Paxos faces SEC lawsuit over BUSD

On Feb. 13, the U.S. Securities and Trade Fee (SEC) enforcement division issued a Wells discover to Paxos, ordering the corporate to cease minting the Binance USD (BUSD) stablecoin.

The discover adopted an SEC investigation into Paxos and its relationship with Binance, whose stablecoin it issued, which concluded that the corporate violated securities legal guidelines. Nonetheless, a Wells discover doesn’t essentially imply that the SEC will take enforcement motion towards Paxos. For the SEC to pursue this matter additional, its 5 commissioners should vote to authorize any enforcement litigation or settlement.

In accordance with the discover, the Division of Monetary Companies (DFS) ordered Paxos to cease minting BUSD as a consequence of “a number of unresolved points associated to Paxos’ oversight of its relationship with Binance.” There have been no additional explanations of those points — the CEO of Binance, Changpeng Zhao, mentioned he was solely conscious of the enforcement motion by way of the media.

Paxos is anticipated to submit a response to the Wells discover and current its case as to why it shouldn’t be sued. Within the meantime, the corporate should cease minting new BUSD and allow all prospects to redeem their BUSD for U.S. {dollars}. Paxos has maintained that it has and all the time will again all BUSD tokens 1:1 with U.S. dollar-denominated reserves.

BUSD is the one stablecoin backed by long-term maturity belongings

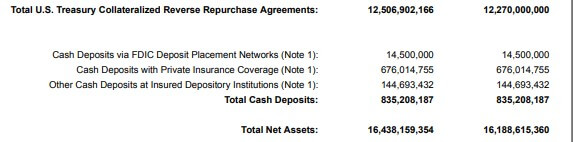

These dollar-denominated reserves, nonetheless, are removed from the norm. Paxos’ unaudited BUSD holdings report exhibits that the stablecoin is backed primarily by long-term maturity belongings. On Feb. 10, the corporate’s report confirmed 16.14 billion excellent BUSD tokens and an equal or increased steadiness of belongings held in custody.

Slightly below $3.1 billion is held in short-term U.S. Treasury Debt, which can mature by mid-April 2023.

On Feb. 10, $12.5 billion of Paxos’ $16.4 billion BUSD reserves had been held in U.S. Treasury Reverse Repurchase Agreements. Solely two repurchase agreements mature in 2023 and 2024 — the remainder of the $12.5 billion have maturity dates starting from 2026 to 2052.

