The most important information within the cryptoverse for Nov. 28 consists of Kraken CEO saying Binance Proof-of-Reserve is pointless with out proof of liabilities, Coinbase dropping Bitcoin price $2 billion over the weekend, and BlockFi submitting for Chapter 11 chapter.

CryptoSlate High Tales

One other $2B price of Bitcoin withdrawn from Coinbase over weekend

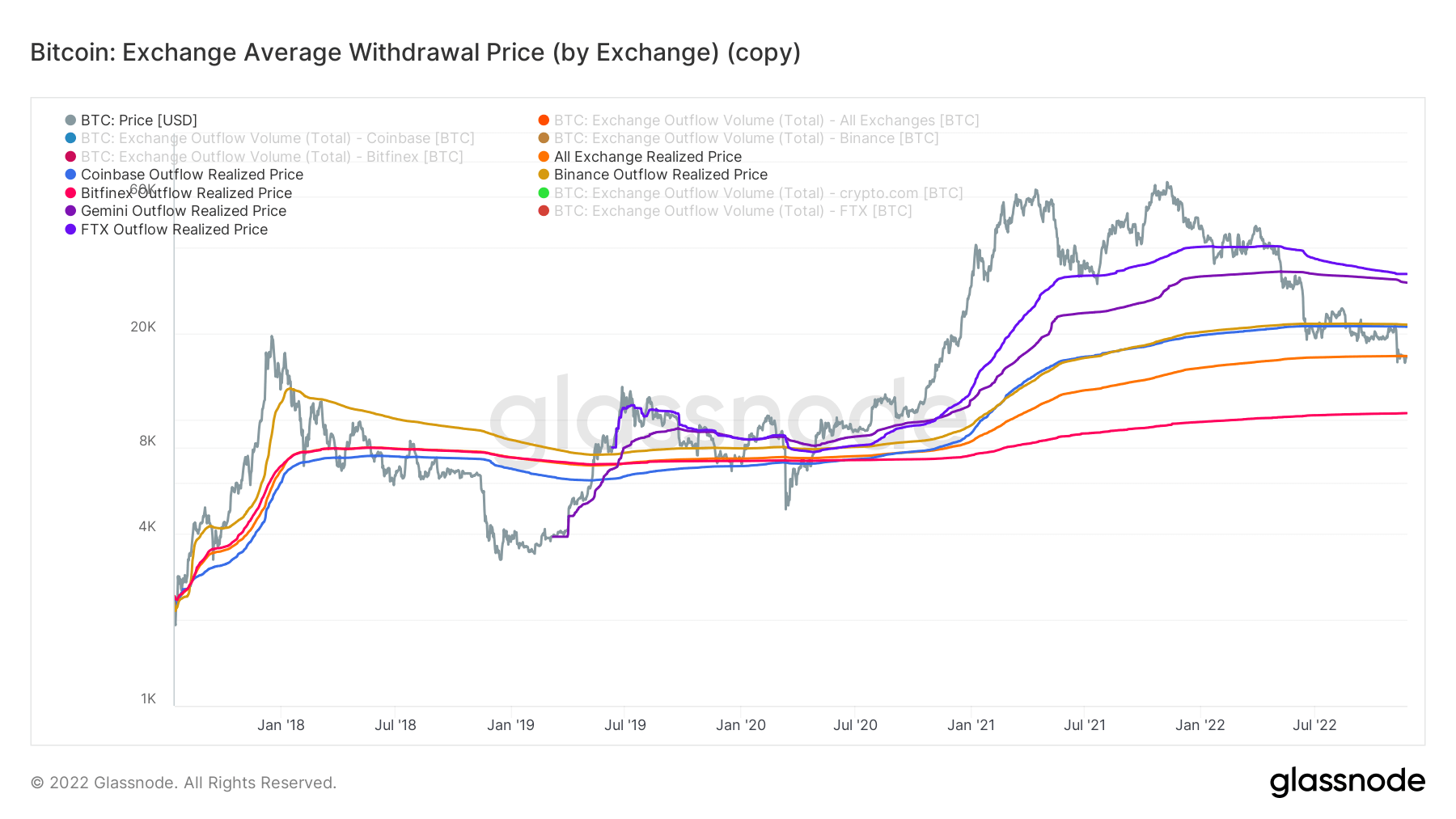

Based on Glassnode, crypto exchanges have misplaced over $15 billion price of Bitcoin (BTC) prior to now 5 days, with Coinbase dropping essentially the most.

Between Nov. 24 and Nov. 25, about 100,000 BTC (totaling $1.5 billion) was reportedly withdrawn from Coinbass. The development continued over the weekend of Nov. 26 and Nov. 27, which noticed some $2 billion price of Bitcoin go away the change’s reserve

Consequently, Coinbase has misplaced $3.5 billion over the previous 5 days, whereas Binance has topped its reserve with roughly $1.2 billion price of Bitcoin.

Kraken’s Powell says Binance Proof-of-Reserve is pointless with out liabilities

Kraken CEO Jesse Powell argued that Binance’s proof of reserve (PoR) was inadequate because it failed to focus on its liabilities. He added that implementing a Merkle Tree with out an exterior auditor just isn’t sufficient to show that the change didn’t enhance its reserve with accounts having detrimental balances.

