Ethereum whales and sharks have been accumulating Ether (ETH) at a report price for the reason that FTX crash, Santiment reported on Nov. 30.

🐳🦈 #Ethereum‘s massive key addresses have been rising in quantity for the reason that #FTX debacle in early November. Pictured are the important thing moments the place shark & whale addresses have amassed & dumped. The variety of 100 to 100k $ETH addresses is at a 20-month excessive. https://t.co/beawFcBRvi pic.twitter.com/dR8zEqurZQ

— Santiment (@santimentfeed) November 30, 2022

The market intelligence platform revealed that wallets holding between 100 and 100,000 ETH had reached a 20-month excessive. A Nov. 23 tweet from the agency stated the final time these wallets amassed this aggressively; ETH rallied by as much as 50%.

🐳🦈 #Ethereum‘s lively shark & whale addresses proceed accumulating with costs lower than 1 / 4 of their #AllTimeHigh ranges a yr in the past. In Oct/Nov 2020, these 100 to 100k $ETH addresses assisted in pushing $ETH to a +50% worth rise over 5 weeks. https://t.co/v8gh4RfV7z pic.twitter.com/Oe3lTo12uj

— Santiment (@santimentfeed) November 23, 2022

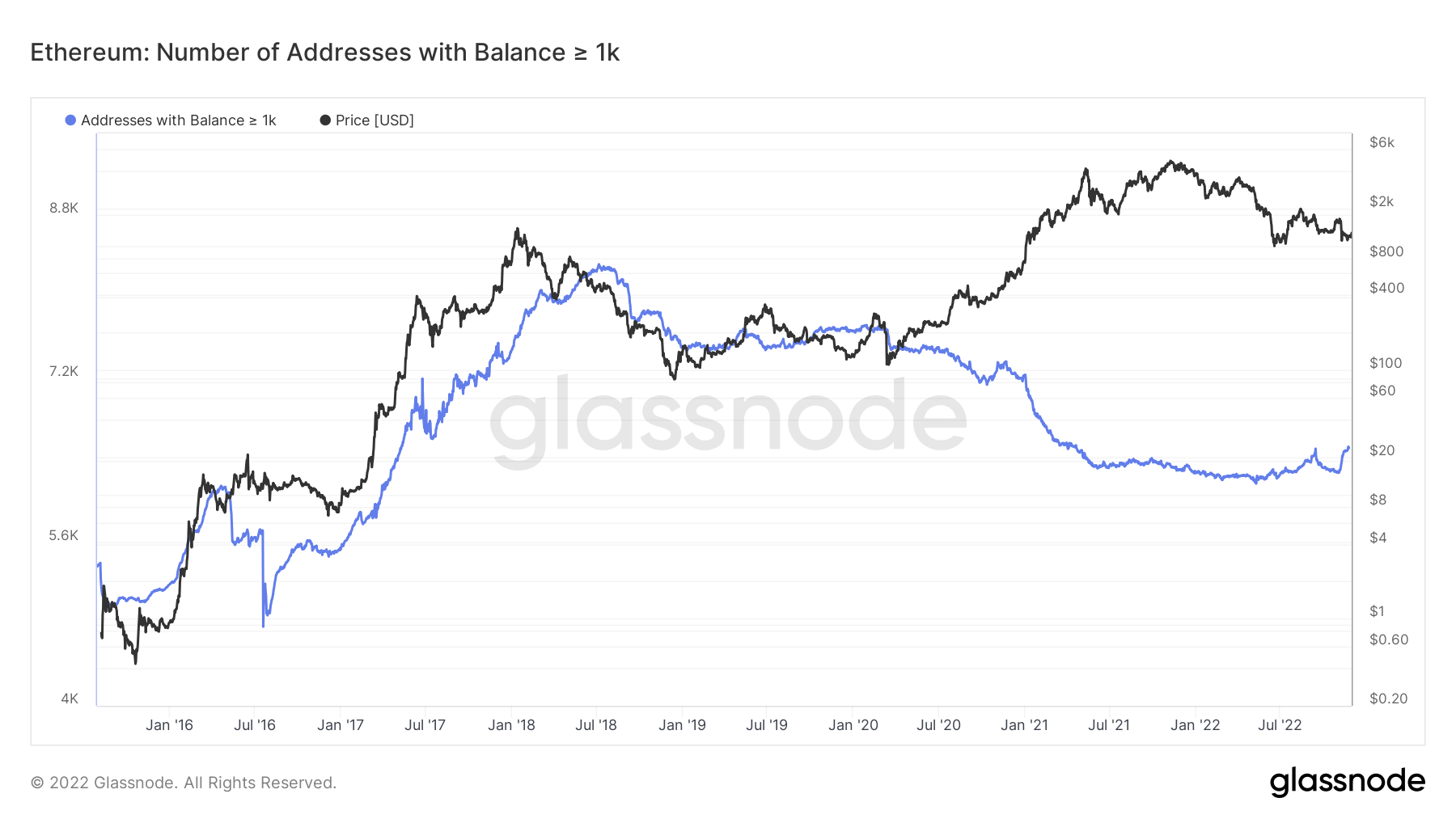

CryptoSlate, utilizing Glassnode knowledge, confirmed that ETH addresses holding above 1000ETH had seen an uptick of their accumulation.

