Terra Luna collapse. Nonetheless, as a growing state of affairs, there may be scope for places to increase additional.

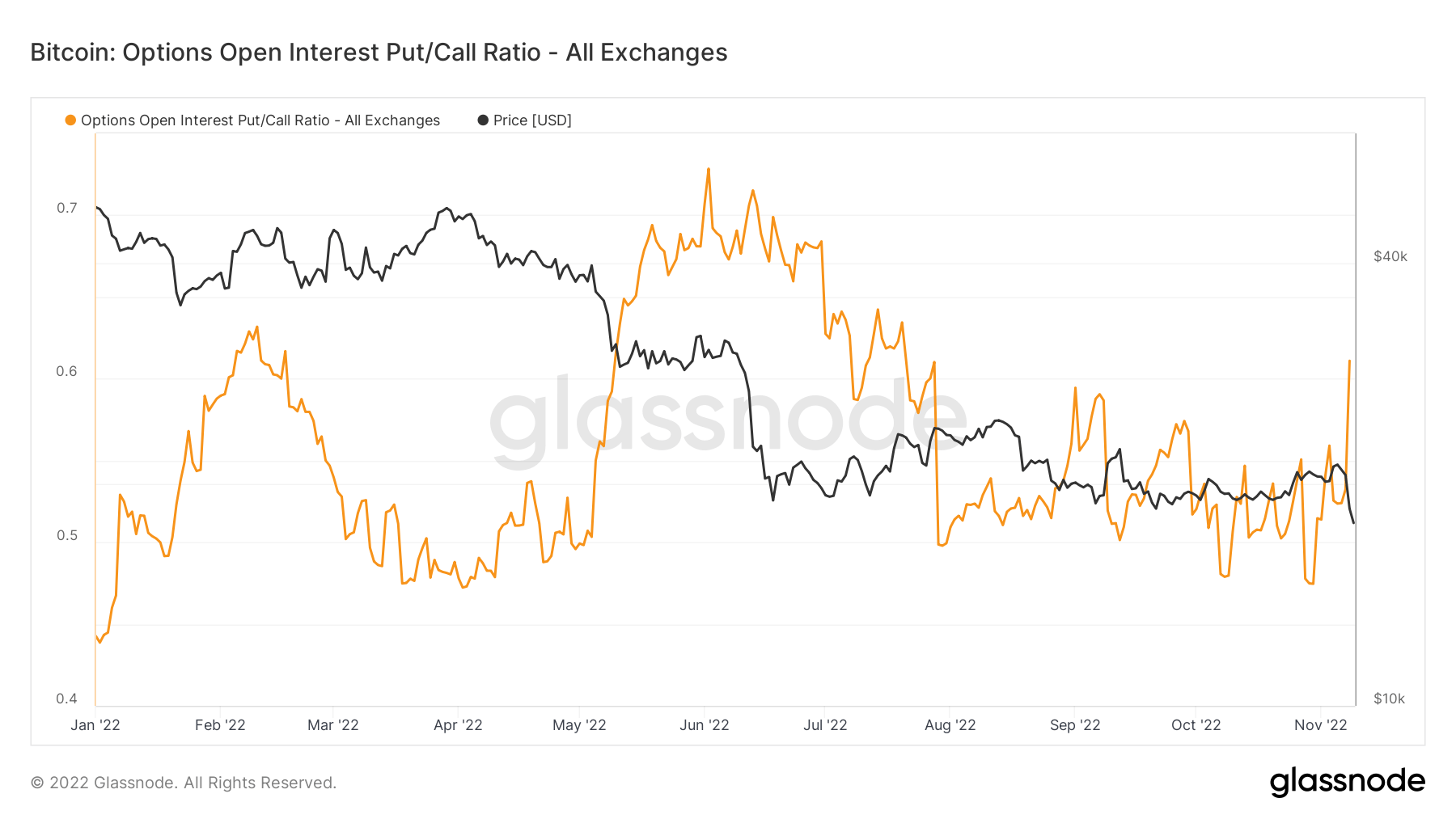

ATM Implied Volatility

Implied Volatility (IV) gauges market sentiment towards the likelihood of adjustments in a selected asset’s value – usually used to cost choices contracts. IV often will increase throughout market downturns and reduces below bullish market situations.

It may be thought-about a proxy of market threat and is often expressed in proportion phrases over a selected time-frame.

IV follows anticipated value actions inside one commonplace deviation over a yr. The metric will be additional supplemented by delineating IV for choices contracts expiring in 1 week, 1 month, 3 months, and 6 months from the current.

The chart under exhibits a pointy reversal from earlier bullish lows, suggesting choices merchants expect an uptick in volatility forward.

