Monitoring the motion of Bitcoin‘s provide, significantly when categorized by the point since final lively, is pivotal for understanding investor conduct and forecasting market traits. This evaluation sheds mild on the present state of Bitcoin holdings and offers vital insights into its future actions.

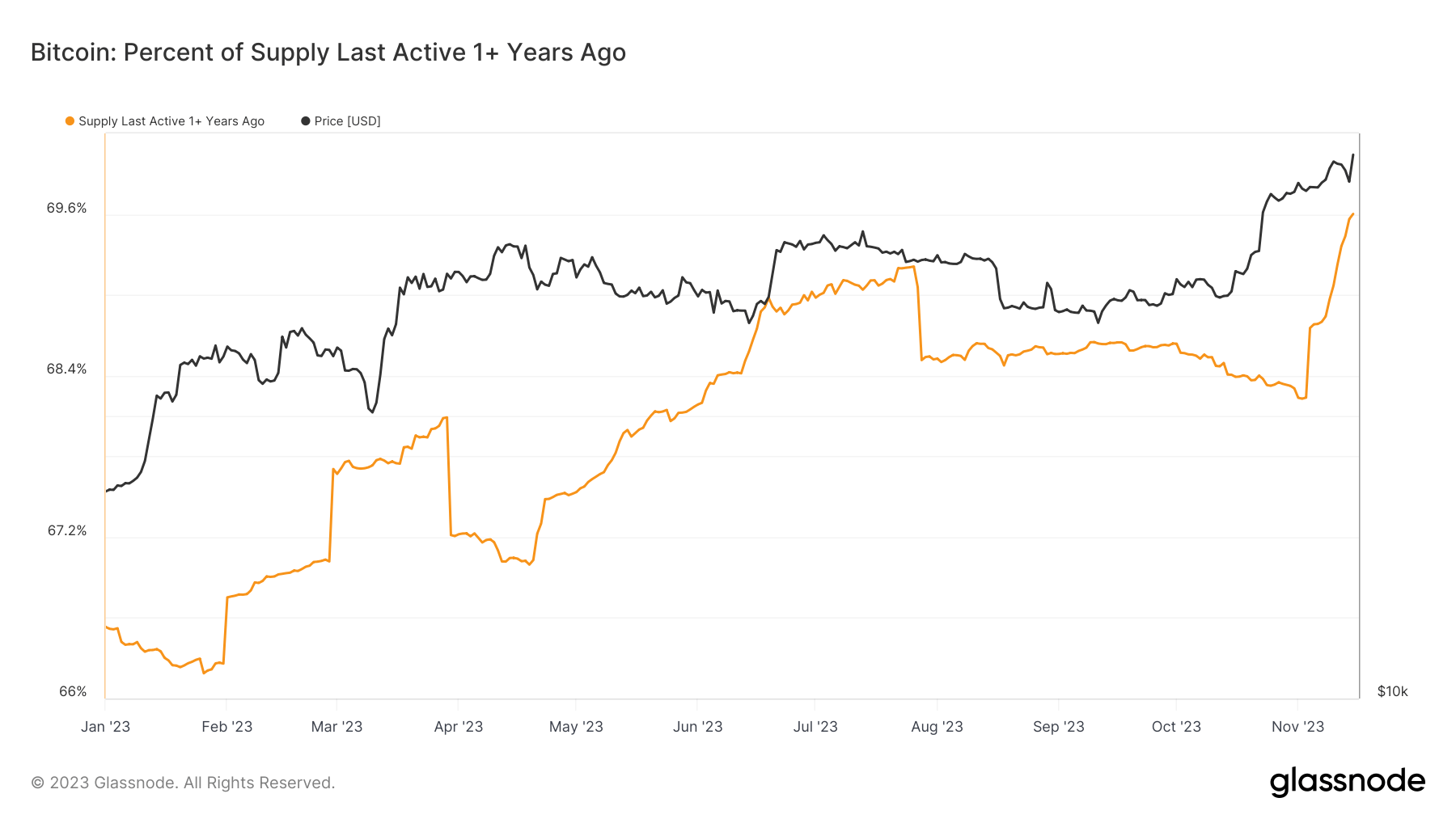

There was a exceptional shift in Bitcoin’s provide dynamics that adopted its latest worth rally. In simply over a month, Bitcoin’s worth surged from $26,846 to $37,964. Throughout the identical interval, the share of Bitcoin’s provide final moved over a yr in the past elevated by round 4%, indicating a heightened tendency amongst buyers to carry their belongings for longer durations.