$1 billion value of stablecoins depart Ethereum

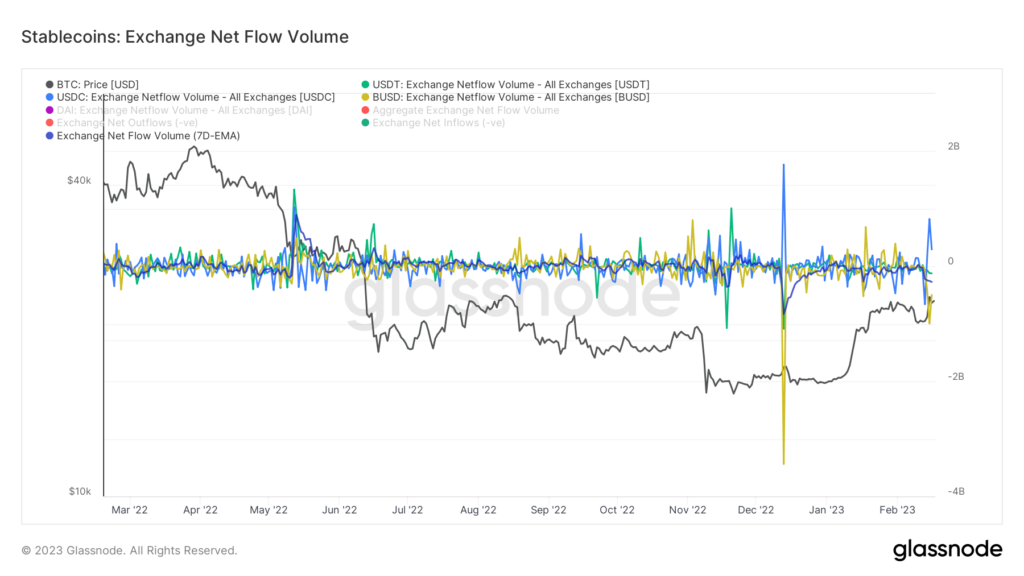

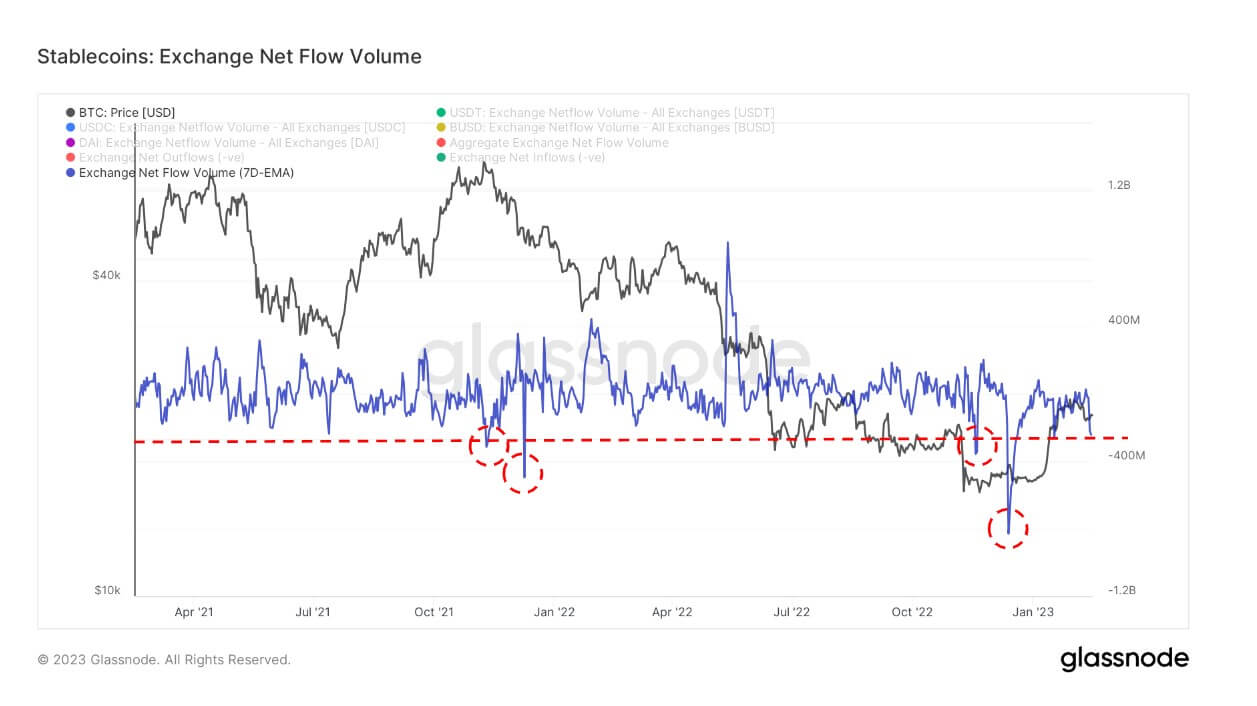

The scrutiny over BUSD precipitated unprecedented FUD available in the market. This was evident within the large outflows of stablecoins from exchanges – since Feb. 13, over $1 billion value of varied stablecoins left the Ethereum community.

The vast majority of this loss will be attributed to BUSD, which noticed the full variety of excellent tokens lower by round 700,000 between Feb. 10 and Feb. 14.

That is the fifth-largest outflow of stablecoins on Ethereum up to now two years. And whereas the $271 billion in outflows recorded on Feb. 16 are a fraction of the $830 billion recorded on Dec. 13, it nonetheless exhibits the influence the SEC’s probe into Paxos has in the marketplace.

