Fast Take

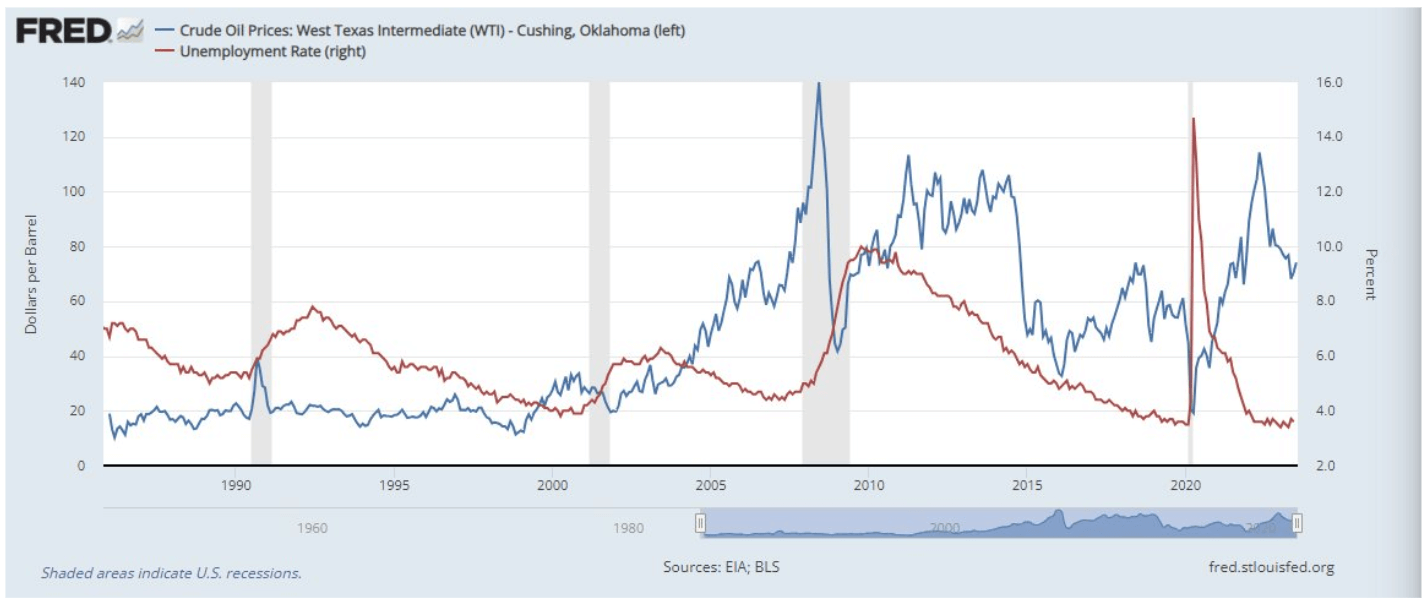

The intricate relationship between crude oil costs and unemployment is a topic of shut examination within the present financial panorama. Oil costs are on an upward trajectory, at the moment round $80 per barrel, a notable enhance from the $66 per barrel seen in March.

Such an increase in oil costs can induce a cascading impact, escalating the costs of products, notably meals and vitality. This results in inflationary pressures, a priority for the Federal Reserve because it counteracts its aim of preserving value stability.

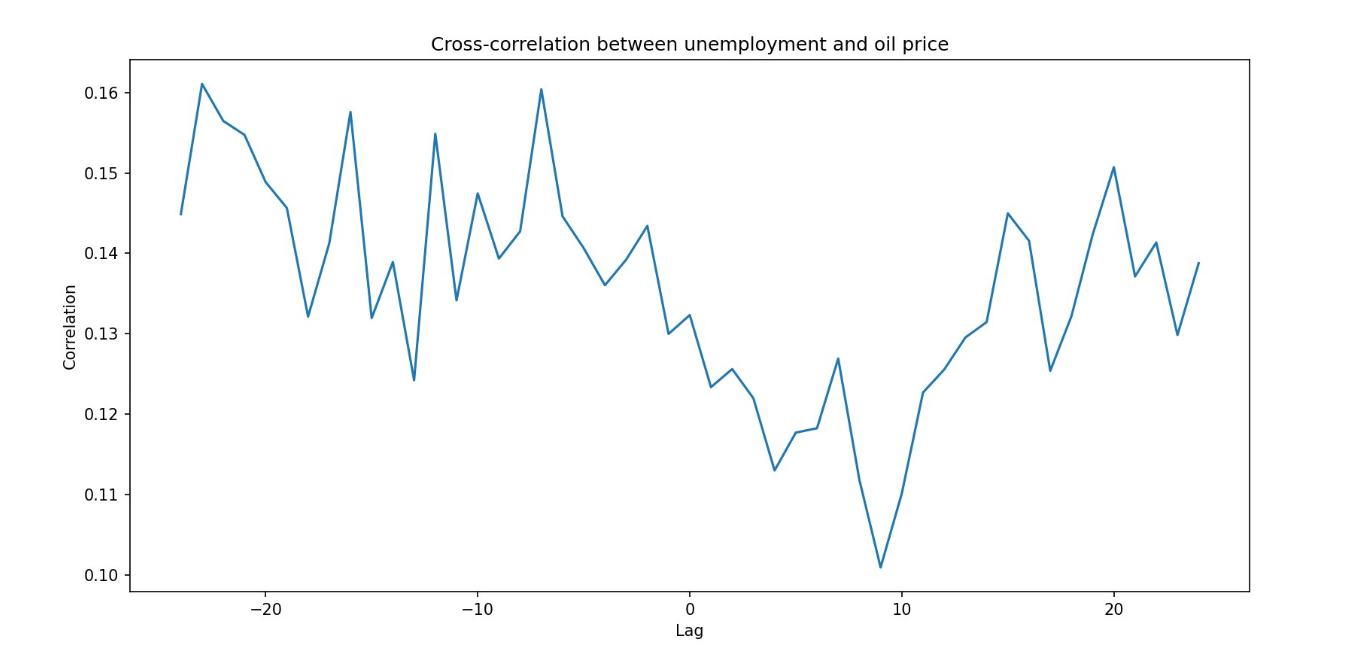

Fascinatingly, the interaction between oil costs and unemployment normally follows a selected pattern. A rise in oil costs typically precedes an increase in unemployment, which, excluding the COVID-19 pandemic, has led to a recession three out of 4 occasions. This correlation usually takes about six months to manifest.

The market is at the moment observing a unfavorable year-over-year comparability for oil, which bodes nicely for the Client Worth Index (CPI) metric.

Nevertheless, given the present rising pattern of oil costs, this case calls for cautious monitoring. It’s essential for financial contributors to vigilantly monitor these shifts to foretell and reduce potential unfavorable impacts on unemployment and inflation

This level is supported by Viraj Patel, FX & World Macro Strategist:

“Until oil will get again to $100/bbl it’s not ‘inflationary’. At greatest latest rally in commodities is much less deflationary”

The submit Are the complicated interplays between crude oil costs and unemployment charges trigger for concern? appeared first on CryptoSlate.