ETH whales and sharks accumulation sample

Santiment highlighted the buildup sample resulting in Ethereum Merge. In accordance with the chart, Ethereum whales and sharks acquired extra ETH within the weeks previous the Merge, which pushed the asset’s worth up however dumped instantly after the Merge.

The blockchain analytics agency famous that the addresses dumped between October and November when there was a slight rebound in ETH worth versus BTC.

Nevertheless, ETH whales and sharks started accumulating once more instantly after the FTX implosion as the worth of most digital foreign money crashed.

ETH shrimps are additionally buying

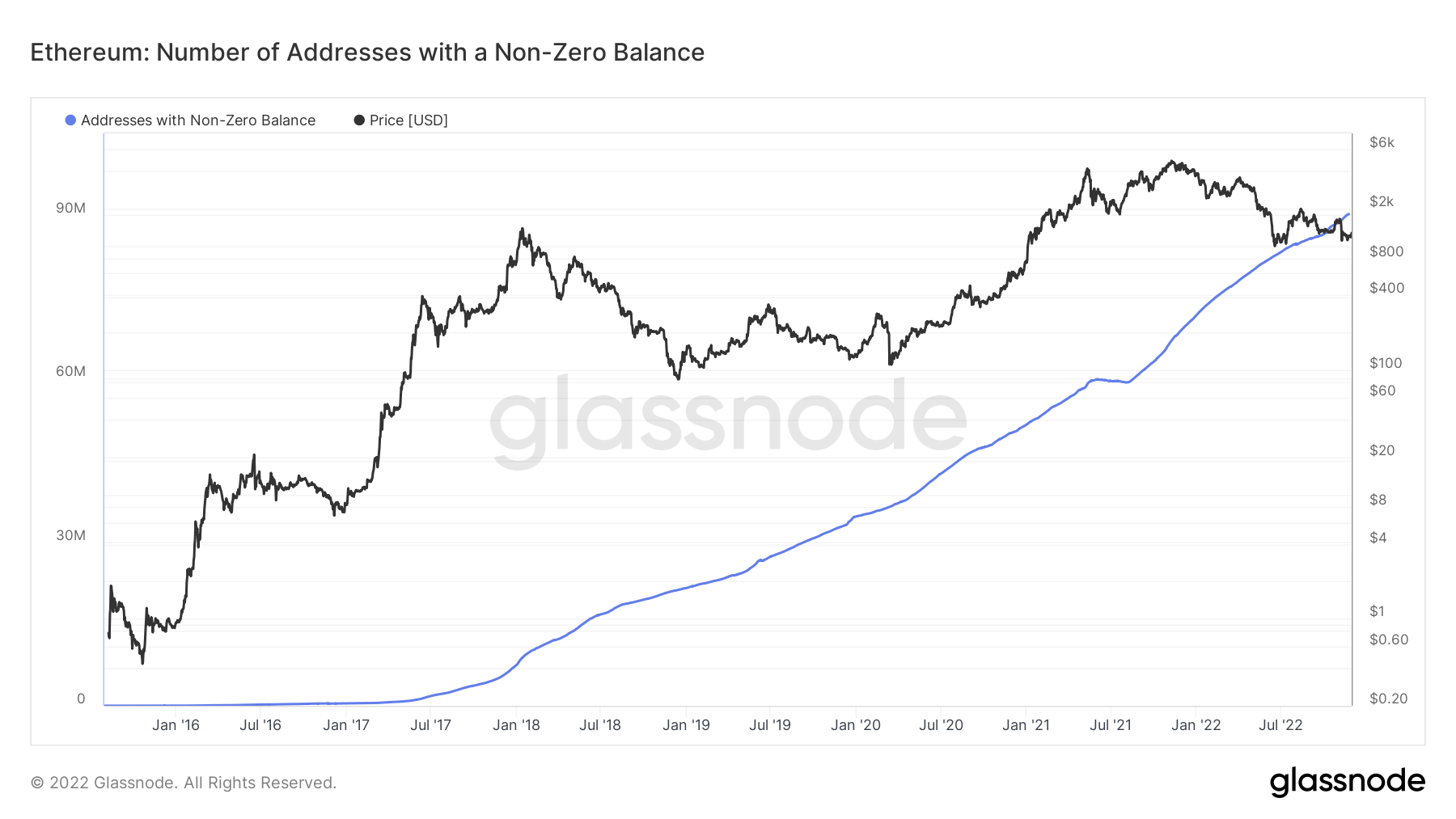

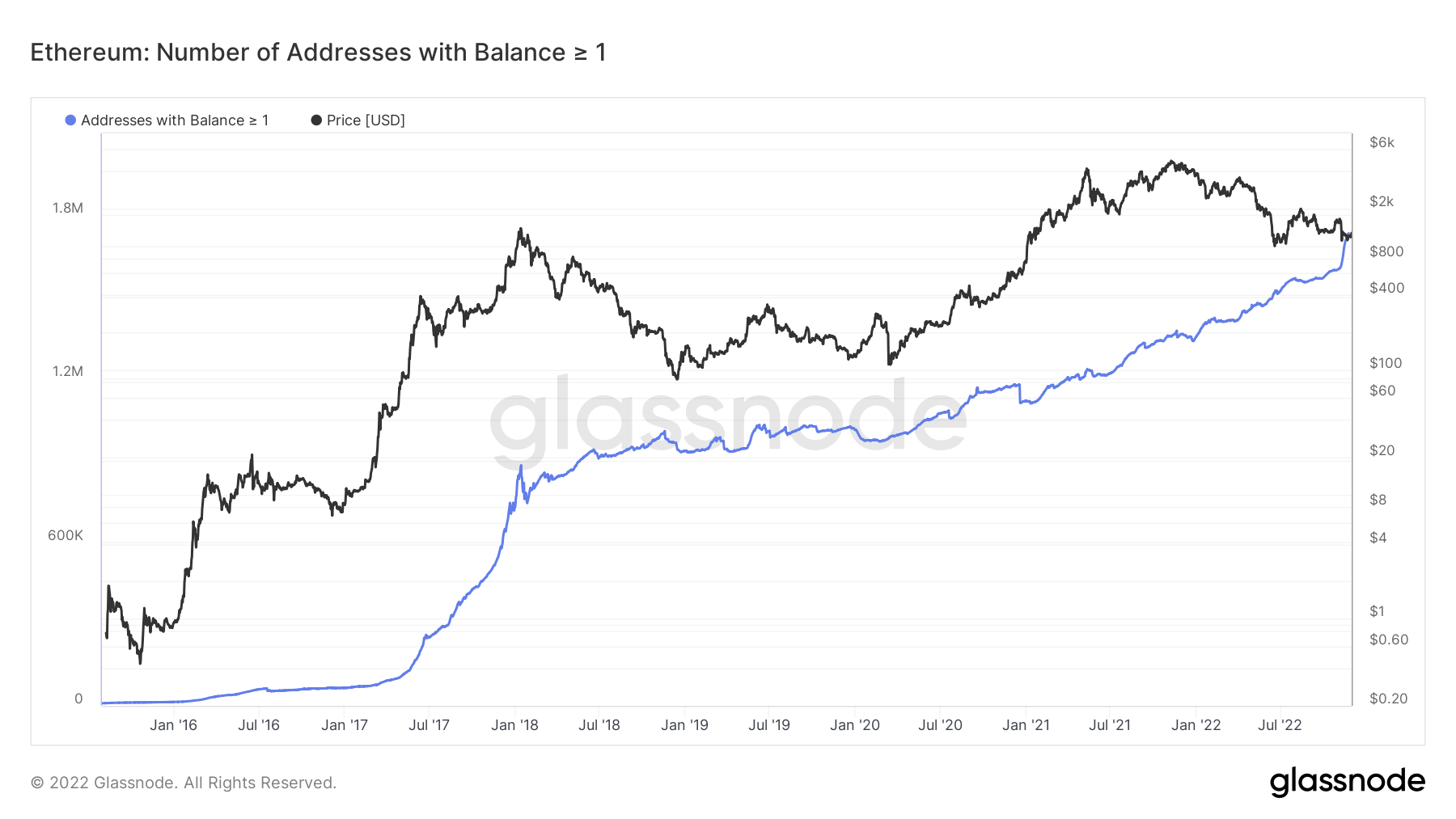

Glassnode knowledge confirmed that shrimps had been additionally massively buying Ether. Shrimps are addresses holding lower than 1 ETH.

In accordance with the charts under, ETH addresses with a non-zero stability and addresses holding as much as 1 ETH have all reached a brand new all-time excessive

In the meantime, the variety of lively addresses on Ethereum additionally reached the best degree in additional than six weeks on November 28.

📈 #Ethereum‘s lively addresses surged to its highest degree in over 6 weeks yesterday, and that seemingly factored into at the moment’s worth progress. On October fifteenth, the final time addresses spiked at this degree, the value of $ETH jumped +30% over the subsequent 3 weeks. https://t.co/8LFsUn6Thz pic.twitter.com/hDekw9Em51

— Santiment (@santimentfeed) November 29, 2022

Santiment wrote that the final time ETH lively addresses reached this degree was on October 15, when Ether’s worth jumped by over 30% within the following three weeks.

ETH worth up 4%

The latest spate of ETH accumulation has positively affected its worth. The asset is up over 4% within the final 24 hours to $1,265, based on CryptoSlate knowledge.

The second-largest digital asset by market cap has elevated by over 11% within the final seven days.