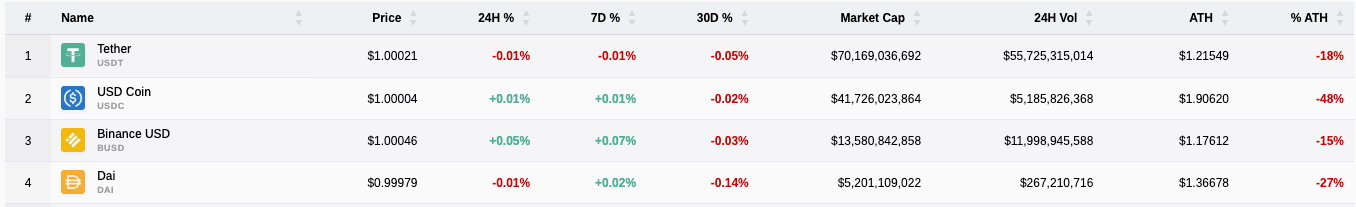

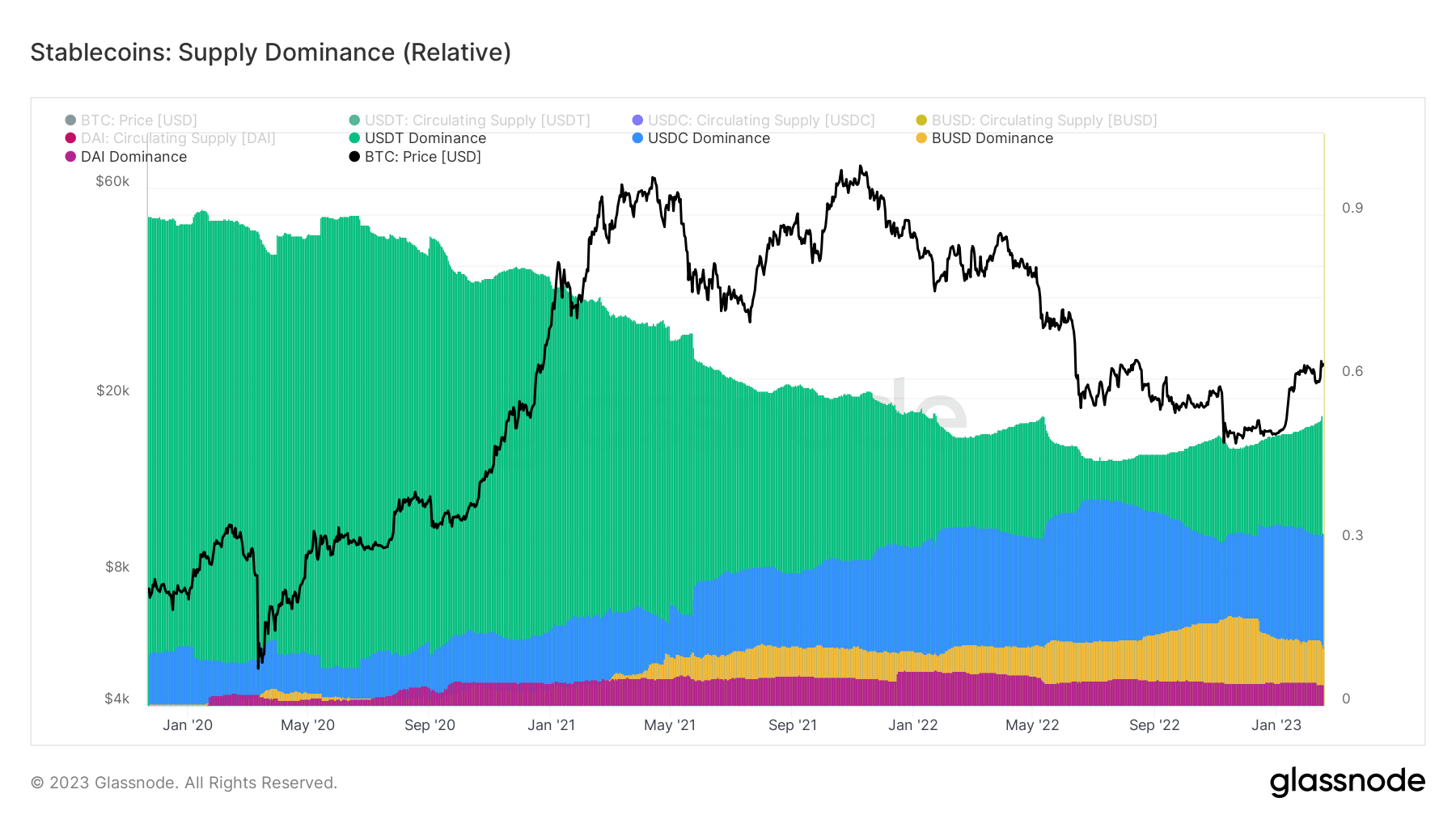

BUSD sees its dominance lower

Being the third-largest stablecoin by market cap, any adjustments in quantity BUSD experiences are sure to influence the remainder of the stablecoin sector profoundly. The coin has decreased its dominance from 17%, recorded in November 2022, to 12% on Feb 14.

The identical goes for the top-ranked stablecoins, USDC and DAI, each of which have seen decreased market dominance because the starting of the yr.

A reverse development will be noticed in USDT. Tether’s stablecoin has seen its dominance enhance since November 2022, surpassing 53% on Feb 15, 2023.

Changpeng Zhao, the CEO of Binance, mentioned that the SEC’s order to Paxos will trigger BUSD’s market cap to lower over time. Whereas Paxos will proceed to service the product, the market expects the redemptions will proceed to deplete BUSD’s provide even additional till a call from the SEC is made.

Till then, we might see USDT’s market cap and sector dominance enhance even additional. The biggest stablecoin by market cap, USDT, has already seen a notable influx since SEC’s probe into Paxos.

