Fast Take

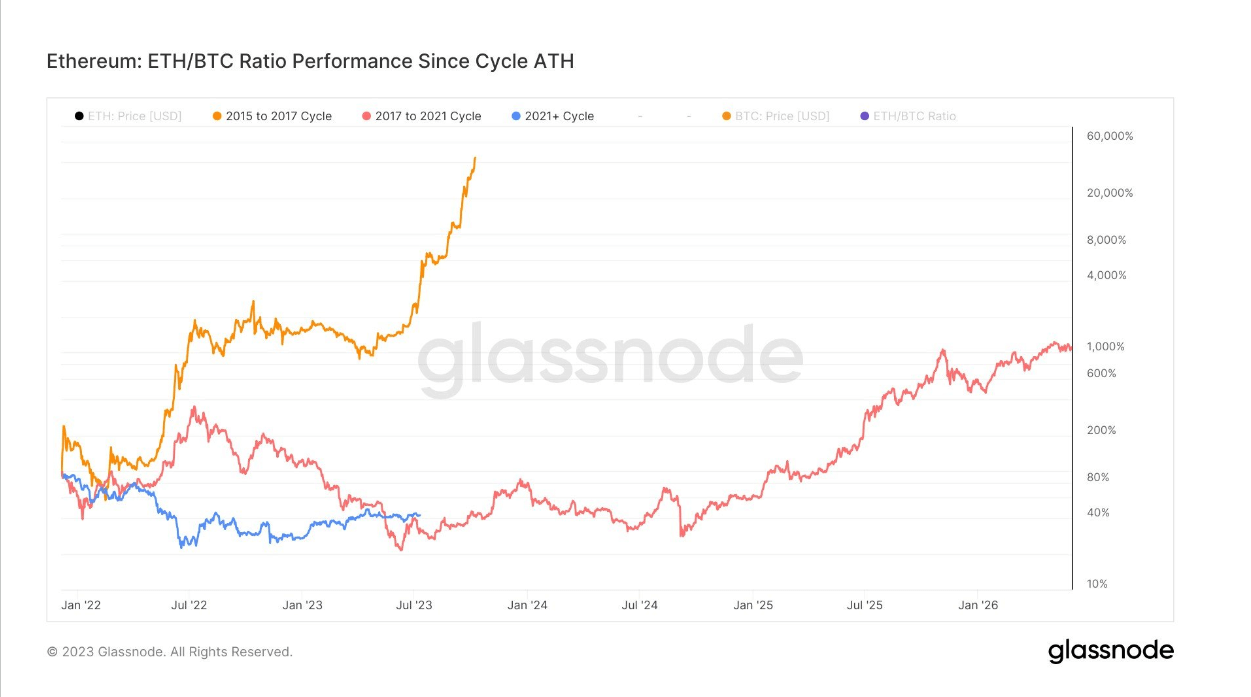

The Ethereum to Bitcoin ratio is at the moment at 0.061, because it hovers round year-to-date lows. The radio is calculated by dividing the worth of Ethereum by the worth of Bitcoin and presents an intriguing comparability towards earlier market cycles, particularly when assessing efficiency from the cycle’s all-time excessive (ATH).

The 2015 to 2017 cycle noticed an impressive efficiency from Ethereum, with returns exceeding 60,000% and markedly outperforming Bitcoin. This era marked a major excessive level for the Ethereum to Bitcoin ratio.

Within the subsequent cycle from 2017 to 2021, Ethereum continued to carry out effectively, though with a decreased, spectacular return excessive of 1,000%. This cycle hinted at a declining development in Ethereum’s dominance over Bitcoin.

Now, we discover ourselves in a cycle that commenced in November 2021. Ethereum’s efficiency on this cycle is marginally higher than the previous cycle however is usually seen as underperforming.

As we transfer ahead, it’s a degree of hypothesis whether or not Ethereum will proceed this sample of underperformance in every succeeding cycle or whether or not it would disrupt the development. The query arises: will Ethereum throw a ‘spanner within the works’ of this noticed development? Solely time will inform.

The put up Analyzing the efficiency of Ethereum towards Bitcoin throughout market cycles appeared first on CryptoSlate.