Assessing the well being of the crypto market requires extra than simply Bitcoin’s value.

Wanting on the share of Bitcoin holders which are in revenue, which means they purchased BTC at a value decrease than its present spot value, is a stable indicator of future actions.

Holders that noticed their BTC enhance in worth usually tend to promote, which may lead to a market swing. These whose holdings have depreciated in worth usually tend to maintain their belongings, main to purchasing stress.

Referred to as realized value, this metric has traditionally been a stable however not an infallible indicator for market actions.

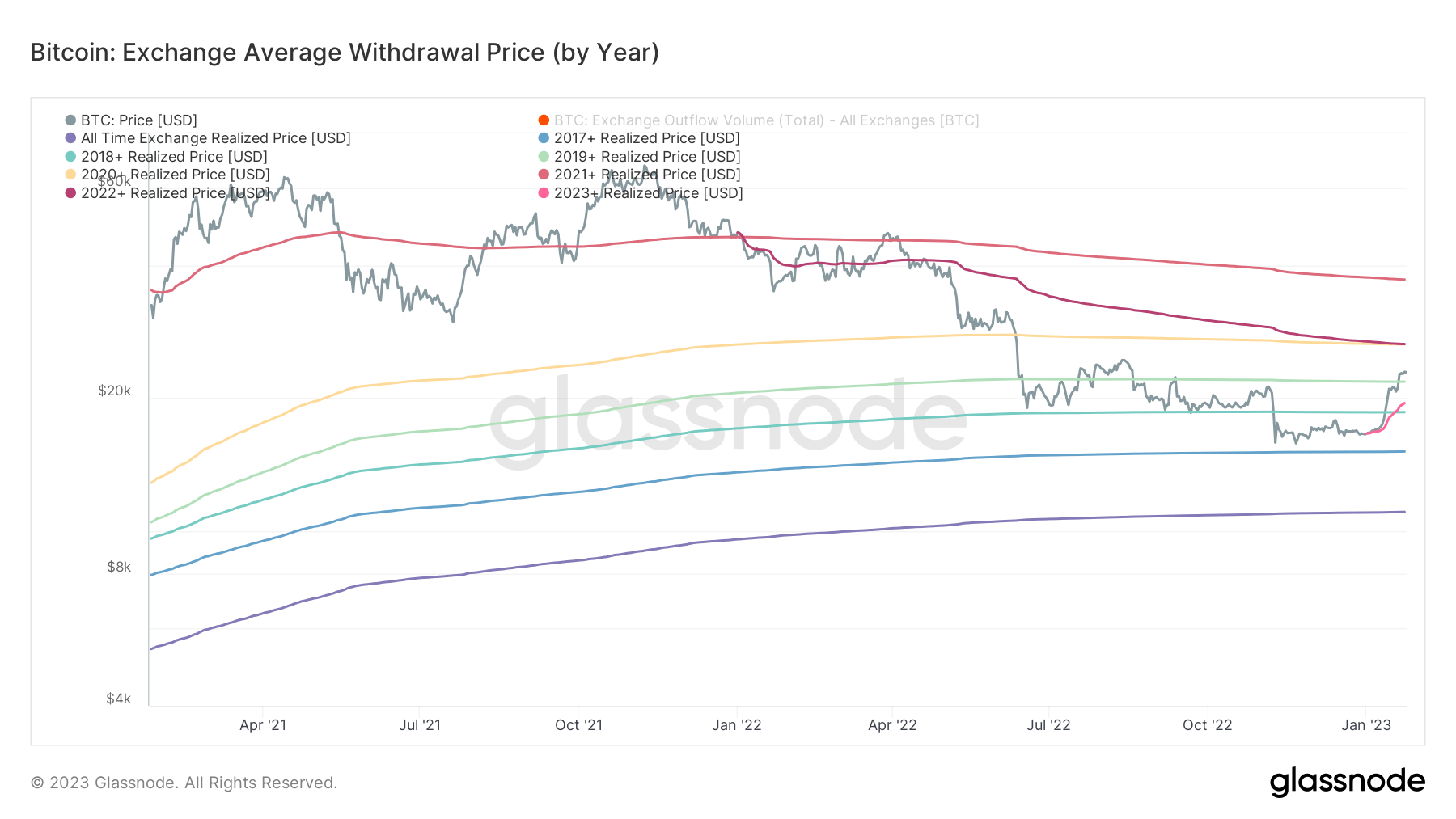

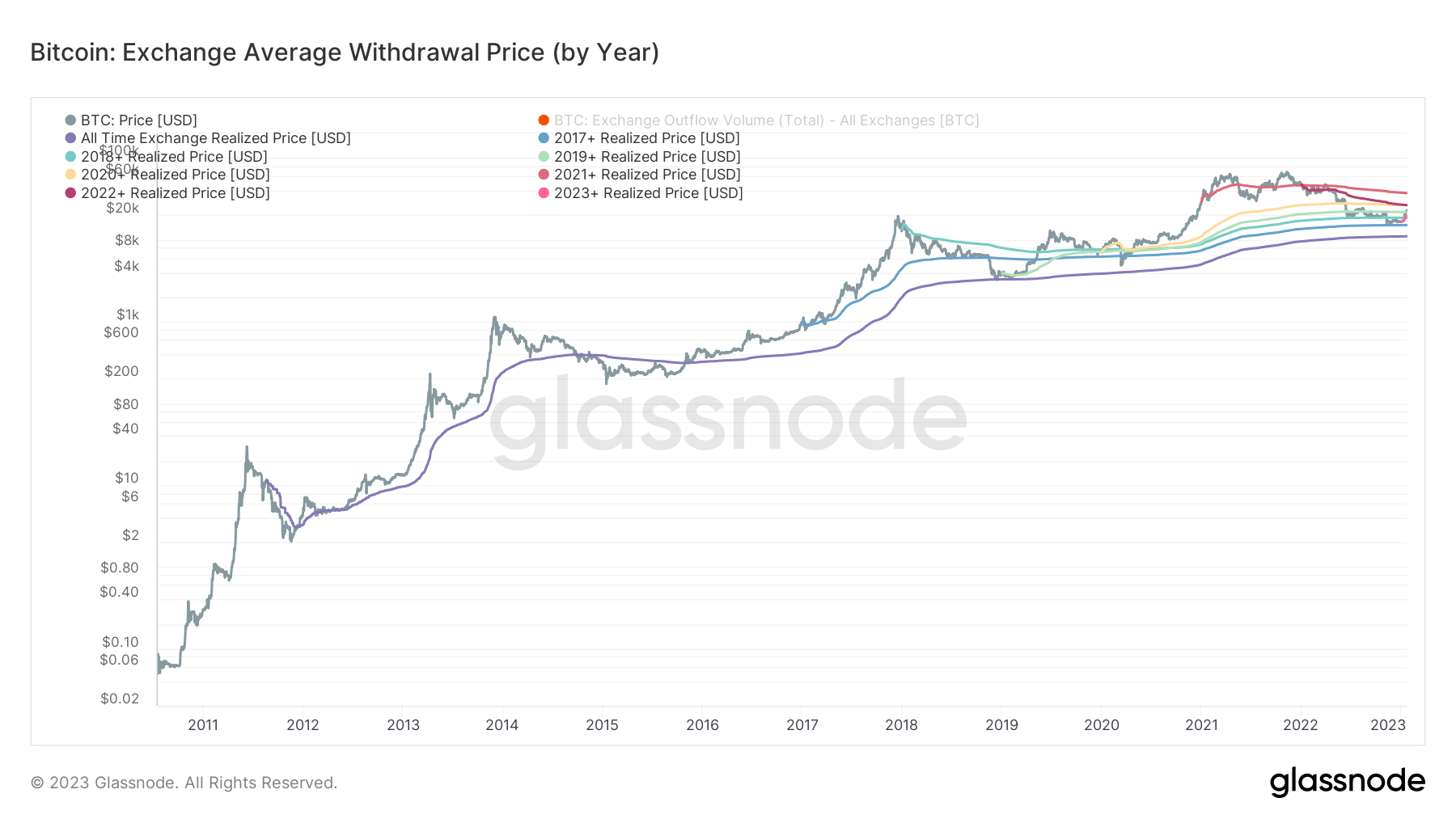

One other technique to strategy the realized value is to give attention to trade withdrawals. Specifically, trying on the common value at which Bitcoin was withdrawn from exchanges supplies a way more dependable estimate of a market-wide price foundation for BTC.

CryptoSlate evaluation appeared on the common withdrawal costs for annually from 2017 to 2023 and the common withdrawal value from 2011 to 2022.

Information from Glassnode confirmed a curve within the common Bitcoin withdrawal value, starting from $15,139 to as excessive as $37,232.

- 2017 = $15,139

- 2018 = $18,598

- 2019 = $21,817

- 2020 = $26,513

- 2021 = $37,232

- 2022 = $26,564

- 2023 = $19,496

The common withdrawal value for Bitcoin from 2011 to 2023 stands at $11,037.

When Bitcoin reached $23,000, it broke above a number of cost-basis ranges, together with each realized value and short-term holder realized. The long-awaited however sluggish restoration has now put buyers that purchased BTC earlier than the COVID-19 pandemic in revenue.

Nonetheless, those who bought BTC through the 2020 pandemic, in 2021, and in 2022 noticed their positions lose worth. Traders that purchased the dip originally of January 2023 have already seen revenue as Bitcoin’s value continued to rise all through the month.