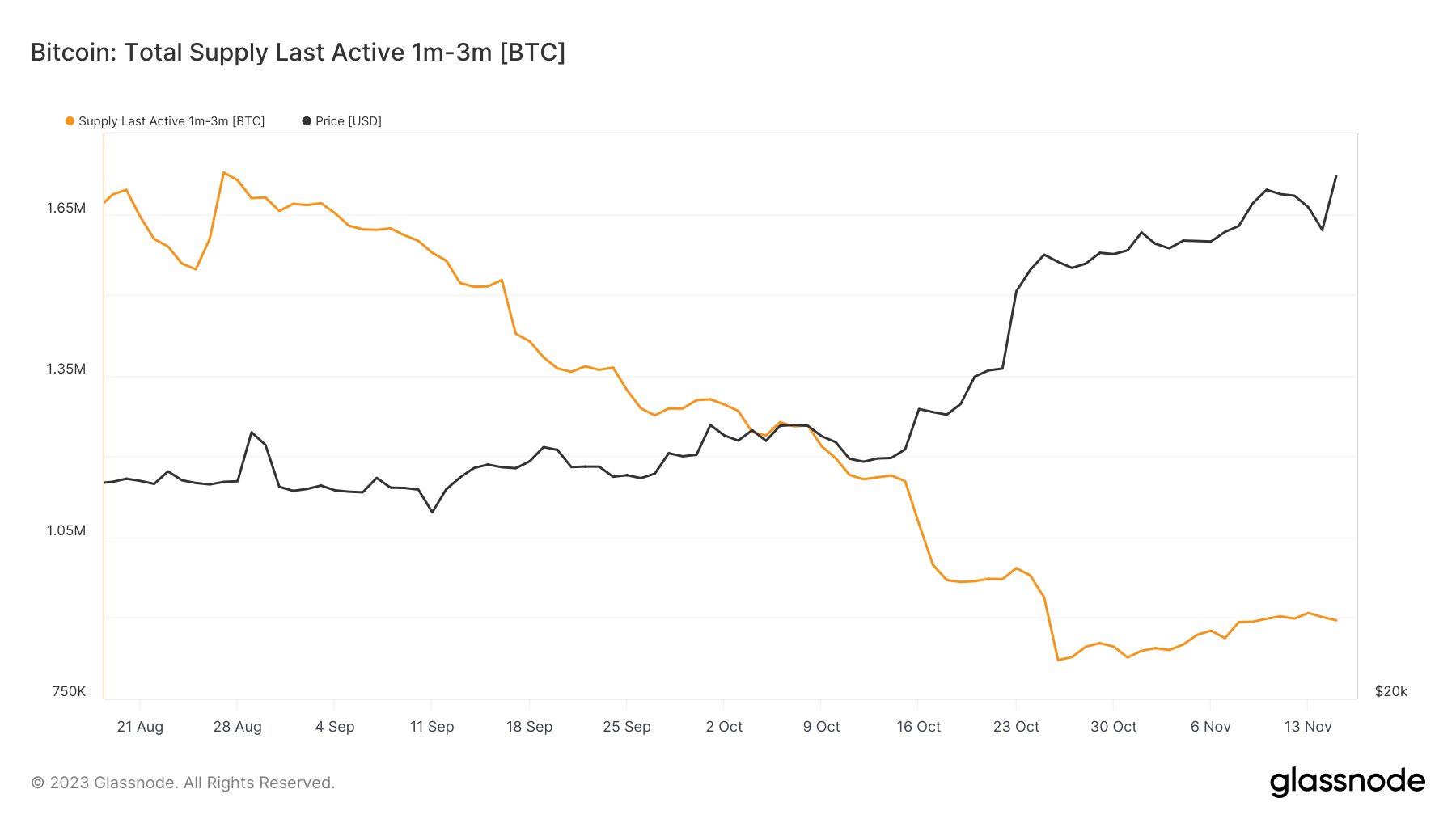

This era additionally noticed modifications in shorter-term provide actions: the availability final lively for 1-3 months decreased from 1.16 million BTC to 895,347 BTC, a considerable drop of roughly 22.7%, reflecting a decline in short-term buying and selling actions.

These traits are indicative of a broader sentiment amongst Bitcoin holders. The growing percentages within the provide final moved classes, particularly over a yr, spotlight a powerful inclination in the direction of holding Bitcoin as a long-term funding or a retailer of worth. This conduct suggests a maturing market the place buyers are much less reactive to short-term worth fluctuations and extra assured within the long-term prospects of Bitcoin.

