The largest information within the cryptoverse for Nov. 23 contains Bitcoin hash ribbon metric’s indication of an upcoming miner capitulation, on-chain knowledge revealing traders making the most of the low costs, and Bitcoin and Ethereum consisting 91% of Bitfinex’s whole reserves.

CryptoSlate High Tales

BTC hash ribbon upcoming convergence indicators miner capitulation

Bitcoin (BTC) miners have been promoting on the most aggressive charge during the last two years, which signifies that the upcoming hash charge adjustment shall be damaging within the subsequent epoch.

The Bitcoin hash ribbons are sometimes used to establish value bottoms. When the hash ribbon indicators an upcoming miner capitulation, the Bitcoin value falls.

At present, the hash ribbon convergence indicators that the top of this capitalization interval is almost over, and an upwards flip available in the market is probably going.

Bitcoin on-chain knowledge exhibits a ray of sunshine in a darkish market

After the FTX collapse, Bitcoin has been struggling to get better to its bear market value of round $20,000. Particularly over the weekend of 19-20 November, Bitcoin remained beneath $16,000.

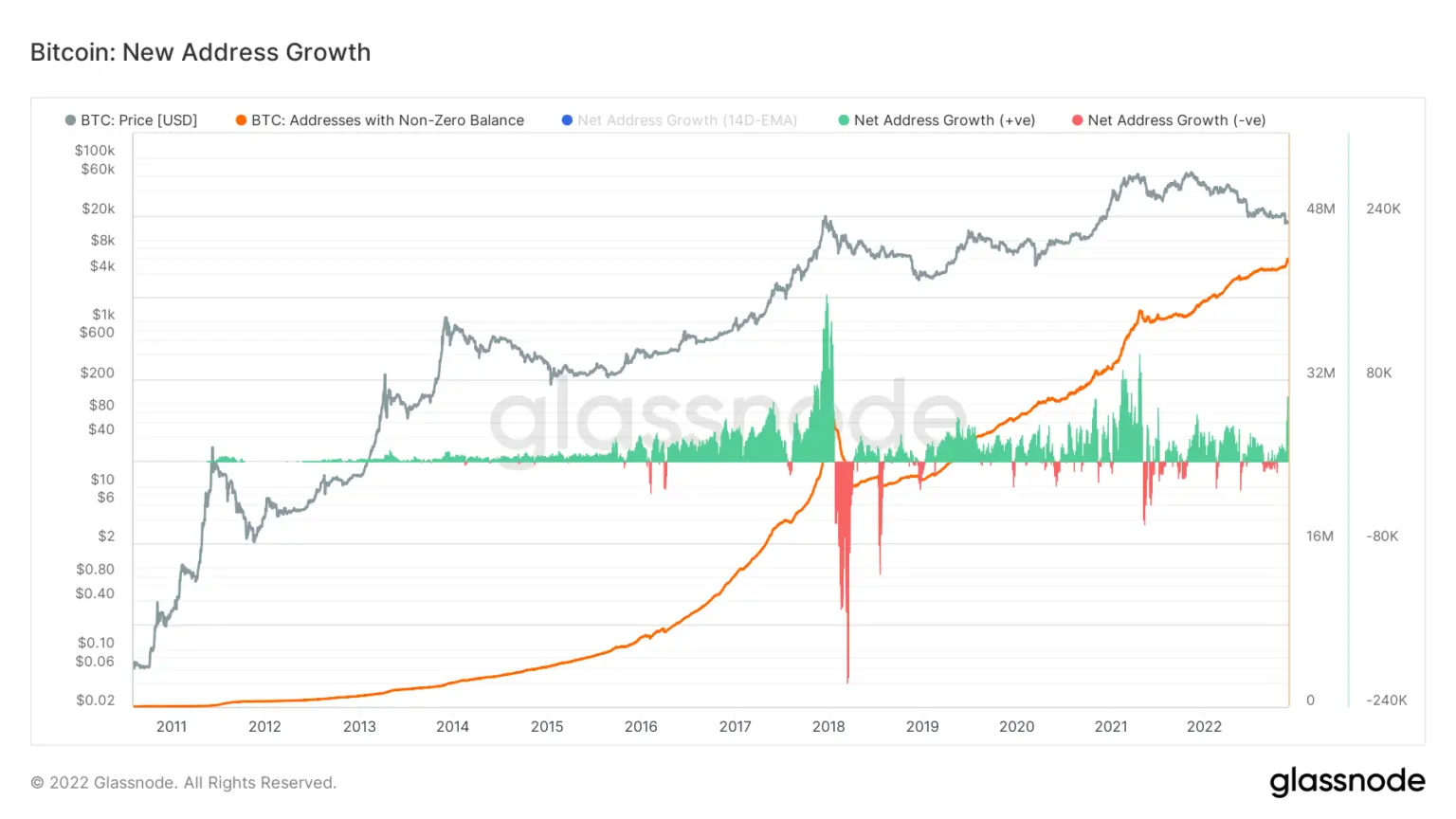

Whereas this can be a bearish value, it was seen as a serious shopping for alternative for a lot of. On-chain knowledge exhibits that the variety of wallets that maintain Bitcoin has been rising whereas the variety of addresses with non-zero balances is reducing.

Bitfinex’s reserves are 91% Bitcoin, Ethereum

Crypto alternate Bitfinex’s reserves of Bitcoin and Ethereum (ETH) account for 91% of its whole holdings. This proportion is 63% for Coinbase, 15% for Binance, and 52% for Crypto.com.