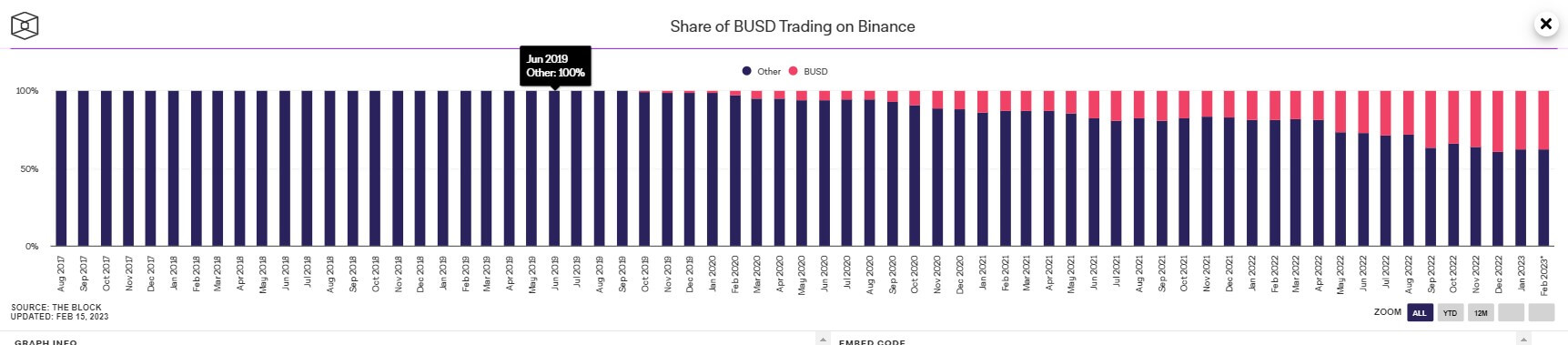

Tether’s stablecoin noticed a big enhance in liquidity on Binance final September when the change delisted USDC, USDP, and TUSD-denominated pairs from the platform. The transfer aimed to enhance worth discovery and the general liquidity on the change. Nonetheless, many noticed it as Binance’s try at attaining vertical integration, as most of its buying and selling pairs – and essentially the most liquid ones — had been tied to BUSD.

The share of BUSD pairs on Binance has been rising steadily since its launch in late 2019 however has seen notable will increase because the change delisted USDC, USDP, and TUSD.

As BUSD’s market cap declines, we will count on the share of BUSD pairs on the change to drop even additional. And whereas there hasn’t been a notable enhance within the share of USDT pairs on the change, there’s a probability it might enhance by the top of the quarter.

Binance’s troubles with sustaining stablecoin peg reserve

The SEC’s enforcement motion towards Paxos is about to have a destructive impact on Binance. The SEC’s discover cited Paxos’ relationship with the change as the rationale behind the enforcement. And whereas Binance isn’t based mostly within the U.S. and thus isn’t topic to U.S. regulation, concentrating on BUSD has definitely shaken the market’s confidence within the change.

Because it witnessed historic withdrawals in November 2022 following the FTX collapse, Binance has been below heavy scrutiny. In January this yr, the change acknowledged it failed to keep up the reserves of Binance-peg BUSD, a stablecoin it points on different blockchains whose worth is pegged to the Paxos-issued BUSD on Ethereum.

Information compiled by blockchain analytics firm ChainArgos and analyzed by Bloomberg confirmed that the Binance-peg BUSD was steadily undercollateralized between 2020 and 2021. On three separate events, the hole between BUSD reserves held by Binance and the availability of Binance-peg BUSD surpassed $1 billion.

The change has acknowledged its previous troubles in sustaining the reserve for Binance-peg BUSD and mentioned it has since improved the method with enhanced discrepancy checks to make sure the token is backed 1:1 with BUSD.

BNB begins gradual restoration

Binance’s native token, BNB, hasn’t been resistant to the Paxos information.

The token noticed its worth drop by over 11% in lower than 24 hours as traders mulled over the prospect of elevated regulatory scrutiny into Binance. Nonetheless, the slip in confidence appears to have been short-lived, as BNB regained most of its losses on Feb. 16, leaping by over 9% because the Feb. 13 information.

Conclusion

The total results of the SEC’s probe into Paxos are but to be felt.

If the SEC decides to take enforcement motion towards Paxos and take it to court docket over securities regulation violations, the market might enter right into a interval of unprecedented volatility. Many analysts have argued that BUSD doesn’t cross the Howey Take a look at, a set of standards set by the SEC to find out whether or not an asset classifies as a safety. If the Fee continues to pursue the matter in court docket, it might set a precedent for the remainder of the crypto trade and threaten all different main stablecoin issuers.

Elevated regulatory uncertainty might destabilize the market, which has simply begun a gradual restoration from the collapse of FTX. It might additionally drastically change the crypto panorama within the U.S., as many firms might search to set their roots in a extra regulatory-friendly surroundings.