Bitcoin mining agency Bitfarms’ third-quarter report reveals that the miner bought extra BTC than it made within the quarter -the miner bought 2,595 BTC whereas mining 1,515 BTC.

The miner centered on strengthening its place to outlive the bear market by slicing prices and lowering its debt obligations considerably through the quarter.

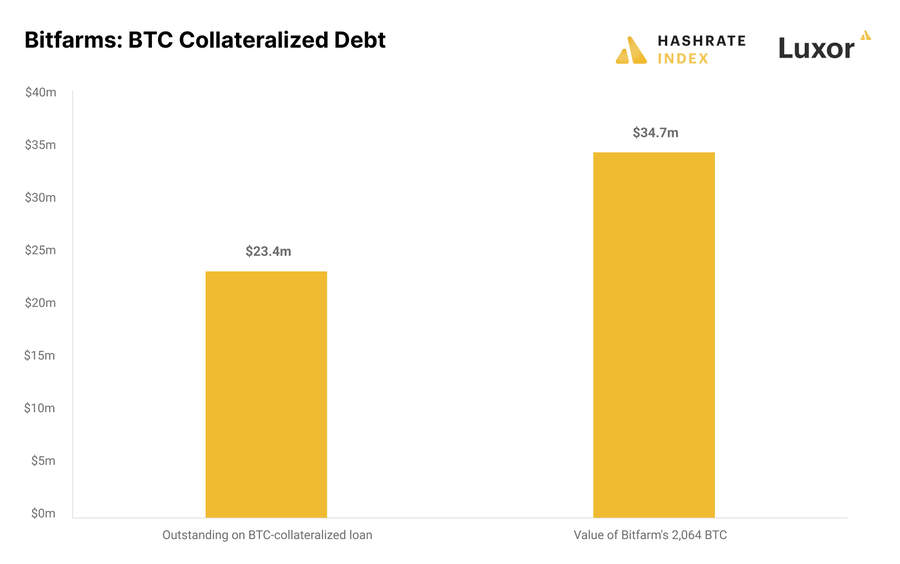

Nevertheless, the miner nonetheless holds $55 million in machine-collateralized debt and $23 million in Bitcoin-collateralized debt.

Bitfarms’ liquidity underneath highlight

Bitcoin mining analyst Jaran Mellerud stated that whereas Bitfarms’ Bitcoin gross sales helped it to scale back its debt burden, the miner doesn’t have a lot Bitcoin left.

Mellerud stated:

“(Bitfarms) holds $38 million of money and a pair of,064 bitcoin. The issue is that 1,724 of those Bitcoin are pledged as collateral, giving the corporate a complete unpledged liquidity of solely $44 million.”

The value of the flagship digital asset poses one other main problem for the agency because it should preserve a collateral worth of 125% to the mortgage.

Mellerud stated the miner’s complete Bitcoin stack of two,064 equals 141% of the mortgage. So, if BTC’s value fell to round $14,200, the corporate’s mortgage may very well be liquidated.

Following this, analyst Mellerud concluded that “the corporate’s liquidity is inadequate to fund its deliberate expansions.”

Bitfarms retains prices down

Bitfarms’ third-quarter report revealed that the agency’s common and administrative bills have been down 15% to $6 million, excluding non-cash share-based compensation.

Talking on this, Mellerud praised the agency for minimizing its manufacturing prices whereas preserving its administrative prices comparatively low in comparison with opponents.