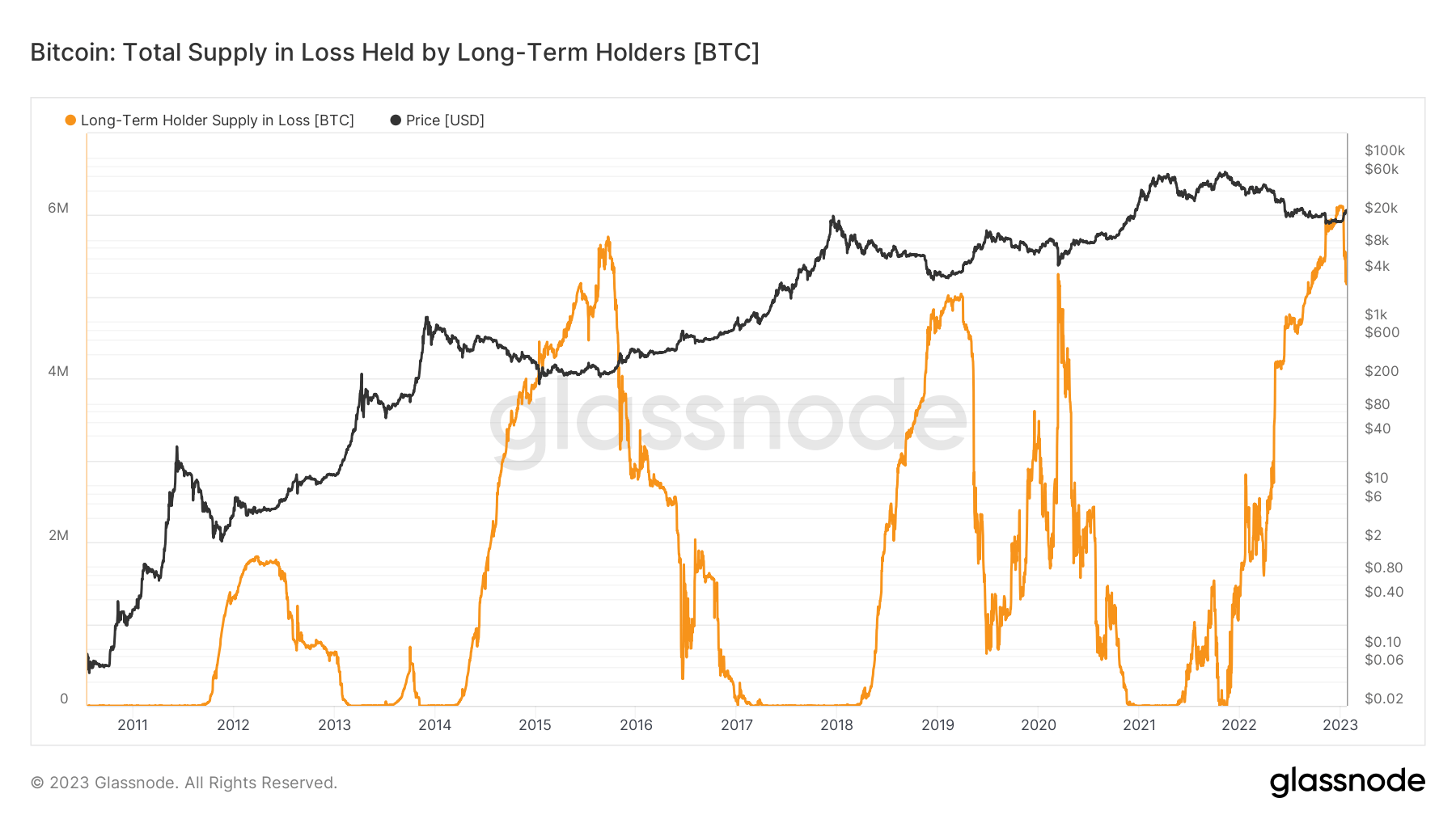

The common withdrawal value turns into much more necessary when analyzed alongside long-term holders.

Outlined as these proudly owning BTC for longer than 155 days, long-term holders are much less prone to spend their cash. The realized value at which they purchased BTC has traditionally served as a stable resistance indicator. Nonetheless, the common withdrawal value for long-term holders could be a good higher gauge for resistance, because it represents the common worth at which they transferred their cash from exchanges to wallets.

On the finish of 2022, the market noticed the entire provide in loss held by long-term holders attain an all-time excessive. And whereas the quantity dropped from 6 million BTC to five million BTC because the starting of the 12 months, it nonetheless exhibits a good portion of the availability at a loss.

This means that long-term holders may proceed to take a seat on the 5 million BTC till their realized value is met, making a stable resistance that would cease Bitcoin from slipping beneath its 2022 low.