In line with the exchanges’ proof of reserves, Bitfinex’s 91%-large Bitcoin and Ethereum reserves equate to 207,356.67967717 Bitcoins and 1,225.600 Ethereums.

U.S. Senators need justice division to carry FTX execs accountable for collapse

U.S. Senators Elizabeth Watten and Sheldon Whitehouse composed a letter to the U.S. Division of Justice (DOJ). They requested DOJ to carry FTX executives “accountable to the fullest extent of the legislation” of the FTX collapse.

U.S. Congressman defends decentralization, blames SBF, Gensler, CeFi for FTX collapse

U.S. Congressman Tom Emmer argued that the FTX collapse was a failure of centralized finance (CeFi), not a failure of crypto.

Emmer additionally stated that the FTX founder Sam Bankman-Fried (SBF) and the U.S. Securities and Trade Fee’s (SEC) chairman Gary Gensler additionally share the blame.

Referring to the connection between the SEC and SBF, Emmer stated that the SEC was working with SBF and gave him a particular remedy that different exchanges weren’t getting.

File portions of Bitcoin depart exchanges in readiness for contagion fallout

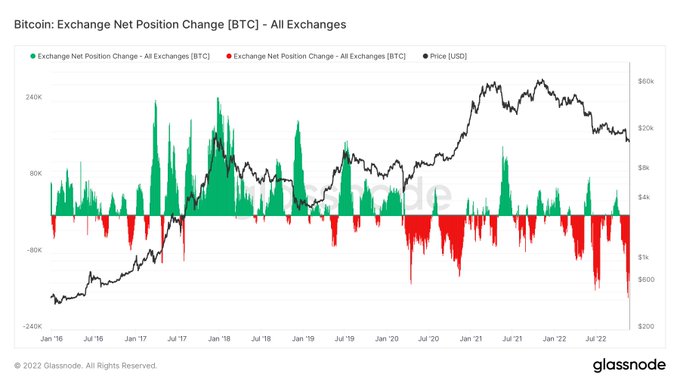

Over the previous 30 days, 136,882 Bitcoins had been withdrawn from the exchanges, which equates to 0.7% of the whole circulating provide.

the chart above additionally demonstrates huge Bitcoin outflows since 2016 and marks the present outflow ranges as the best. Even on the peak of the Terra (LUNA) crash contagion, round 120,000 Bitcoins had left exchanges.

Mango Market hacker’s try to use Aave fails

Mango Market’s exploiter Avraham Eisenberg transferred $40 million price of USD Coin (USDC) into Aave (AAVE) with the aim of borrowing Curve DAO Token (CRV) to brief. This technique is named Eisenberg’s “extremely worthwhile buying and selling technique,” which he beforehand exploited the Mango Market with.

First, he got here for Mango, and I didn’t communicate out, for I’m not an investor

Then he got here for USDT, and I didn’t communicate out, for he didn’t pose a threat

Now, he tries to hunt the mortgage of one of many godfather’s of DeFi and that is when the foot is put right down to defend pic.twitter.com/feV78YPtq0

— Andrew Kang (@Rewkang) November 22, 2022

Nonetheless, within the case of the CRV token, Eisenberg’s plan didn’t go accordingly because the neighborhood rallied behind the CRV token and triggered it to spike 46% within the final 24 hours.

Hackers steal $42M from Fenbushi Capital founder’s pockets

Fenbushi Capital’s normal accomplice Bo Shen was attacked by malicious actors, who stole $42 million from his private pockets on Nov. 10.

Shen revealed the assault on Nov. 23 through his private Twitter account. In line with blockchain safety agency Beosin, the hack resulted from a non-public key compromise.

Newest mining rigs amp up problem to zone out competitors

Cyber safety analyst Matt C drew consideration to the rising stress of the most recent mining rigs upon earlier generations of miners.

#Bitcoin mining profitability by @LuxorTechTeam says all of it..

Antminer S19 XP is 3+ instances superior to earlier gens 💰

2022 Miners placing problem by the roof whereas making an attempt to ship competitors out of enterprise. pic.twitter.com/g5akp0RXjf— Matt C⚡️ (@mithcoons) November 23, 2022

Contemplating that hashing prices $0.07/kWh, Antminer S19XP emerges as probably the most worthwhile mining rig.

Information from across the Cryptoverse

Genesis is assembly traders to get lending again up on its toes

Genesis CEO printed a letter informing Genesis purchasers that the manager staff is assembly with potential traders to provide you with an answer to repair the illiquidity drawback of the lending providers. The letter stated that Genesis is anticipating to determine on a plan of action within the coming days.

Apple to purchase rights of guide on SBF

Well-known creator Michael Lewis had spent six months with SBF earlier than the alternate collapsed and can write a guide that sheds gentle on SBF’s crypto empire. The guide is anticipated to show right into a characteristic movie, and Apple is near inking a deal for the guide rights with Lewis, in keeping with MacRumors.

Onomy raises $10M to unite DeFi, Foreign exchange

Onomy protocol raised $10 million from traders like Bitfinex and Ava Labs throughout its personal funding spherical. The protocol goals to converge DeFi and the Foreign exchange markets.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 2.73% to commerce at $16.566, whereas Ethereum (ETH) spiked by 3.97% to commerce at $1,172.