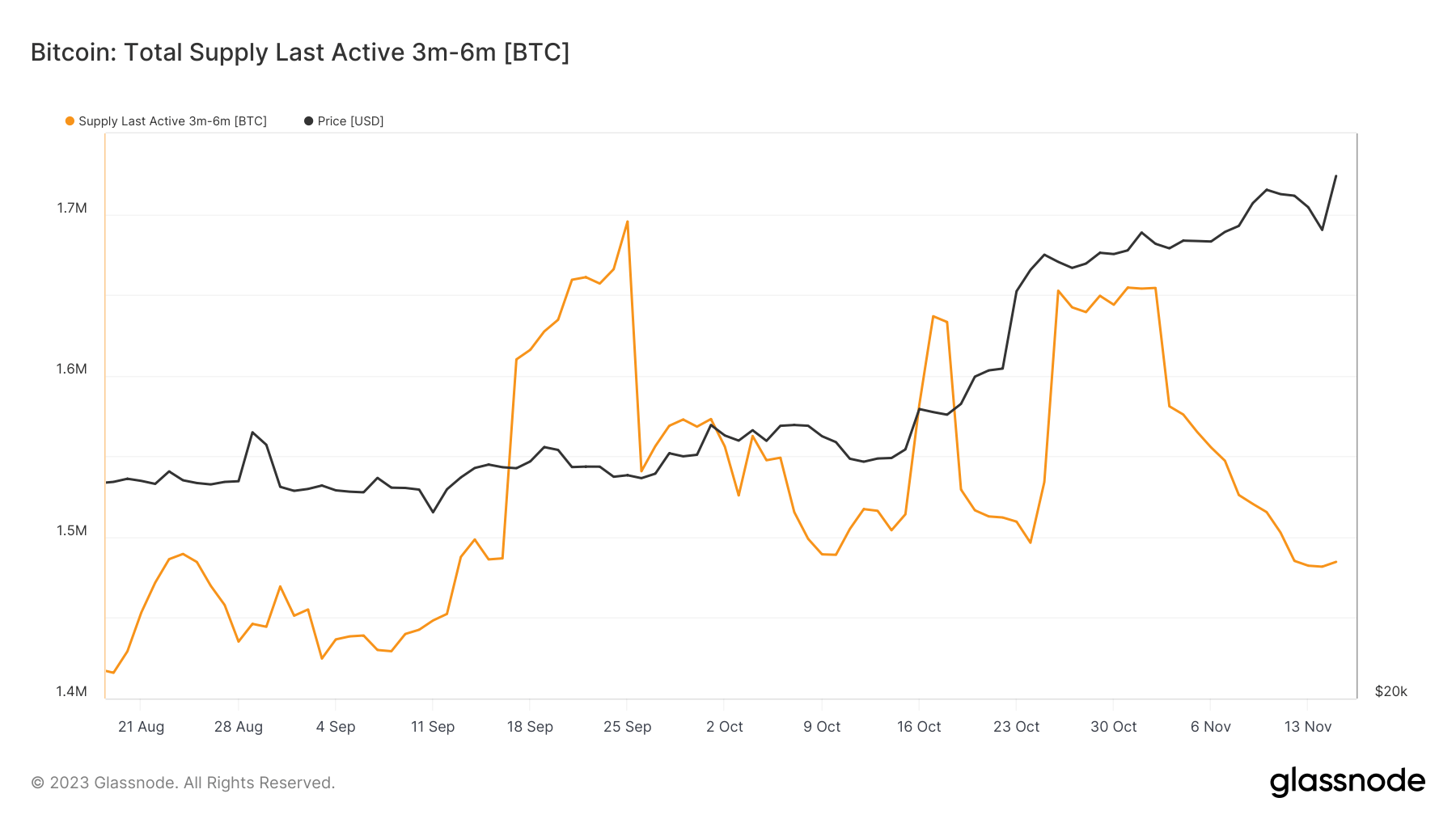

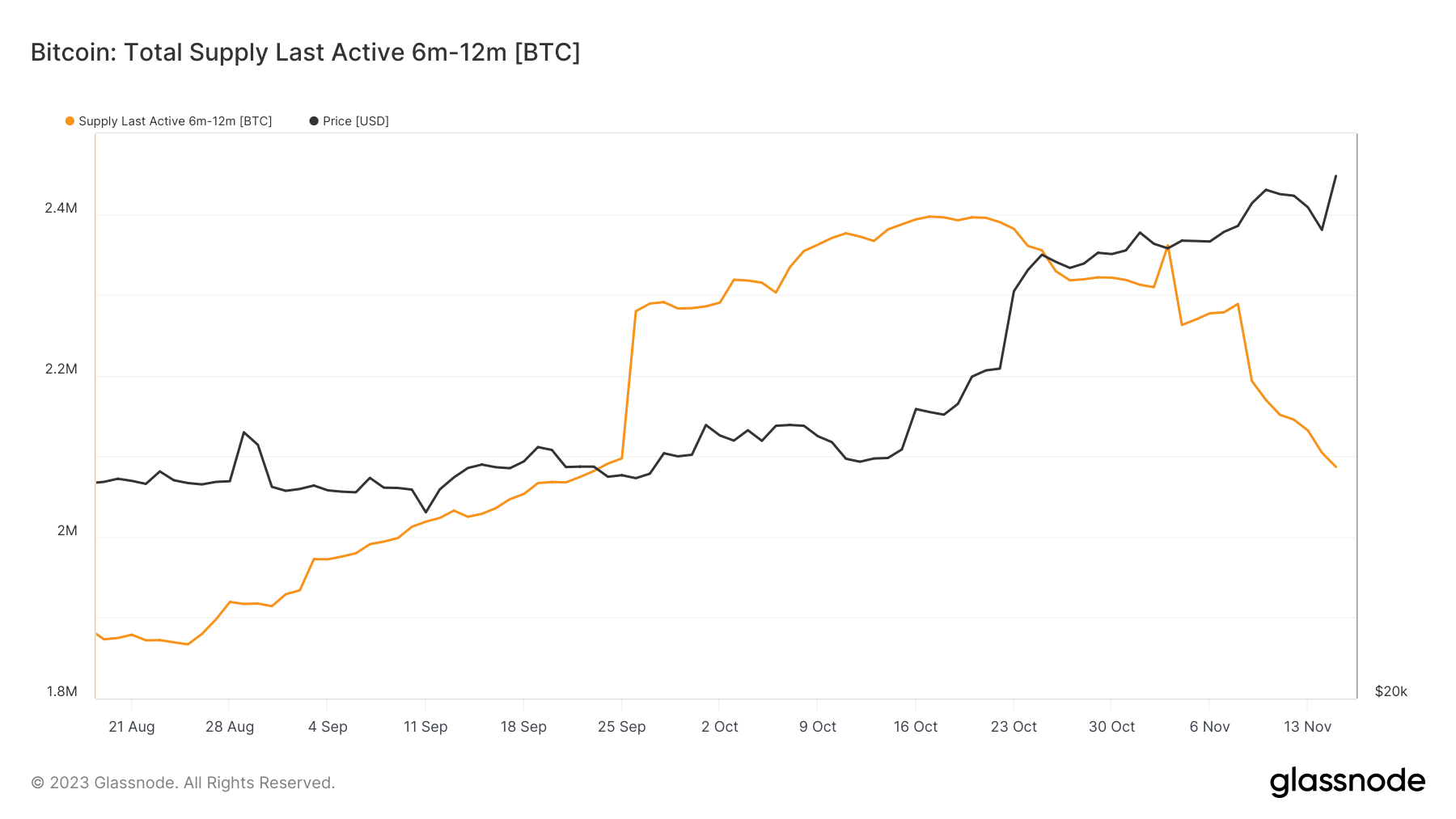

The provision final lively within the 3-6 and 6-12 months classes additionally confirmed intriguing actions. The three-6 months class noticed a rise adopted by a slight lower, whereas the 6-12 months class constantly decreased.

This fluctuation may point out a motion of Bitcoin from a comparatively dormant state (6-12 months) to a extra lively state (3-6 months), doubtlessly in response to market developments or worth actions.

These provide dynamics are essential for understanding the liquidity and stability of the Bitcoin market. A good portion of Bitcoin being held for prolonged durations results in a lower within the circulating provide, which may contribute to cost will increase, particularly within the context of Bitcoin’s capped provide. Alternatively, low liquidity, marked by much less provide out there for commerce, can result in elevated worth volatility.

The insights drawn from this evaluation aren’t simply reflective of present market situations but additionally predictive of potential future traits. As an illustration, if a substantial portion of Bitcoin that has been held for over three years begins changing into lively, it’d sign a possible promoting strain, presumably resulting in a worth lower. Furthermore, the response of those provide classes to exterior occasions can present precious insights into how completely different investor segments understand and react to those developments.

The put up Analyzing Bitcoin’s provide traits as surge in long-term Bitcoin holdings factors to investor confidence appeared first on CryptoSlate.