Fast Take

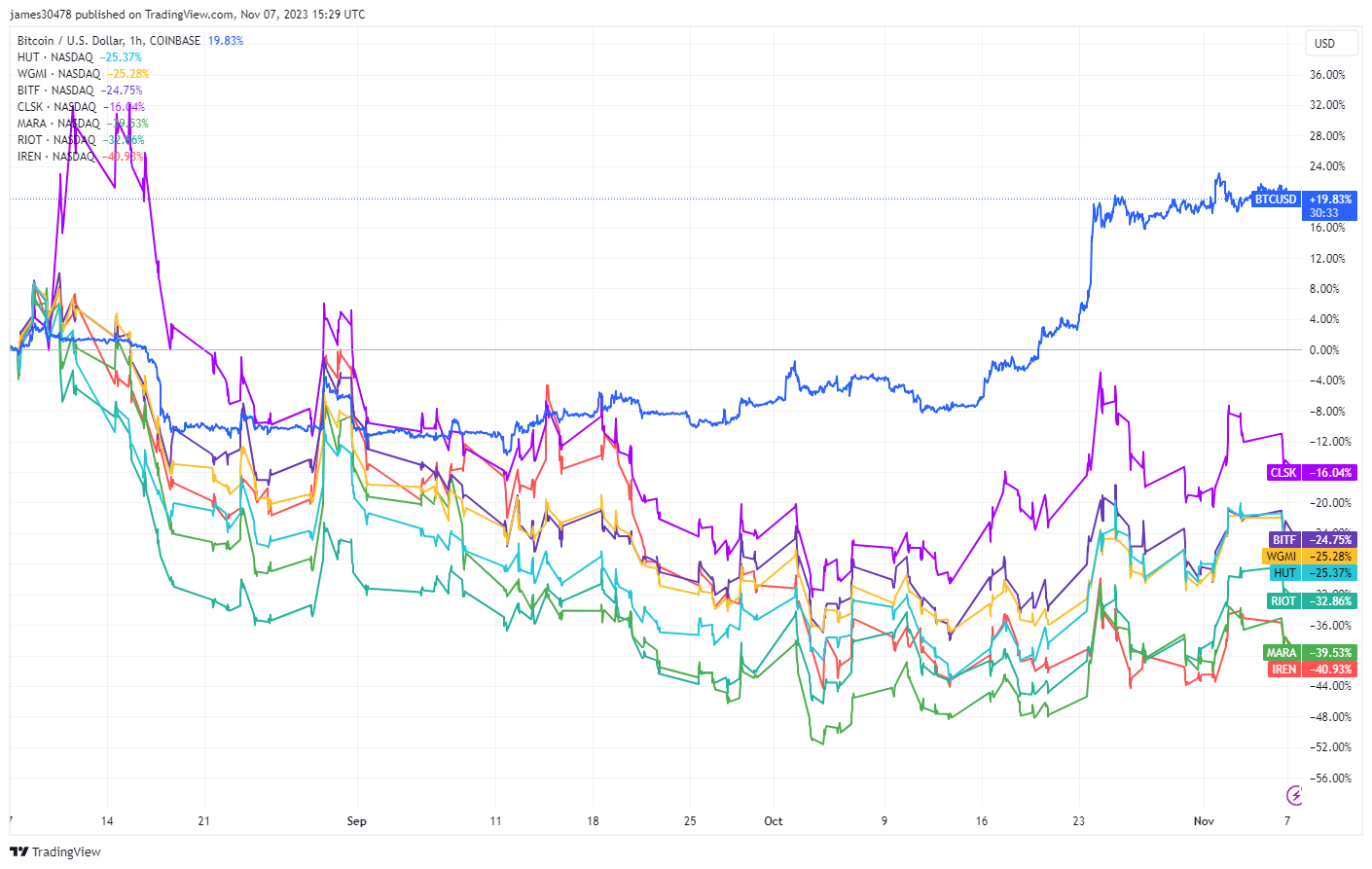

Over the previous three months, the Bitcoin panorama has introduced a putting anomaly. Bitcoin, the flagship cryptocurrency, has skilled a 20% surge, climbing close to its year-to-date (YTD) excessive, round $35,000. Conversely, this upward momentum seems to have bypassed Bitcoin mining shares, which have reported a considerable decline.

Distinguished mining shares resembling Cleanspark, Bitfarms, Hut 8, and WGMI all recorded declines between 15% and 25%. Extra dramatically, Riot Blockchain and Marathon Digital Holdings noticed reductions of 32% and 39%, respectively, whereas Iris Vitality reported a considerable 41% drop. This divergence is particularly important given Bitcoin’s efficiency.

The crux of this divergence could possibly be traced again to the forthcoming Bitcoin halving occasion scheduled for April 2024. Bitcoin mining shares are primarily valued primarily based on the anticipated future money flows generated by way of Bitcoin, based on analyst Caleb Franzen. With the block rewards anticipated to halve submit the occasion, market hypothesis means that the value of Bitcoin would want to double to keep up the sustainability of those companies equivalently to pre-halving ranges, based on Franzen.

In essence, the present market sentiment may replicate a insecurity that Bitcoin’s worth might want to rise considerably.

| Mining Shares | 3 Month Efficiency |

|---|---|

| Cleanspark | -15% |

| Bitfarms | -20% |

| Hut 8 | -25% |

| WGMI | -18% |

| Riot Blockchain | -32% |

| Marathon Digital Holdings | -39% |

| Iris Vitality | -41% |

| Bitcoin | 20% |

Supply: Buying and selling View

The submit Anticipated Bitcoin halving could contribute to mining shares’ decline regardless of Bitcoin’s rise appeared first on CryptoSlate.