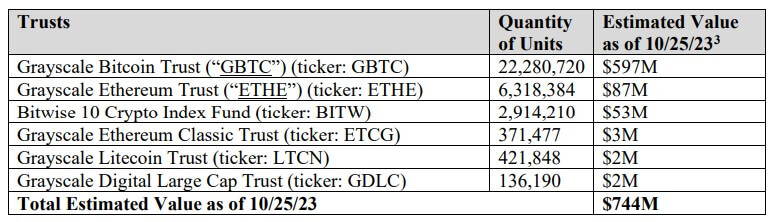

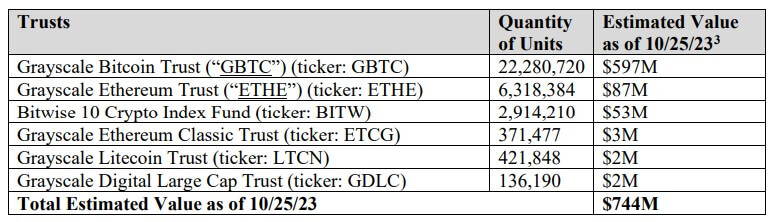

Bankrupt cryptocurrency alternate FTX has expressed readiness to promote $744 million value of its Belief property held at Grayscale and Bitwise, based on a Nov. 3 courtroom submitting.

The Belief property consist of varied exchange-traded merchandise managed by Grayscale, together with its Bitcoin and Ethereum Trusts and Bitwise’s 10 Crypto index fund. The submitting reveals that Grayscale oversees roughly $691 million in FTX property, whereas Bitwise manages round $53 million as of October 25, 2023.

The failed crypto firm defined that promoting these property was essential to mitigate “towards potential downward value swings within the Belief Property, maximize the worth of the Debtors’ estates, and permit for forthcoming dollarized distributions to collectors.”

It added:

“Executing the proposed procedures and monetization of the Belief Property represents a sound train of the Debtors’ enterprise judgment and can profit collectors and stakeholders by mitigating market danger and making ready the estates for plan distributions.”

On account of this, FTX stated it could appoint an funding adviser in session with the Committee and the Advert Hoc Committee of Non-US Prospects of FTX.com. This adviser can be tasked with advertising and promoting the Belief Asset beneath an funding companies settlement authorised by the Courtroom.

Edgar W. Mosley II, a managing director at one in all FTX’s present monetary advisers, Alvarez & Marsal North America, declared that:

“The proposed sale will assist enable the [FTX] estates to organize for forthcoming dollarized distributions to collectors and permit the Debtors to behave rapidly to promote the Belief Property on the opportune time.”

In the meantime, this transfer marks one other important step by FTX’s chapter managers as they try to compensate prospects and buyers who suffered losses from the agency’s crash final yr.

CryptoSlate reported that the corporate had begun divesting a part of its crypto holdings as a part of its chapter processes and just lately proposed a settlement of buyer property disputes that might see it return as much as $9 billion to prospects.

Additionally, Sam Bankman-Fried, the alternate founder, was discovered responsible of all seven prices by the jury final week and doubtlessly faces greater than 100 years of imprisonment.