In response, Binance CEO Changpeng Zhao mentioned that his change was working to contain exterior auditors quickly whereas sustaining that the PoR didn’t embrace detrimental balances.

Jokes about wrapped ETH depeg trigger temporary panic on Twitter

With insolvency rumors taking up the crypto neighborhood, distinguished Ethereum advocates together with Vitalik Buterin made a joke that wrapped Ethereum (WETH) was about to turn out to be bancrupt.

To keep away from additional panic locally, Ethereum developer Hudson Jameson known as out the joke and clarified that WETH will technically not face insolvency as it’s a good contract that’s as decentralized as Ethereum and can’t face a financial institution run.

Nonetheless, the WETH joke brought about ETH’s worth to say no by roughly 4%, with some neighborhood members cautioning that such jokes might get “the silliest of customers” rekt.

BitBoy alleges O’Leary was key participant in Celsius collapse together with FTX

Crypto YouTuber “Bitboy” whereas talking on Altcoin Every day known as out Kevin O’Leary for strongly supporting Sam Bankman-Fried (SBF). Bitboy alleged that SBF focused competing platforms akin to Celsius and contributed to its collapse to amass extra liquidity for FTX.

Bitboy added that SBF-supporter O’Leary had publicly known as for Celsius to go right down to zero, previous to the crypto lender’s fallout.

Texas needs to be the centerpiece of Bitcoin innovation, says Governor Abbott

Texas Governor Greg Abbott has known as on Bitcoin firms to arrange their places of work in Texas, because it was advancing pro-Bitcoin/blockchain agenda that may make the state “extra inviting” for Bitcoin innovation.

Abbott added that Texas was enhancing its laws to be “form of anti-regulation”, whereas offering the wanted infrastructure for Bitcoin to succeed.

Germany has the second highest focus of ETH nodes on this planet

Based on CV VC Labs’s 2022 Blockchain report, about 22.8% of all Ethereum validators function from Germany. This makes the European nation have the second-highest focus of ETH nodes, solely behind the US which leads with 45.3%.

Moreover, the report highlighted that German blockchain tasks raised roughly $8 billion throughout 220 funding, with about 34 startups turning into unicorns.

JP Morgan believes regulation will result in convergence of crypto, TradFi

Within the wake of the FTX collapse, JP Morgan & Chase highlighted potential adjustments it believes will assist crypto and conventional finance protection. The banking big mentioned it anticipates the approval of regulatory frameworks just like the European Union’s Markets in Crypto Property (MiCA) invoice in 2023, which is able to focus largely on buyer safety and self-custody regulation.

It added that crypto exchanges could also be required to enhance transparency by publishing an everyday reserve, property, and liabilities audit. Additionally, it predicts a shift away from centralized exchanges (CEX) to decentralized exchanges (DEX).

Blockfi turns into one other sufferer of the FTX collpase with chapter submitting

Barely two weeks after pausing prospects’ withdrawals, crypto lender BlockFi has filed for a Chapter 11 chapter resulting from its large publicity to FTX. It reportedly owes about 100,000 collectors together with the Securities and the Trade Fee (SEC) which it owes some $30 million.

BlockFi added that it has roughly $256 million in money to undergo the restructuring course of, with the intention of “maximizing values for all shoppers and stakeholders.”

LINE-founded cryptocurrency change BITFRONT broadcasts closure

Asia-based crypto change BITFRONT introduced plans to stop operation efficient March 31, 2023. After the date, it would halt withdrawals and go on to delete all private information of customers from its system.

VP of AAX speaks out in opposition to dealing with of firm chapter determination

The chapter development has hit Hong Kong change AAX, which disclosed it can’t pay staff’ salaries past November, whereas its prospects will obtain about 50% of their funds.

AAX Vice President Ben Caselin moved to stop his position and expressed dissatisfaction over the chapter course of.

Analysis Spotlight

Binance led 2017 ‘dumb cash’ Bitcoin funding; FTX leads 2022 cycle

Again in 2017 when Binance was established, it served as a haven for dumb cash buyers who FOMOed into Bitcoin trades based mostly on hype and withdrew their holdings even at loss after the value peaked.

Quick ahead to 2022, Binance has grown to turn out to be the main crypto change, making it a house for good cash buyers, whereas exchanges like bankrupt FTX housed the dumb cash buyers.

Information from across the Cryptoverse

Gam7 launches $100M grant program

Web3 gaming DAO Gam7 has established a $100 million grant program for recreation builders to construct instruments and scaling options that may result in the worldwide adoption of Web3 video games.

Kraken to pay $363K to U.S. Treasury

The U.S. Division of Treasury introduced that it has levied a $362,158 on crypto change Kraken for failing to implement sanctions in opposition to Iran.

Kraken reportedly failed to dam the IP addresses of Iranian customers who transacted on the change at a time when the Treasury positioned a ban on Iran.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) decreased barely by -1.87% to commerce at $16.243, whereas Ethereum (ETH) decreased by -3.44% to commerce at $1,172.