Be part of Our Telegram channel to remain updated on breaking information protection

A interval of market tug-of-war is what ended Balancer‘s bearish development that began on the eleventh of September to the twenty first of September. The market impasse continued from the twenty third until the fifteenth of October. Patrons started to have the higher hand from the sixteenth of October up until date. With the looks of the three consecutive bullish candles on the chart, a brand new development has began.

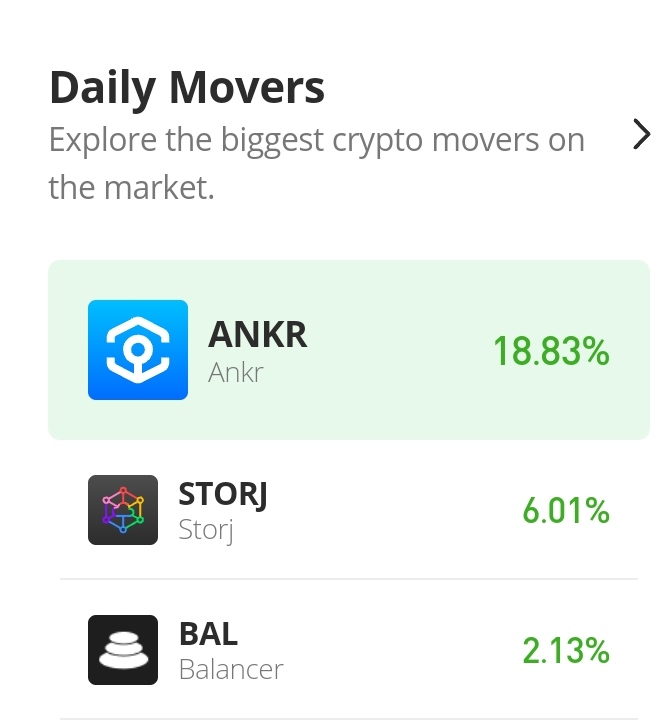

Balancer Market Value Statistic:

- BAL/USD worth now: $5.44

- BAL/USD market cap: $236,754,718

- BAL/USD circulating provide: 43,822,909.75

- BAL/USD whole provide: 52,125,147

- BAL/USD coin market rating: #119

Key Ranges

- Resistance: $6.00, $6.50 $7.00

- Assist: $4.50 $4.00, $3.50

Balancer Market Value Evaluation: The Indicators’ Level of View

Though the Balancer bullish development was established with three consecutive candlesticks, the knowledge from the Bollinger band has turn out to be a supply of main concern. Regardless of the bullish transfer out there for the previous three days, the higher and decrease band of the Bollinger stays unaffected by the market efficiency. This can be as a consequence of much less quantity of buying and selling quantity. When the distinction between the proximity of the help and resistance is just not a lot, the prospect that the market will enter right into a consolidation interval once more turns into excessive.

However, within the RSI indicator, the RSI line which was shifting on the base of the bearish zone has now risen into the bullish zone measuring 53%. There may be nonetheless room for extra bullish efficiency.

BAL/USD 4-Hour Chart Outlook

- The Bollinger band on this perspective is just not just like the one within the every day buying and selling chart which we have now examined above. Once we take a look at the market efficiency in at this time’s buying and selling actions, we will see that the higher band is now responding to the value motion as it’s widening. Within the third session, we seen a worth pullback and this was as a consequence of a restoration from the overbought. The development is predicted to proceed steadily because it attains new increased worth ranges.

- Early Stage Presale Dwell Now

- Doxxed Skilled Workforce

- Use Circumstances in Business – Offset Carbon Footprint

Associated

Be part of Our Telegram channel to remain updated on breaking information protection