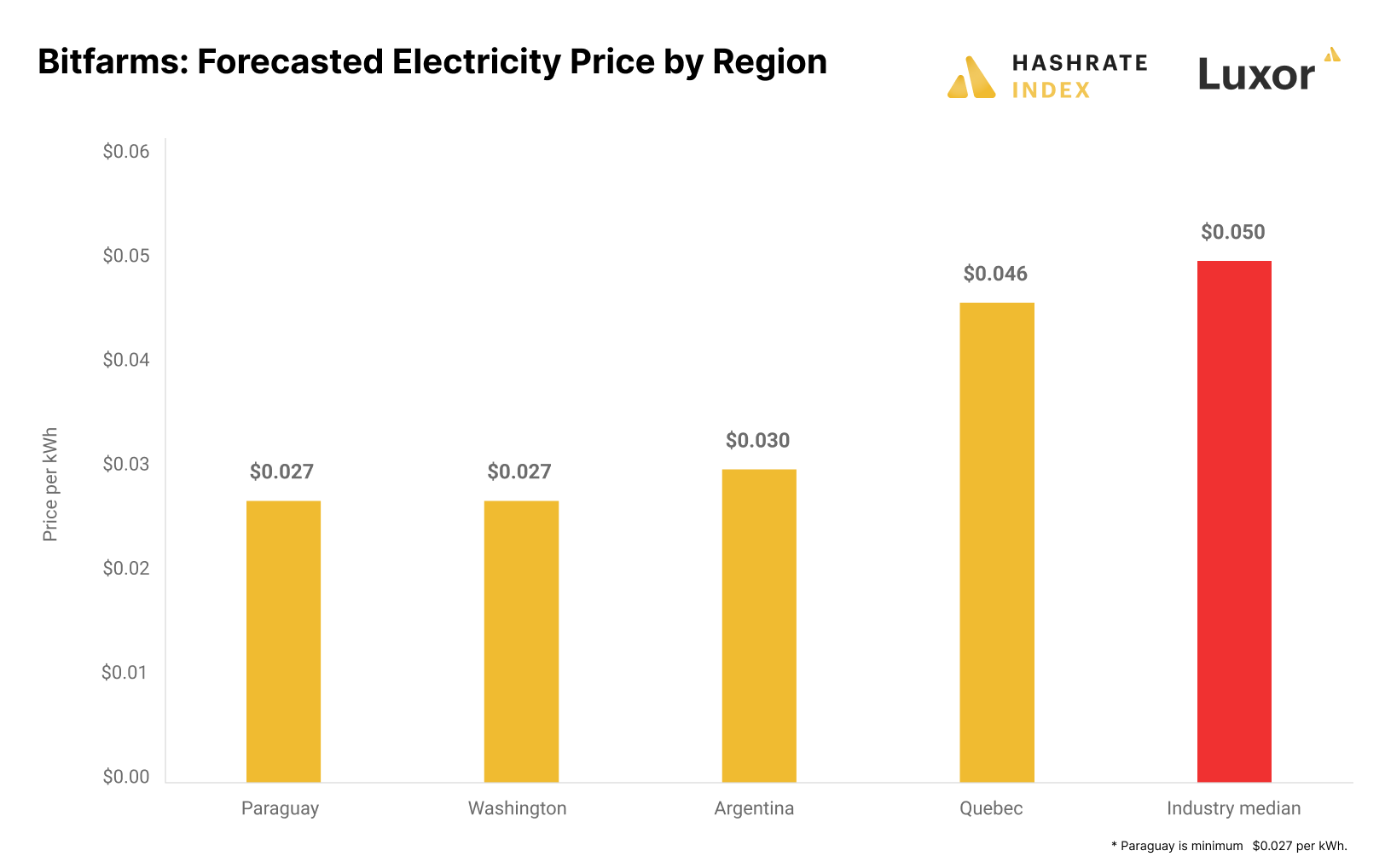

In keeping with Mellerud, Bitfarm has entry to cheaper electrical energy as its charges are considerably decrease than the trade median of round $0.05 per kWh. Bitfarms’ expects to pay $0.027 per kWh in Washington, $0.03 per kWh in Argentina, and $0.046 per kWh in Quebec.

In the meantime, many of the firm’s income comes from its Quebec amenities which account for over 80% of its income.

Nevertheless, the Bitcoin mining agency’s plan to develop into South America is stalling on account of forms. Mellerud famous that the corporate would possibly want exterior financing or in the reduction of on its growth plans.