Whereas Bitcoin is often thought-about the spine of the crypto trade, one ought to by no means underestimate the position stablecoins play available in the market.

Stablecoins are primarily the fiat foreign money of the crypto ecosystem and act as the principle provider of liquidity to the market.

When wanting on the crypto market as a closed system containing solely stablecoins and cryptocurrencies, the provision of stablecoins and their conduct turns into more and more necessary. That is particularly helpful when analyzing Bitcoin’s efficiency, because the ratio between the 2 can point out a possible worth rise.

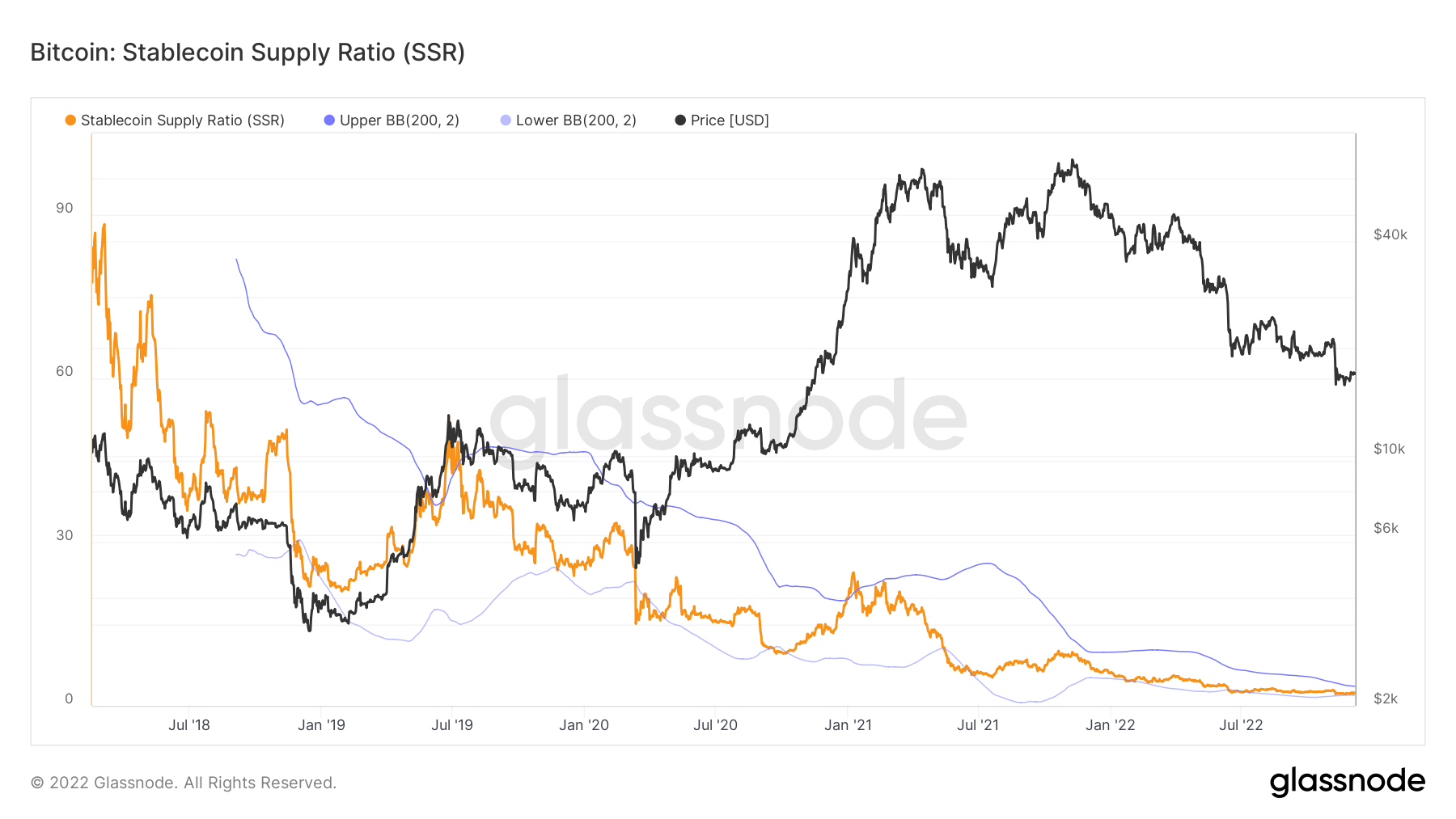

The Stablecoin Provide Ratio (SSR) reveals the ratio between Bitcoin’s circulating provide and the provision of stablecoins.

Any motion seen in SSR gives perception into what has extra weight available on the market — Bitcoin or stablecoins. The ratio primarily compares the ability standing between the 2.

