Fast Take

The current overview of worldwide economics displays a posh panorama of central banking selections and insurance policies, largely centered round inflation and employment charges. Proof signifies that central banks worldwide are on the cusp of peak charge cycles. As an illustration, the European Central Financial institution, with a charge of 4%, believes its strategy is sufficiently restrictive. Concurrently, the Financial institution of England finds itself divided over a possible closing 25bps charge hike as inflation got here in decrease than anticipated this morning however nonetheless over thrice the central financial institution’s goal.

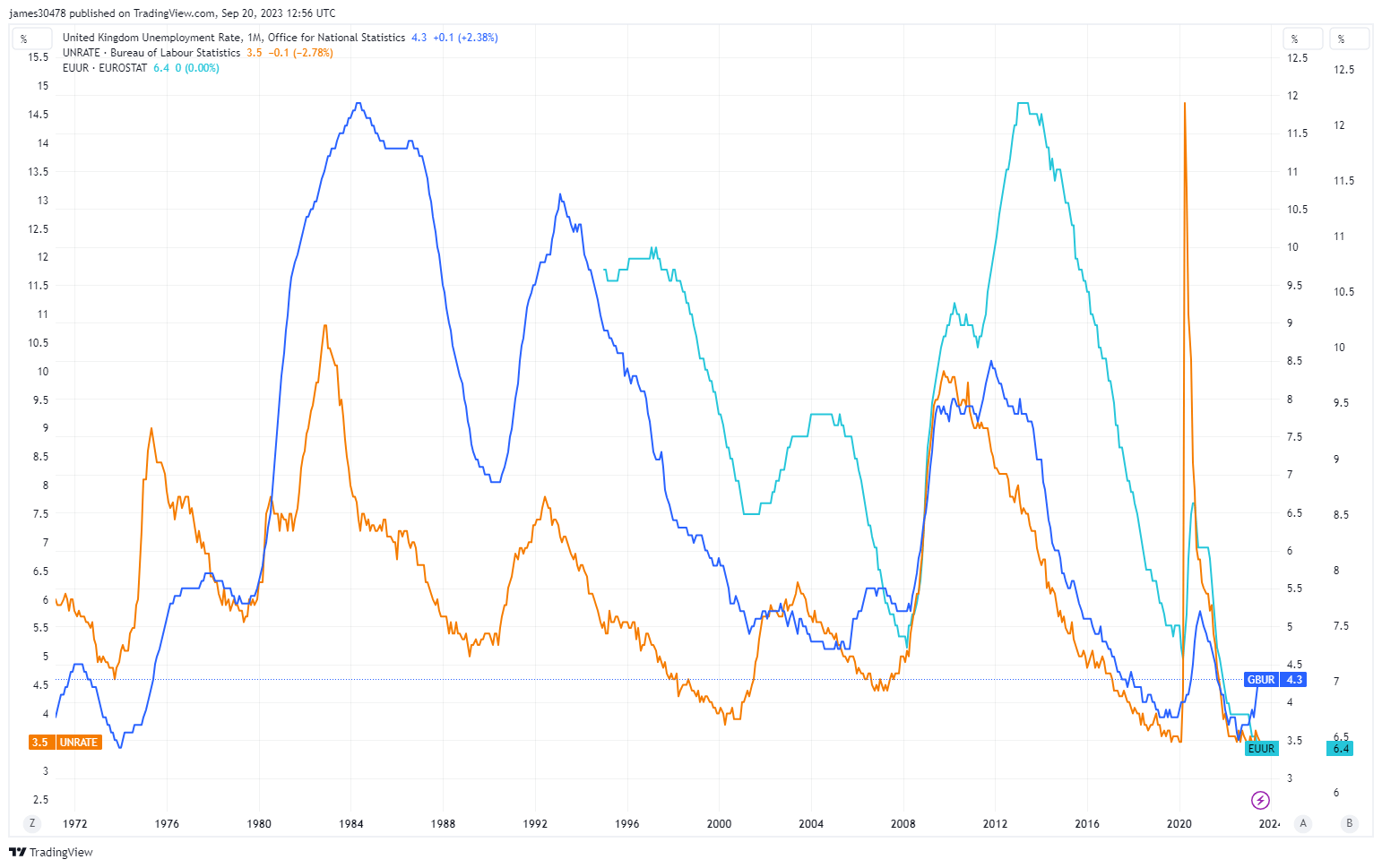

Within the U.S., regardless of an anticipated pause by the Federal Reserve, the fact of inflation stays distant from the two% goal. Including extra complexity is Canada’s expertise of inflation acceleration, akin to the U.S., concurrently with file low unemployment charges. These secular lows throughout all areas, as highlighted by Bob Elliott, CIO at Limitless Fnds, underline a big financial contradiction. Areas proceed to keep up their base charge decrease than inflation, with the U.S. barely managing a restrictive stance.

This information raises a essential query: Are central banks globally performing prematurely of their declaration of victory over inflation, particularly towards the backdrop of low unemployment? A complete understanding of those dynamics might affect the way forward for international monetary stability.

The put up Are international banks claiming untimely victory towards inflation? appeared first on CryptoSlate.