Fast Take

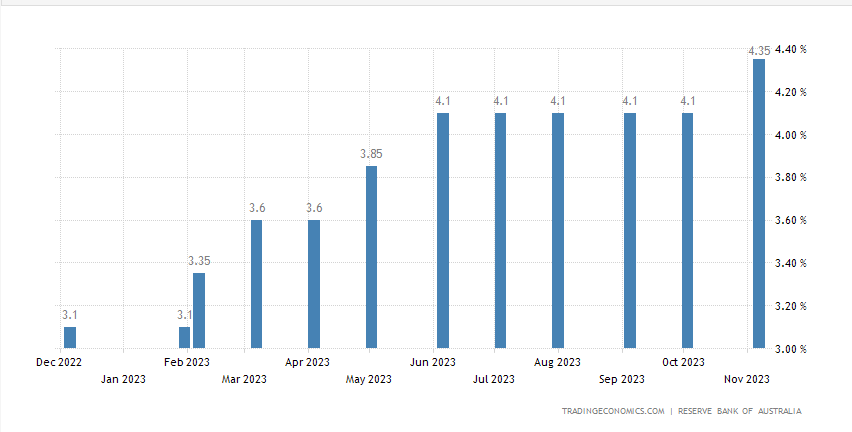

The Reserve Financial institution of Australia’s (RBA) current resolution to extend their rate of interest from 4.1% to 4.35% – the primary rise since Might 2023 – presents an intriguing pattern in distinction to the anticipated actions of the Federal Reserve and different Western central banks. Australia’s Shopper Worth Index (CPI) inflation at present persists at 5.4%

Most markets are bracing for a pause in fee hikes from these establishments, forecasting a possible reduce subsequent 12 months regardless of inflation not hitting the two% goal.

Australia’s transfer might recommend the daybreak of a brand new wave of rate of interest will increase, putting it on the forefront of this shift. This potential international financial coverage change might have far-reaching implications, notably on Bitcoin and different risk-tolerant property, which have already factored within the expectation of no additional fee hikes within the present cycle by the Federal Reserve.

With this sudden flip of occasions, a recalibration of those property’ valuations could happen. Future market actions will hinge on whether or not different central banks align with the RBA’s resolution or preserve the established order, thus intensifying the worldwide financial chess sport.

The submit Australian central financial institution’s shock rate of interest hike might sign international shift appeared first on CryptoSlate.