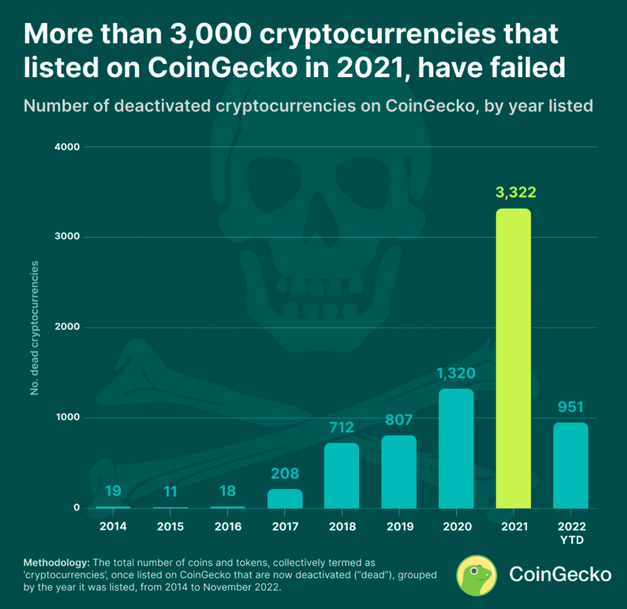

CoinGecko compiled useless token knowledge on its platform since 2014, exhibiting that 2021 was the largest 12 months for deactivated cash, coming in with 3,322 tasks folding.

Unusually, deep inside crypto winter, the variety of useless tokens for the present 12 months is considerably fewer than the prior 12 months, at 951.

947 useless crypto tasks anticipated per 12 months

Because the bull market was selecting up tempo in 2021, greater than 8,000 tasks in whole have been listed on CoinGecko. Nevertheless, presently, “almost 40% have been deactivated and delisted” since then.

“That is 2.5 occasions larger than the quantity of cryptocurrencies listed in 2020 that failed, and three.5 occasions larger than 2022 YTD.”

Explaining the numerous rise in useless cash in 2021, the platform apportioned blame on “‘meme coin season” which was prevalent through the mania of final 12 months.

At the moment, many tasks sprung up with nameless dev groups providing buyers “little to no worth.” These tasks typically failed resulting from being fly-by-night money grabs with low dedication from the devs.

At the moment, there are 13,130 cash listed on CoinGecko, considerably greater than the 8,000 in 2021. But 2022 confirmed considerably fewer tasks folding. This implies the launching of meme cash just isn’t as pervasive this 12 months in comparison with the final.

Nevertheless, it’s price noting that CoinMarketCap presently lists a complete of 21,903 tokens. As such, CoinGecko knowledge doesn’t give an entire overview of the market.

CoinGecko labeled 2021 an “anomaly 12 months.” Excluding 2021 knowledge, i.e. for the info set 2018, 2019, 2020, and 2022, a median of 947 crypto tasks die per 12 months.

The methodology used

To find out whether or not a crypto token was useless or deactivated, CoinGecko checked out whether or not the token:

- had zero buying and selling exercise throughout the final 2 months.

- was revealed as a rip-off or rug pull through information or direct stories from verifiable sources.

- or the undertaking had requested deactivation.

The latter occurs when the crew disbands, rebrands, shutters the undertaking, or undergoes main token adjustments to the purpose the outdated token turns into illiquid or useless.