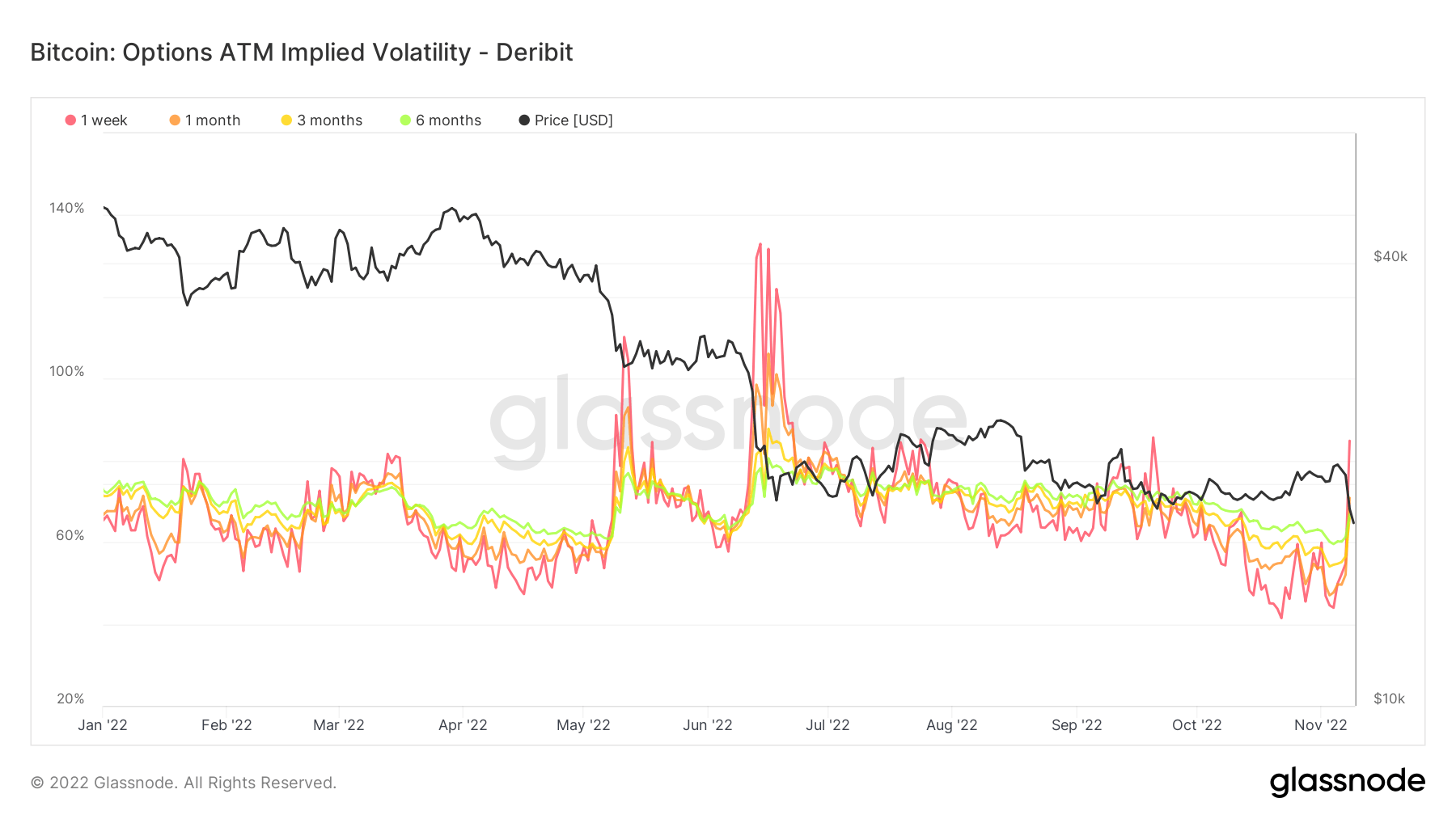

Choices 25 Delta Skew

The Choices 25 Delta Skew metric seems on the ratio of put-to-call choices expressed by way of Implied Volatility (IV).

For choices with a particular expiration date, this metric seems at places with a delta of -25% and calls with a delta of +25%, netted off to reach at a knowledge level. In different phrases, it is a measure of the choice’s value sensitivity given a change within the spot Bitcoin value.

The person intervals confer with choice contracts expiring 1 week, 1 month, 3 months, and 6 months from now, respectively.

The uptick within the 25 Delta Skew exhibits merchants are scrambling for places, marking a U-turn in sentiment confirmed by OIPCR knowledge.