When the SSR is excessive, it reveals that the provision of stablecoins is low when in comparison with Bitcoin’s market cap. This means that there’s little shopping for strain available on the market, as there are fewer stablecoins (i.e. liquidity) to go round. Low shopping for strain can point out that Bitcoin’s worth may drop and is taken into account to be a bearish signal.

A low SSR implies that the provision of stablecoins is excessive when in comparison with Bitcoin’s market cap. It’s thought-about a bullish signal because it reveals extra liquidity that’s ready to be deployed into Bitcoin.

Seeing the SSR improve reveals that the shopping for energy is slowing down, whereas a lowering pattern reveals the rise in stablecoin shopping for energy.

Information analyzed by CryptoSlate confirmed that the SSR has been steadily lowering for the reason that starting of the 12 months. The ratio has seen two virtually vertical drops this 12 months — one following the collapse of Luna, and the opposite attributable to the implosion of FTX.

The ratio presently stands at 2.34, the bottom it has been since 2018.

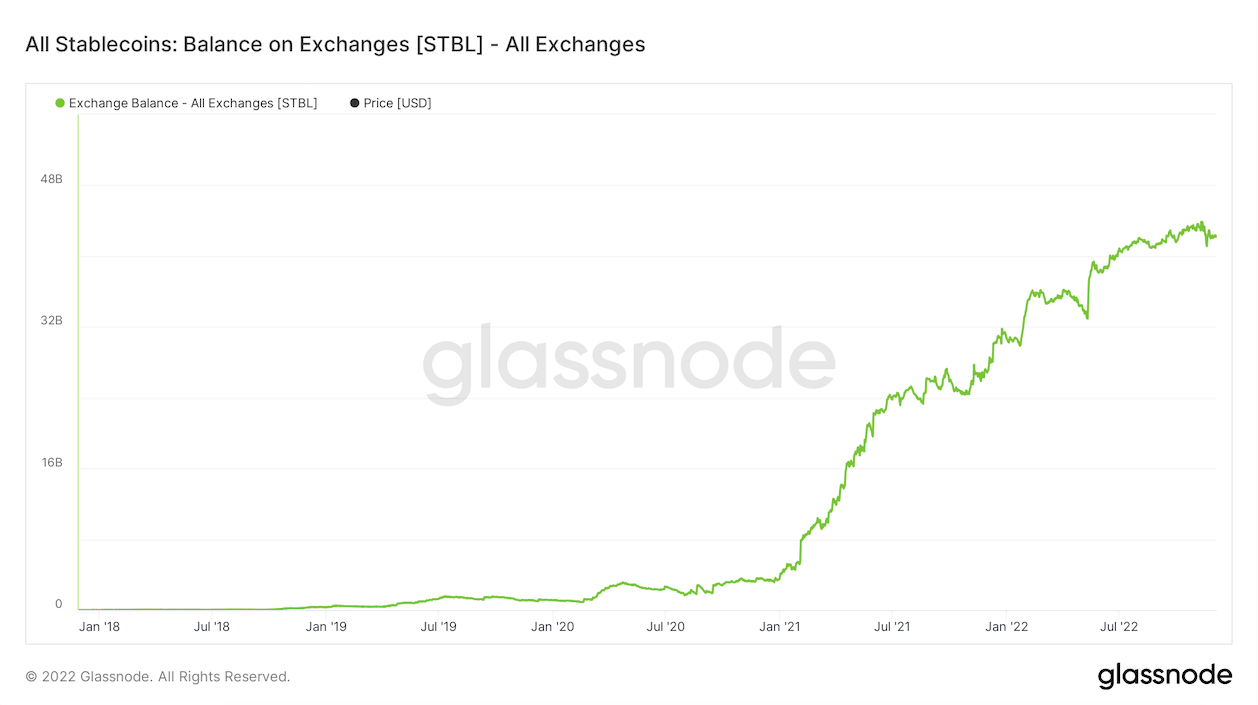

The dropping SSR is additional corroborated by the quickly rising stablecoin steadiness on exchanges.

Just like the SSR, the steadiness on exchanges reveals the quantity of “untapped” liquidity sitting on the sidelines of centralized exchanges. Based on information from Glassnode, the stablecoin steadiness on exchanges has grown exponentially since January 2021. And whereas it noticed sharp decreases within the weeks following the Luna collapse and the aftermath of FTX, its rising pattern has continued all year long.

As of December 6, over $42 billion price of stablecoins is sitting on centralized exchanges. This means that there’s round $42 billion in liquidity on the sidelines of the market, able to be deployed into cryptocurrencies like Bitcoin.